WEX (WEX) Valuation in Focus After Expanding EV Fleet Access with Tesla Supercharger Integration

WEX (WEX) has announced the integration of the Tesla Supercharger network into its platform, adding more than 20,000 fast-charging points at over 1,500 locations for its EV fleet customers. This move enhances access to high-speed charging and expands user choice across networks.

See our latest analysis for WEX.

The recent Tesla Supercharger integration arrives as WEX’s stock has had a challenging year, with a 1-year total shareholder return of -21.2% and momentum still soft, despite a sharp 4.4% single-day share price bounce following the announcement. While short-term volatility has picked up around major product news, long-term returns have struggled to keep pace with peers, putting the spotlight firmly on the growth potential of WEX’s evolving platform.

If WEX’s latest EV push got you thinking about the sector’s future, it could be the perfect moment to broaden your investing scope and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and a substantial intrinsic discount, the key question remains: Is WEX undervalued and primed for a rebound, or has the market already priced in expectations for future growth?

Most Popular Narrative: 17.7% Undervalued

WEX's most widely followed narrative sees its fair value well above the last close of $146.05, suggesting the market may be overlooking the projected financial momentum. The fair value calculation takes into account expanding margins, innovation, and new partnerships, all elements that could change the trajectory for shareholders.

*Expanding investments in product innovation (AI-powered claims processing, enhanced payment platforms, and API integrations) and significant sales force increases, especially in Corporate Payments and Mobility, indicate a forward pipeline of new customer wins and greater share of digital payment transactions. This positions WEX to benefit from higher transaction volume, improved margins through operating leverage, and increased cross-sell of value-added services.*

Do you want to discover the specific financial outlook that fuels this premium? One major factor is bold projections about future profit margins and revenue expansion included in the narrative. Want the inside scoop on which forward-looking numbers could justify a target far beyond today’s price? Click through to unlock the details driving this compelling call.

Result: Fair Value of $177.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a rapid shift towards EVs or intensifying competition in digital payments could still threaten WEX’s growth story and margins in the future.

Find out about the key risks to this WEX narrative.

Another View: Peers and Ratios Send a Mixed Signal

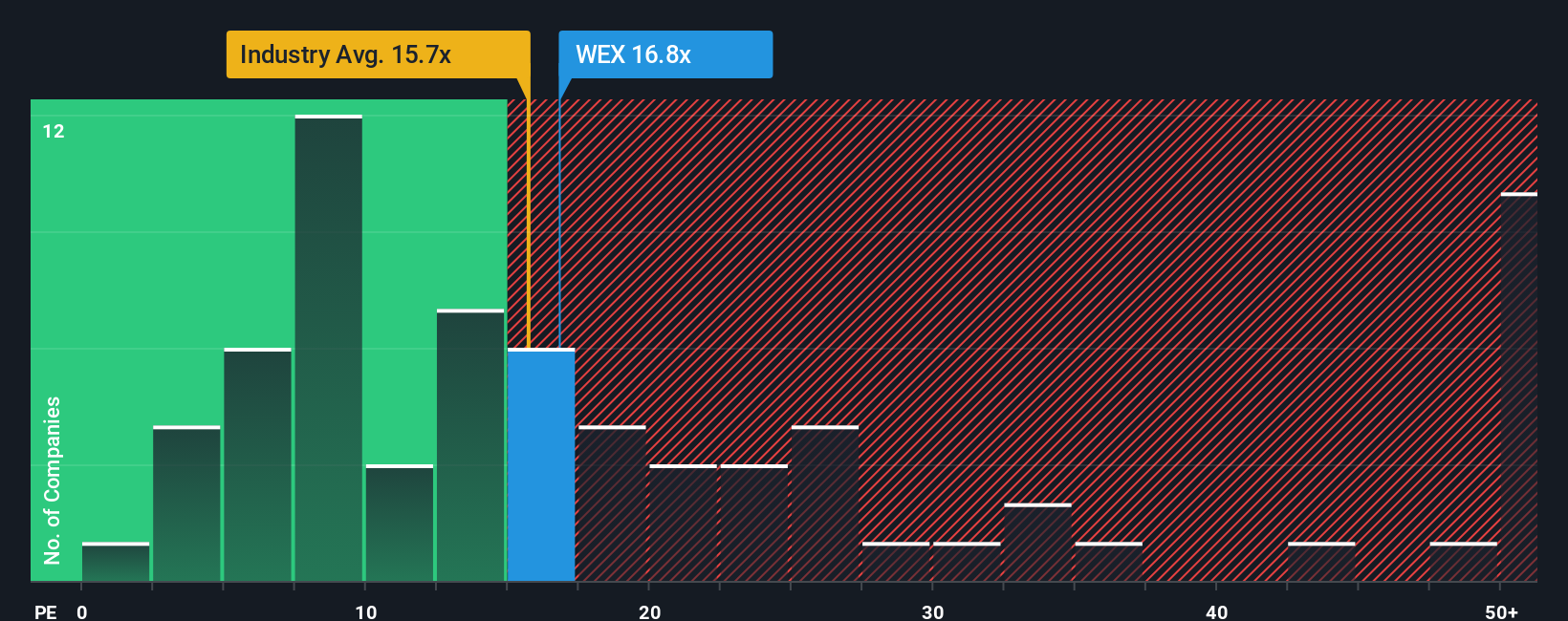

Looking beyond intrinsic value, WEX trades on a price-to-earnings ratio of 17.7x, which is higher than the industry average of 13x but below the peer average of 30.6x. The fair ratio is estimated at 17.3x. This suggests the current market price is neither particularly cheap nor wildly expensive. Is this a sign that WEX may move closer to the fair ratio over time, or does the premium leave limited room for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WEX Narrative

If you see things differently or want to investigate the numbers firsthand, you can easily craft your own WEX narrative from scratch in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding WEX.

Looking for More Smart Investment Moves?

Don't let opportunity pass you by. Make the next leap in your portfolio by tapping into sectors where innovation and growth are rewriting the rules of wealth.

- Capture tomorrow’s growth and spot emerging trends with these 25 AI penny stocks, which are powering the AI transformation across industries.

- Maximize yield potential and secure a stream of income by checking out these 17 dividend stocks with yields > 3%, offering robust dividends above 3%.

- Stay ahead of market shifts by targeting potential bargains with these 918 undervalued stocks based on cash flows, based on strong cash flows and real value signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com