How Bank of America’s Upgrade and Margin Outlook Could Influence Illinois Tool Works (ITW) Investors

- Earlier this quarter, Illinois Tool Works received a rating upgrade from Bank of America, driven by a positive profit forecast and expected margin gains for 2026 and 2027.

- Additionally, recent insider trading activity and institutional investor portfolio adjustments highlight shifting confidence and evolving ownership dynamics among key stakeholders.

- We'll examine how Bank of America's improved margin outlook could shape the investment narrative for Illinois Tool Works.

Find companies with promising cash flow potential yet trading below their fair value.

Illinois Tool Works Investment Narrative Recap

To be comfortable as an Illinois Tool Works shareholder, investors need to believe in the company’s ability to translate steady portfolio innovation and margin expansion into sustainable earnings, even during periods of challenging organic growth. Recent analyst optimism about 2026–2027 profit margins may influence short-term sentiment, but doesn't fundamentally change the current catalysts or magnify immediate risks, such as persistent pressure in the automotive and construction segments.

Of recent updates, insider trading activity stands out as highly relevant. Company executives’ purchases and sales, combined with significant institutional portfolio changes, reflect evolving degrees of confidence during ongoing questions about sector-specific demand and the effectiveness of ITW’s growth and margin initiatives.

On the other hand, investors should be aware that ongoing regional auto sector weakness could limit recovery if...

Read the full narrative on Illinois Tool Works (it's free!)

Illinois Tool Works' outlook anticipates $17.6 billion in revenue and $3.6 billion in earnings by 2028. This projection is based on a 3.7% annual revenue growth rate and an increase in earnings of approximately $0.2 billion from the current $3.4 billion level.

Uncover how Illinois Tool Works' forecasts yield a $261.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

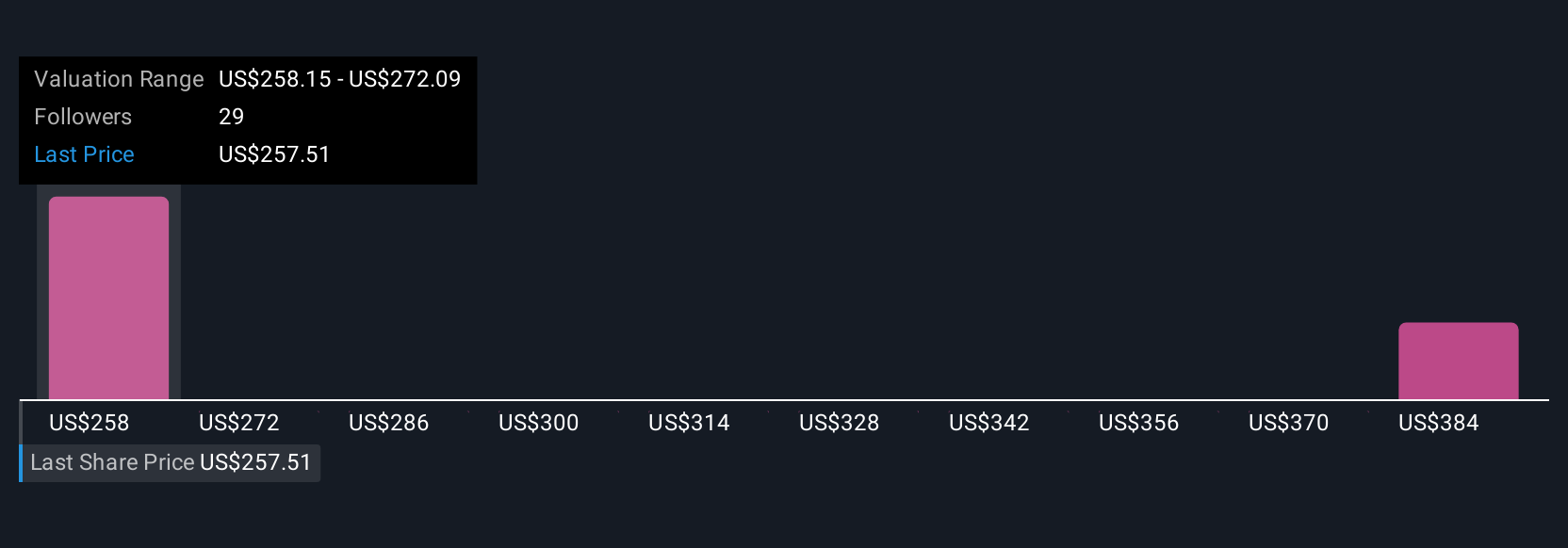

Simply Wall St Community members have published two fair value estimates for ITW, from US$261 up to US$576, showing substantial variance in outlook. Amid these differing valuations, continued margin expansion is seen as crucial for the company’s ability to support its earnings and share price performance over the medium term.

Explore 2 other fair value estimates on Illinois Tool Works - why the stock might be worth over 2x more than the current price!

Build Your Own Illinois Tool Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illinois Tool Works research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Illinois Tool Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illinois Tool Works' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com