Is Public Service Enterprise Group (PEG) Trading Below Its True Value? A Fresh Look at Valuation

Public Service Enterprise Group (PEG) stock has been relatively steady, with shares closing at $81.27. Over the past month, the stock is down 3%, while its performance for the year so far is off by about 5%.

See our latest analysis for Public Service Enterprise Group.

Public Service Enterprise Group has seen its share price slip 4.5% so far in 2024, reflecting some fading momentum after a robust multi-year run. While sentiment has cooled recently, long-term investors have still enjoyed a 62% total shareholder return over the past five years. This highlights the company's durable value despite ongoing shifts in the utilities sector.

If you’re weighing what else might be gaining traction beyond utilities, now is the perfect moment to discover fast growing stocks with high insider ownership

This sets the stage for the big question: Is Public Service Enterprise Group trading below its true value, or is the current price already factoring in the company’s future prospects for growth?

Most Popular Narrative: 10.3% Undervalued

Compared to the latest close at $81.27, the narrative fair value estimate of $90.61 sees Public Service Enterprise Group as trading at a notable discount. The gap reflects strong long-term growth drivers that analysts believe are not yet fully priced in.

Ongoing policy and regulatory support for decarbonization and clean energy (e.g., zero-emission credits, capacity price collars, federal nuclear PTC availability, and bonus depreciation) provide highly visible and stable long-term cash flows from the nuclear fleet and incentive alignment that sustains or improves net margins amidst rising clean electricity demand.

What is the real math behind this bullish target? The narrative leans on a powerful mix of future margin gains and a bold profit multiple not usually seen in this sector. The most important drivers are not just revenue growth but rising profitability and ambitious earnings forecasts. Curious what record projections they are betting on? Only in the full narrative will you discover the figures that underpin this valuation.

Result: Fair Value of $90.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory uncertainties and the unpredictable conversion of data center demand could limit Public Service Enterprise Group's projected growth and long-term returns.

Find out about the key risks to this Public Service Enterprise Group narrative.

Another View: SWS DCF Model Offers a Different Take

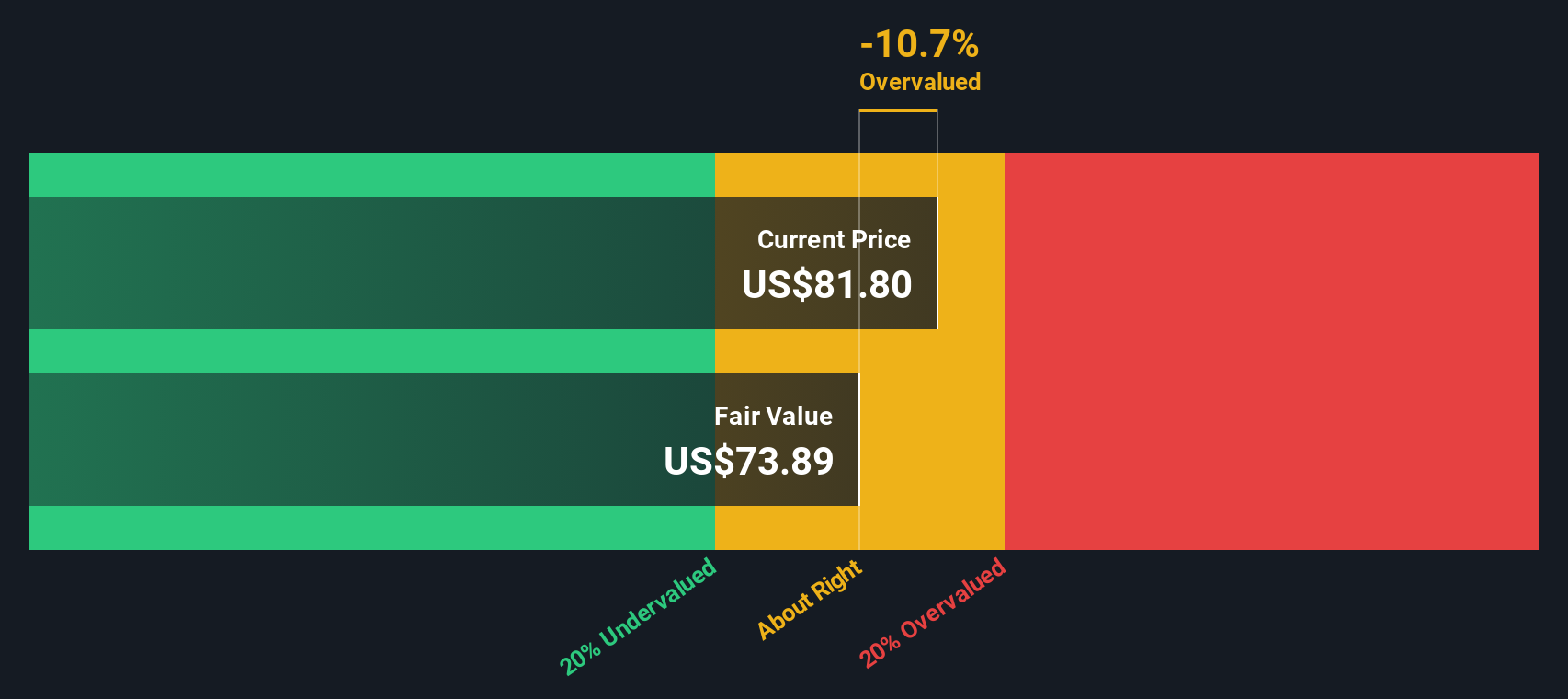

Instead of focusing on analyst earnings multiples, our SWS DCF model comes to a different conclusion. Based on expected future cash flows, PEG’s shares look slightly overvalued compared to our DCF fair value of $74.22. That is about 9% below the recent trading price, suggesting less upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Public Service Enterprise Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Public Service Enterprise Group Narrative

If you see things differently or trust your own process, you can dig into the numbers and build your personal take in just a few minutes. Do it your way

A great starting point for your Public Service Enterprise Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit yourself to a single opportunity when you can explore exciting trends across various markets? Discover stocks with strong growth potential and enhance your portfolio starting today.

- Capture the next wave in healthcare and artificial intelligence by starting with these 30 healthcare AI stocks, which are transforming patient care and medical research.

- Grow your income streams by targeting these 17 dividend stocks with yields > 3%, offering yields above 3% from companies with solid financials.

- Benefit from the rapidly evolving world of cryptocurrencies and blockchain technology by reviewing these 81 cryptocurrency and blockchain stocks, which are leading real-world innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com