Novanta (NOVT) Valuation in Focus After $500M Equity Offering for Growth and Strategic Moves

Novanta (NOVT) recently priced a major public offering of tangible equity units in an effort to raise over $500 million. The company plans to use these funds for potential acquisitions, debt repayment, and various strategic initiatives.

See our latest analysis for Novanta.

Novanta’s share price jumped 7.4% in a single day following the announcement of its equity offering. This comes after a rough stretch, as the year-to-date share price return is down nearly 29% and the total shareholder return over the past year sits at -37%. While the fundraising has sparked fresh momentum, recent performance suggests investors remain cautious, weighing both the risks and growth potential tied to the company’s ambitious plans.

If you’re exploring what else could deliver upside in a shifting market, now’s the perfect time to discover fast growing stocks with high insider ownership

With shares still well below analyst price targets but sentiment remaining cautious, the real question is whether Novanta is an overlooked value or if the market has already factored in the company’s future growth. Could this be a buying opportunity?

Most Popular Narrative: 30.8% Undervalued

Novanta’s most cited narrative places its fair value at $154, which is significantly above the last close price of $106.51. The gap signals that narrative followers see the market missing sizable upside, fueled by evolving robotics and healthcare trends.

Rapid adoption of robotics and automation in manufacturing and healthcare (including AI-enabled warehouse automation, surgical robotics, and future humanoid robotics) is accelerating demand for Novanta's advanced sensing and precision motion technologies. The company's design wins and multi-year contracts (for example, a $50M warehouse robotics deal and multiple new design wins in physical AI and robotics) position it to grow revenue at above-market rates through 2026 and beyond.

Want to know what bold projections are fueling this high target? The fair value hinges on a dramatic profit ramp and future earnings multiples usually seen in the most hyped sectors. Question is: what specific financial leaps turn these industry trends into powerful valuation upside? Explore the numbers and assumptions the narrative is really betting on.

Result: Fair Value of $154 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and a reliance on acquisitions for growth could threaten Novanta's ability to deliver on these optimistic projections.

Find out about the key risks to this Novanta narrative.

Another View: What the Numbers Say

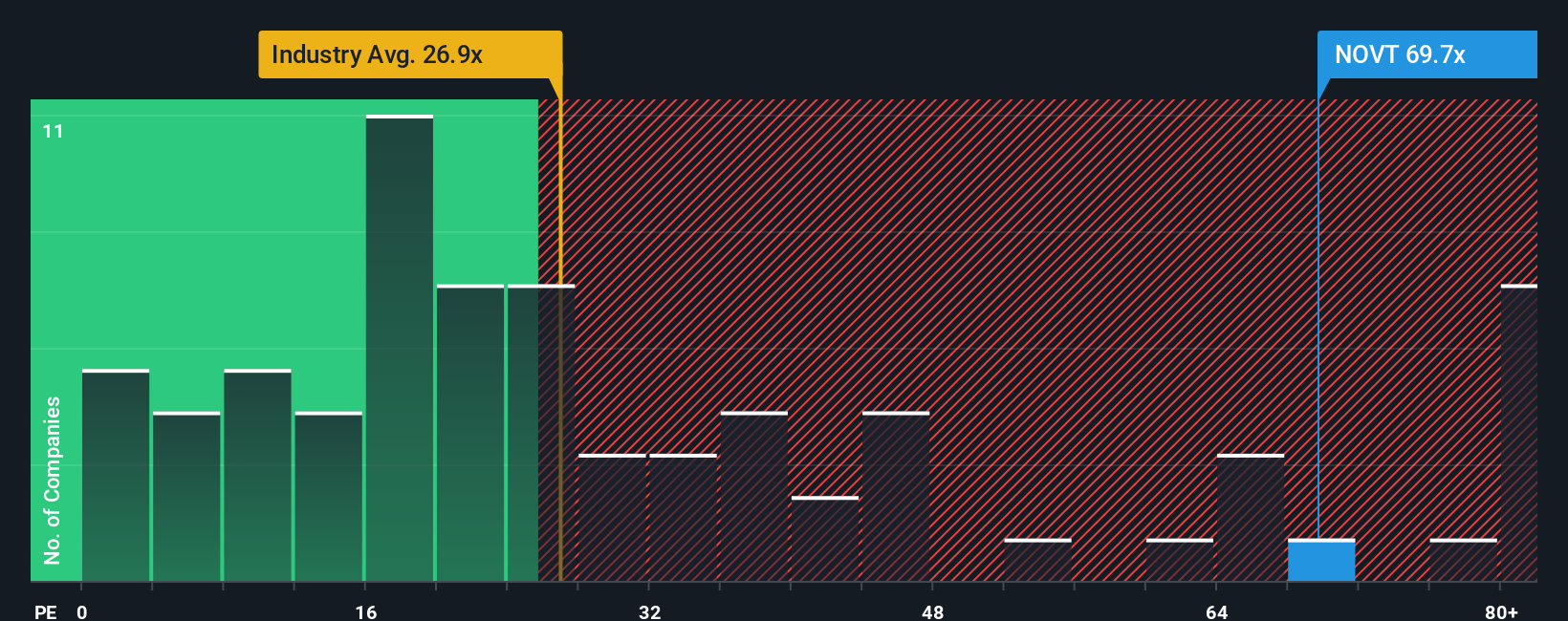

A different lens on Novanta’s valuation comes from looking at how its current price-to-earnings ratio stacks up. Right now, Novanta trades at 72.1 times earnings, far above both the US Electronic industry average of 22.6 times and its average peer’s 21.7 times. Even when compared to the fair ratio of 41.9 times, the market is clearly demanding a significant premium for future growth.

This kind of gap means investors are making a big bet that earnings will deliver in a way peers and historical figures have not. Are these expectations justified, or is the price running ahead of reality? See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Novanta Narrative

If you see the data differently, or want to test your own thesis, you can build a fresh narrative in just a few minutes. Do it your way

A great starting point for your Novanta research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your investing horizons by tapping into fresh trends and hidden winners that others might be missing. Act now to gain an edge and spot tomorrow’s outperformers today.

- Capture the momentum of emerging technology as you target growth opportunities among these 25 AI penny stocks. These companies are shaping industries with advanced automation and intelligence.

- Unlock potential high yields and steady income when you check out these 17 dividend stocks with yields > 3%, featuring companies offering robust dividend payouts above 3%.

- Seize undervalued gems before they're noticed by the crowd by scanning these 919 undervalued stocks based on cash flows for stocks trading below their true cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com