IPG Photonics (IPGP) Is Down 5.9% After Block Insider Sales and New Defense Unit Launch – What's Changed

- IPG Photonics recently reported strong third-quarter results far above expectations, fueled by robust demand in electric vehicle and battery manufacturing, and also announced the opening of a new defense facility in Huntsville, Alabama focused on laser-based counter-unmanned aerial systems.

- Additionally, notable insider sales and a major stockholder divestment occurred alongside the launch of the IPG Defense unit, highlighting both internal business confidence and organizational transition during a period of expansion into laser defense applications.

- We'll examine how accelerating demand in advanced manufacturing and new laser defense initiatives could reshape IPG Photonics' investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

IPG Photonics Investment Narrative Recap

Owning IPG Photonics often comes down to a belief in the long-term adoption of advanced laser technologies across global manufacturing, especially in areas like electric vehicles, batteries, and defense. While strong third-quarter earnings and new business expansion may give a boost to sentiment, this does not materially change the biggest short-term catalyst, accelerating demand in electric vehicle and battery manufacturing, nor does it offset ongoing risks from soft core-market revenues and margin pressure in legacy segments.

The recent opening of IPG’s dedicated defense facility in Huntsville stands out as a potentially important step, as it directly supports the company's pivot toward higher-value laser defense applications. This expansion could enhance IPG’s growth prospects beyond its traditional materials processing markets, but early-stage ventures like defense remain unproven in terms of scale and sustainability, so the risks of execution and adoption are still highly relevant.

However, investors should be fully aware that in contrast to strong headlines about defense and new growth areas, the core business faces persistent pressures from...

Read the full narrative on IPG Photonics (it's free!)

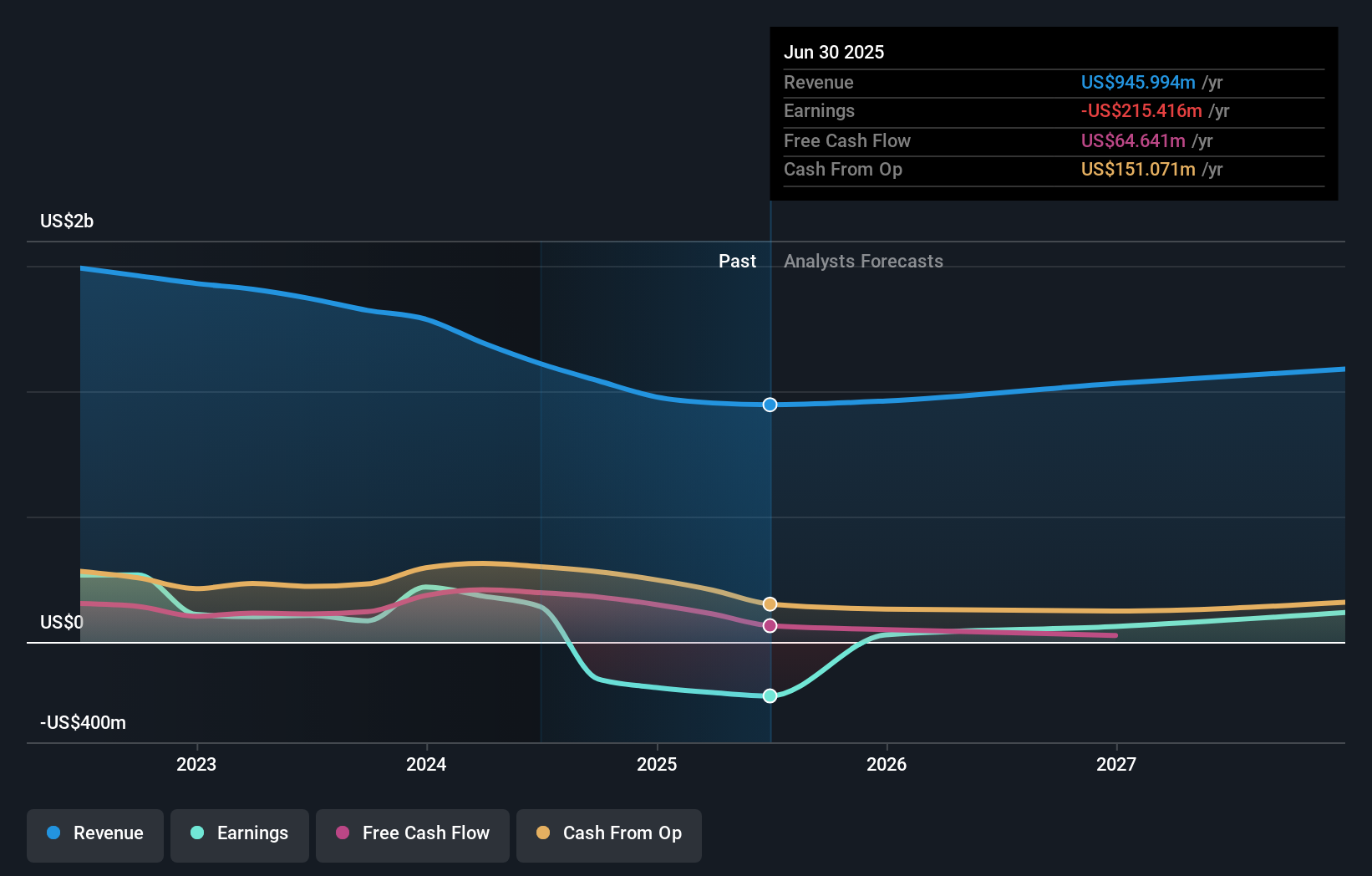

IPG Photonics' outlook anticipates $1.2 billion in revenue and $133.9 million in earnings by 2028. This is based on a projected annual revenue growth rate of 8.1% and an earnings increase of $349.3 million from the current earnings of -$215.4 million.

Uncover how IPG Photonics' forecasts yield a $94.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided two fair value estimates for IPG Photonics ranging from US$60.52 to US$94.00. While many see promise in expanding end-markets like defense, margin pressure from core revenue softness is a risk that could have important implications for future returns; explore alternative viewpoints for a broader understanding.

Explore 2 other fair value estimates on IPG Photonics - why the stock might be worth 19% less than the current price!

Build Your Own IPG Photonics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IPG Photonics research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free IPG Photonics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IPG Photonics' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com