Piper Sandler Companies (PIPR): Assessing Valuation After Launching Private Markets Trading Division With New Leadership

Piper Sandler Companies (PIPR) just launched its private markets trading division, marking a new chapter for the firm. To support this effort, they brought on three managing directors from Forge Global to lead the segment.

See our latest analysis for Piper Sandler Companies.

Piper Sandler’s push into private markets trading comes shortly after leadership additions in both its private and investment banking divisions, suggesting real ambition to widen its reach. While the share price has been essentially flat over the past quarter, the year-to-date price return of 8.1% hints at momentum building beneath the surface, even if the 1-year total shareholder return sits slightly negative. Long-term shareholders, though, have seen a stellar 132% total return over three years and nearly 300% over five.

If the recent expansion has you interested in what’s next, now could be the perfect moment to broaden your horizons and discover fast growing stocks with high insider ownership

Given the company’s strategic moves and its recent performance, investors are left weighing whether Piper Sandler’s current valuation accurately reflects its growth ambitions, or if a genuine buying opportunity is taking shape.

Price-to-Earnings of 24.2x: Is it justified?

Piper Sandler Companies currently trades at a price-to-earnings ratio of 24.2x, which is notably higher than both its peers and the industry average. At a recent close of $323.57, the stock commands a premium valuation that suggests the market is pricing in strong future prospects.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. In sectors like capital markets, where earnings growth potential can be pronounced, a high P/E may reflect expectations for robust profit expansion or other competitive strengths.

However, Piper Sandler’s P/E of 24.2x is well above the peer group average of 13.5x and the broader US Capital Markets industry average of 23.4x. This signals that the stock is priced for faster growth or superior performance. Investors should scrutinize whether such a premium is warranted based on company fundamentals and actual growth rates.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.2x (OVERVALUED)

However, unpredictable market conditions or a slowdown in revenue growth could challenge Piper Sandler’s ability to deliver on its premium valuation.

Find out about the key risks to this Piper Sandler Companies narrative.

Another View: Discounted Cash Flow Paints a Different Picture

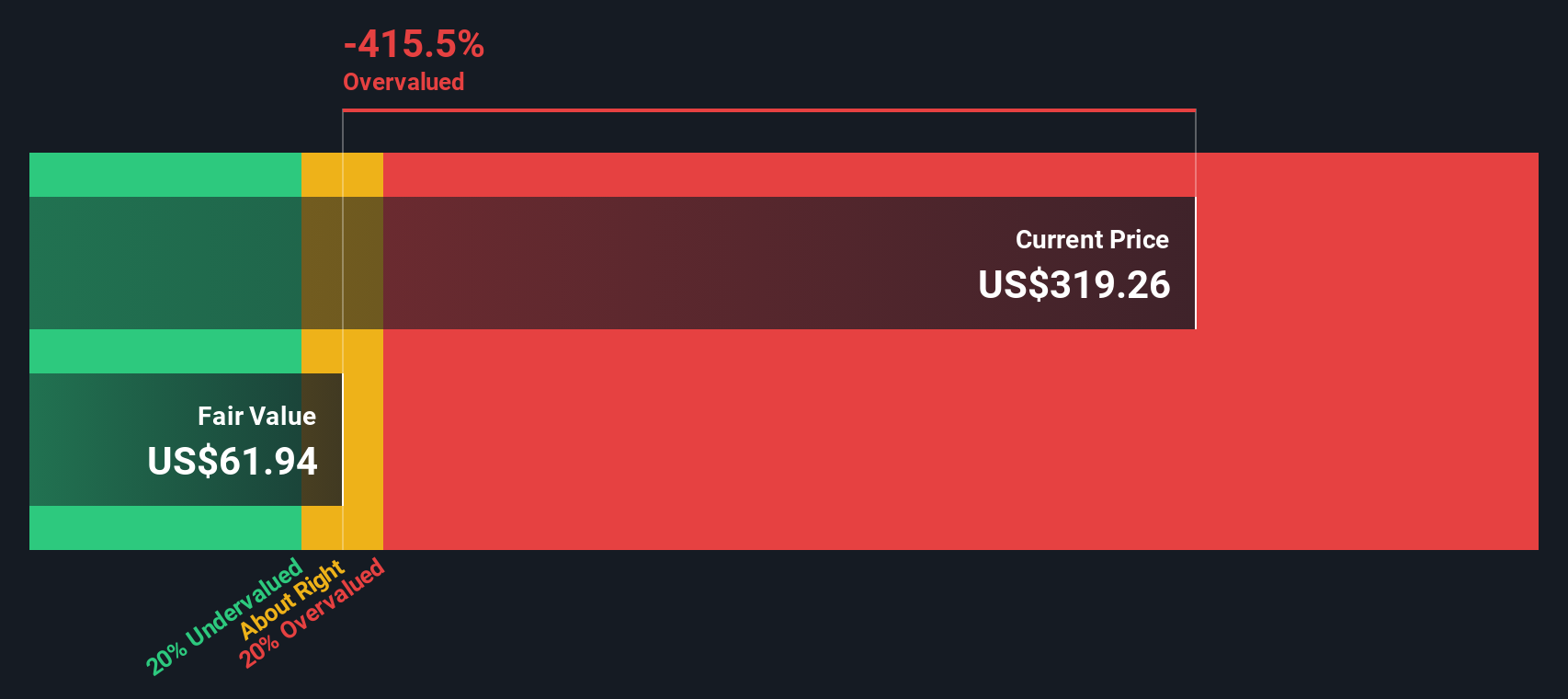

While Piper Sandler’s premium price-to-earnings ratio could signal confidence, our DCF model tells another story. According to the SWS DCF model, the stock’s current price of $323.57 sits well above its estimated fair value of $61.71, suggesting a significant overvaluation. Can this gap be closed by future growth, or is it a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Piper Sandler Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Piper Sandler Companies Narrative

If you have a different perspective or want to dig into the numbers independently, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your watchlist? Make the most of the market’s hottest trends and get ahead with these powerful stock screening tools from Simply Wall Street.

- Uncover opportunities for steady income by comparing top picks offering yields over 3% through these 17 dividend stocks with yields > 3% and see which companies stand out.

- Get ahead of tomorrow’s innovation by scanning these 26 quantum computing stocks, a tool set to transform sectors with advances in quantum computing technology.

- Capitalize on breakthrough healthcare trends by reviewing these 30 healthcare AI stocks, which highlights companies poised to benefit most from the rise of AI in medicine.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com