Is ATI’s (ATI) Unified Leadership Approach Set to Reshape Its Aerospace and Defense Strategy?

- ATI Inc. announced that CEO and President Kimberly A. Fields has been elected Board Chair, effective May 14, 2026, following the retirement of Executive Chair Robert S. Wetherbee, who will step down from the board at that time.

- This transition places unified leadership at the helm as the company sharpens its focus on aerospace and defense, markets now accounting for over 70% of ATI's revenues.

- We'll now explore how this appointment, and the emphasis on leadership continuity, could influence ATI's investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

ATI Investment Narrative Recap

ATI shareholders are typically betting on the company's continued outperformance in aerospace and defense, driven by long-term contracts and capacity expansion, while accepting the ongoing risks from customer concentration and potential downturns in non-aerospace markets. The recent announcement of CEO Kimberly A. Fields becoming Board Chair in 2026 further supports leadership continuity, but this change is not expected to materially shift near-term catalysts or the current risk profile given ATI’s multi-year contracts with key aerospace customers.

Among recent company developments, the extension of a long-term titanium supply agreement with Boeing stands out, reinforcing ATI’s position with its largest aerospace customer and providing a key catalyst for revenue stability. This contract directly supports the company's push for dependable, higher-margin growth from commercial aerospace, which may help offset potential volatility in industrial and non-aerospace segments as management transitions unfold.

Yet, in contrast to the focus on aerospace strength, investors should also be aware of how dependence on a few large customers exposes ATI to...

Read the full narrative on ATI (it's free!)

ATI's outlook projects $5.5 billion in revenue and $635.6 million in earnings by 2028. This assumes a 6.7% annual revenue growth rate and a $218 million increase in earnings from the current level of $417.5 million.

Uncover how ATI's forecasts yield a $118.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

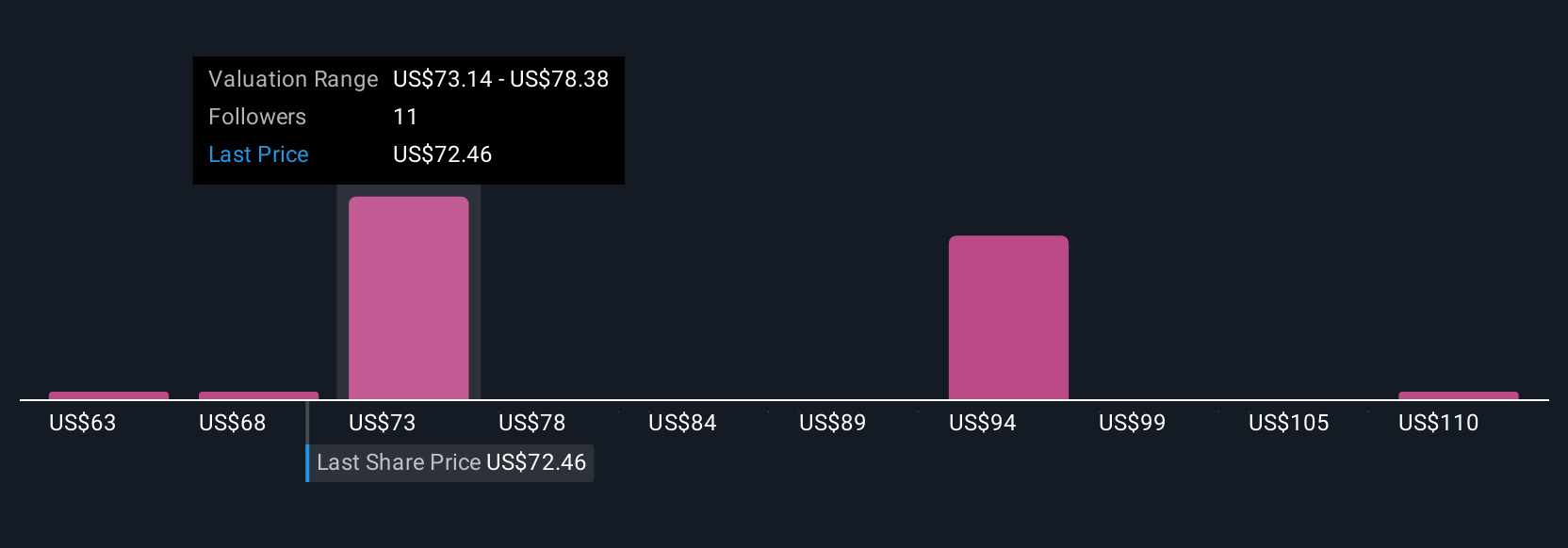

Simply Wall St Community members provided five fair value estimates for ATI, ranging from US$62.68 to US$118 per share. While these differ widely, many are watching the impact of new contracts with major aerospace customers for signals on future performance.

Explore 5 other fair value estimates on ATI - why the stock might be worth 35% less than the current price!

Build Your Own ATI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATI research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ATI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATI's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com