Forrester Research, Inc. (NASDAQ:FORR) Not Doing Enough For Some Investors As Its Shares Slump 25%

Forrester Research, Inc. (NASDAQ:FORR) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

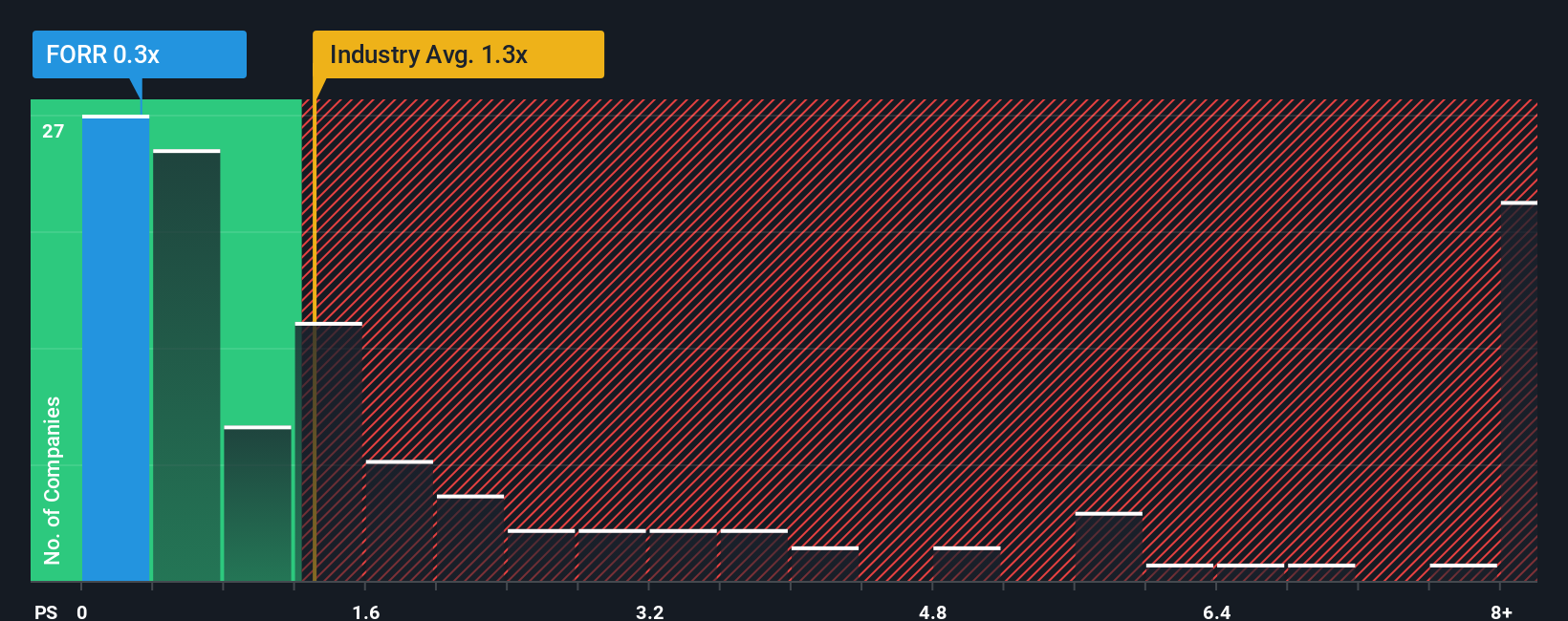

After such a large drop in price, Forrester Research's price-to-sales (or "P/S") ratio of 0.3x might make it look like a buy right now compared to the Professional Services industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Forrester Research

How Has Forrester Research Performed Recently?

While the industry has experienced revenue growth lately, Forrester Research's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Forrester Research.How Is Forrester Research's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Forrester Research's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.7%. As a result, revenue from three years ago have also fallen 24% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 2.0% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to expand by 6.5%, which paints a poor picture.

With this in consideration, we find it intriguing that Forrester Research's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Forrester Research's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Forrester Research's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Forrester Research with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.