Kirby (KEX): A Fresh Look at Valuation Following Recent Share Price Rally

See our latest analysis for Kirby.

Kirby’s momentum has really picked up pace, not just in the past month but as part of a larger trend. While its 1-year total shareholder return is -17.2%, the stock has delivered a strong 113.5% total return over five years. This suggests that despite some recent turbulence, the long-term story remains positive and investors may be reassessing its growth potential.

If the recent surge in Kirby’s share price has you thinking about what’s next, now may be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares rallying and solid fundamentals behind them, the real question is whether Kirby’s current price leaves room for further gains or if the market has already recognized and priced in all of its future growth potential.

Most Popular Narrative: 13.8% Undervalued

With Kirby's fair value pegged at $125.33, which is meaningfully above the last close of $108.04, the narrative suggests considerable upside remains, assuming its projections come to pass.

Supply constraints and industry-wide aging of the barge fleet are restraining new capacity growth. This positions Kirby to benefit from limited vessel availability, capacity consolidation, and rising charter rates over time, all of which could support steady revenue growth and expanding net margins.

Think Kirby’s valuation is just wishful thinking? These estimates aren’t guesswork; they are built on bold growth expectations and ambitious profit targets. Ready to uncover the calculations powering this price? The full narrative lays out the financial foundations you can’t afford to ignore.

Result: Fair Value of $125.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in chemical markets and rising costs could threaten Kirby’s momentum. These factors may challenge both revenue growth and future margin expansion.

Find out about the key risks to this Kirby narrative.

Another View: What Do the Ratios Say?

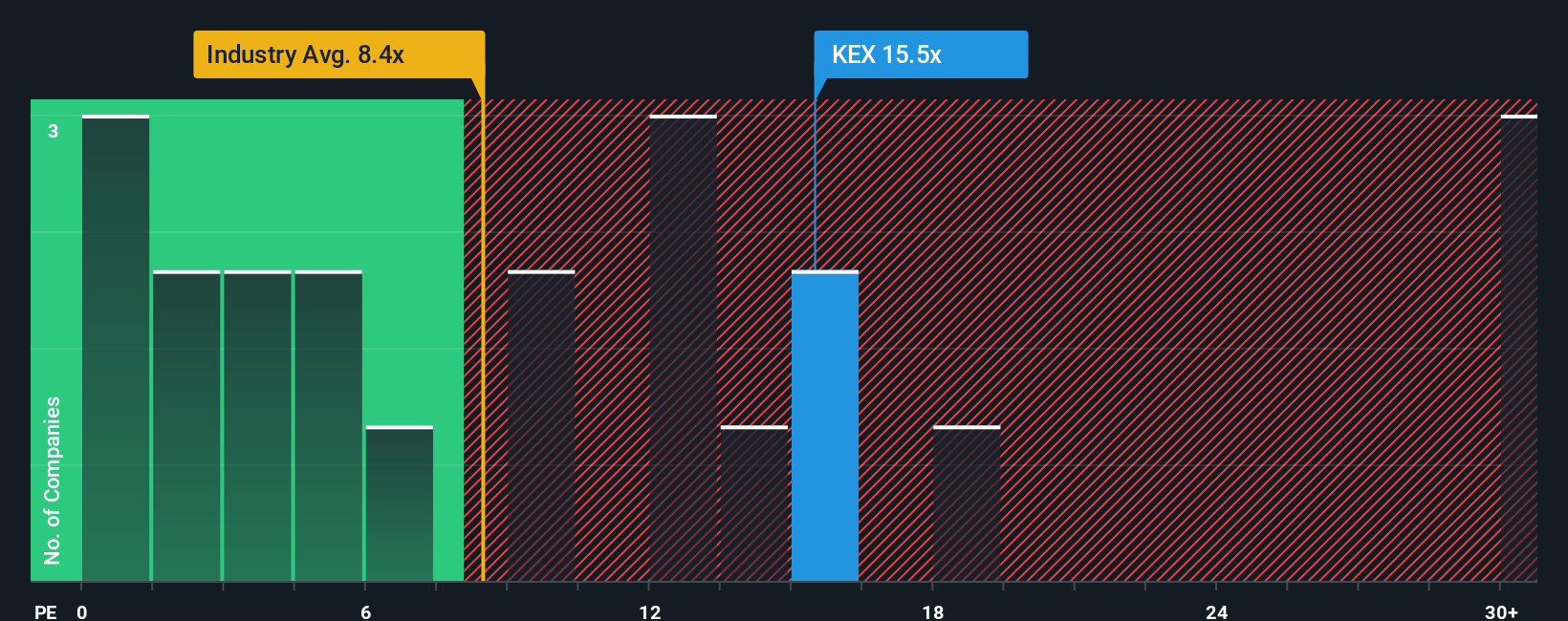

Looking at Kirby's valuation through the lens of its price-to-earnings ratio gives us a different perspective. The company trades at 19.2x earnings, which is noticeably higher than both its peer average of 13.5x and the North American Shipping industry average of 7.5x. The fair ratio sits at 13x, suggesting the market currently expects more from Kirby than from similar companies. That premium could indicate extra risk if growth falls short. Are investors too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kirby Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own Kirby thesis from scratch in just minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Kirby.

Looking for more investment ideas?

Broaden your perspective beyond Kirby and tap into unique growth stories or potential value plays. Your next opportunity could be just one screen away. Don't let great ideas pass by.

- Seize the chance to find hidden gems by checking out these 3580 penny stocks with strong financials poised for remarkable growth and financial resilience.

- Target tomorrow’s winners in tech by reviewing these 26 AI penny stocks set to ride the wave of artificial intelligence innovation in today's fast-evolving market.

- Boost your portfolio’s income potential with these 14 dividend stocks with yields > 3% offering stable returns and yields above 3% for steady long-term rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com