How a Director’s Major Share Purchase Could Influence MSC Industrial Direct’s (MSM) Investment Narrative

- Philip Peller, a director at MSC Industrial Direct, recently acquired 6,666 Class A shares, more than tripling his direct ownership position and reversing a previous trend of insider selling.

- This significant insider purchase is often interpreted as a strong vote of confidence in the company's outlook and its potential growth in the U.S. industrial sector.

- We'll examine how this insider buying activity could influence MSC Industrial Direct's investment narrative, reflecting renewed conviction in its future prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

MSC Industrial Direct Investment Narrative Recap

To be a shareholder in MSC Industrial Direct, you need to believe in the company's ability to capture growth as U.S. manufacturing rebounds and management successfully navigates current soft demand conditions. Philip Peller’s substantial insider purchase is a visible sign of renewed confidence, but it may not materially impact near-term sales volatility or the key risk of weak manufacturing activity in the short term.

Recent leadership changes, with Martina McIsaac set to take over as CEO in early 2026, are especially relevant as insider buying coincides with a period of executive transition. This context could be important for investors tracking whether new management can sustain momentum in programs aimed at driving future growth.

On the other hand, investors should be aware that continued softness in manufacturing activity and persistent macroeconomic challenges could...

Read the full narrative on MSC Industrial Direct (it's free!)

MSC Industrial Direct's outlook anticipates $4.3 billion in revenue and $293.5 million in earnings by 2028. This projection assumes a 4.5% annual revenue growth rate and a $95 million increase in earnings from the current $198.5 million.

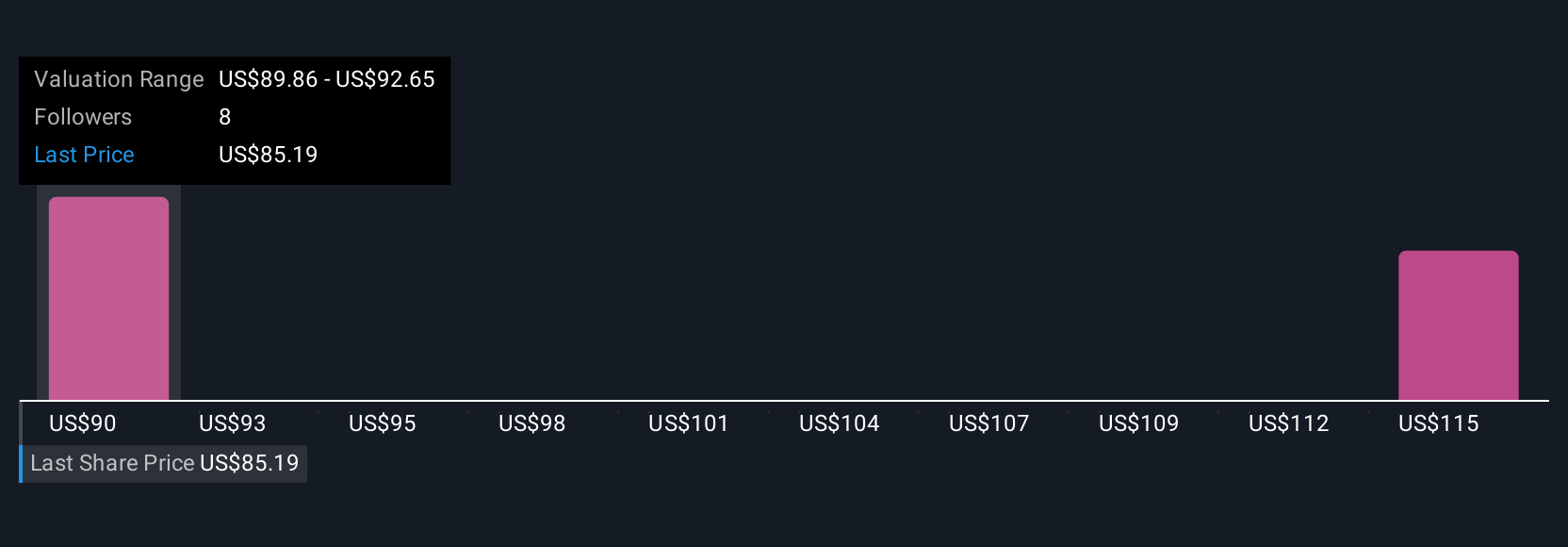

Uncover how MSC Industrial Direct's forecasts yield a $87.50 fair value, in line with its current price.

Exploring Other Perspectives

Two Simply Wall St Community members set fair value estimates for MSC Industrial Direct between US$60.66 and US$87.50. Against this backdrop, execution on growth initiatives remains crucial to broader company performance, so consider how your outlook aligns with these diverse viewpoints.

Explore 2 other fair value estimates on MSC Industrial Direct - why the stock might be worth 31% less than the current price!

Build Your Own MSC Industrial Direct Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSC Industrial Direct research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free MSC Industrial Direct research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSC Industrial Direct's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com