Will SQM’s Upbeat Lithium Sales Guidance Reshape Sociedad Química y Minera de Chile's (SQM) Growth Narrative?

- Earlier this month, Sociedad Química y Minera de Chile S.A. reported third quarter results showing higher year-over-year sales and net income, while also raising its 2025 sales guidance for lithium carbonate equivalent to between 23,000 and 24,000 tons and affirming its production forecast.

- The company’s updated guidance points to increasing operational confidence and suggests expectations for robust demand in key battery and electric vehicle markets.

- We’ll explore how SQM’s stronger lithium sales outlook may influence the company’s investment narrative and future growth trajectory.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Sociedad Química y Minera de Chile Investment Narrative Recap

Being a shareholder in Sociedad Química y Minera de Chile (SQM) means believing in the long-term potential of lithium, driven by demand from electric vehicles and energy storage. The recent boost in sales guidance to 23,000–24,000 tons of lithium carbonate equivalent for 2025 points to short-term volume momentum, but it doesn’t fundamentally alter the principal risk: the company’s heavy exposure to lithium price swings and potential lithium oversupply scenarios.

The company’s third quarter earnings announcement is at the heart of this news, showing higher sales and sharply improved net income year-over-year. This stronger operational performance and revised sales outlook may support sentiment for now, though it does not remove the risk of government intervention or future regulatory delays in strategic assets.

However, investors should not overlook the possibility that growing state involvement, particularly in projects like Salar Futuro, could...

Read the full narrative on Sociedad Química y Minera de Chile (it's free!)

Sociedad Química y Minera de Chile is projected to reach $6.5 billion in revenue and $1.9 billion in earnings by 2028. This outlook assumes a yearly revenue growth rate of 15.4% and a $1.4 billion increase in earnings from the current level of $477.5 million.

Uncover how Sociedad Química y Minera de Chile's forecasts yield a $56.66 fair value, a 10% downside to its current price.

Exploring Other Perspectives

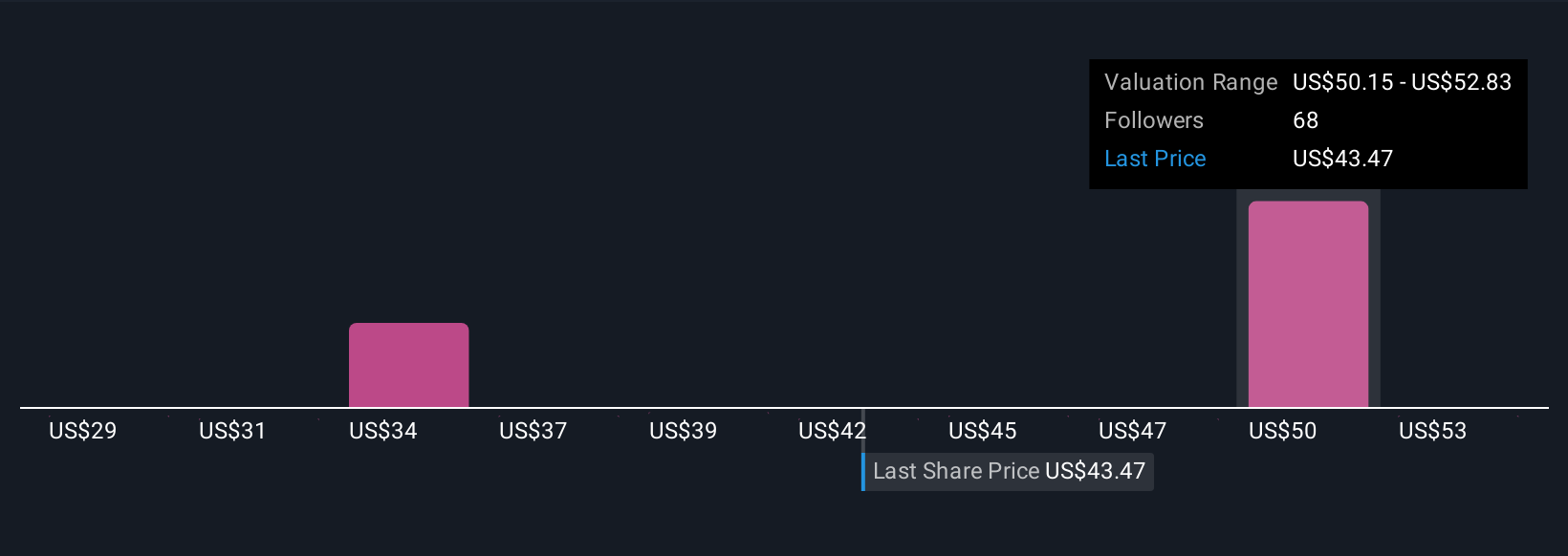

Simply Wall St Community members shared 8 fair value estimates for SQM, ranging from US$31.62 to US$73.79 per share. Alongside these different views, remember that lithium price volatility remains a central theme influencing company performance; explore the range of community perspectives for a balanced outlook.

Explore 8 other fair value estimates on Sociedad Química y Minera de Chile - why the stock might be worth 50% less than the current price!

Build Your Own Sociedad Química y Minera de Chile Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sociedad Química y Minera de Chile research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sociedad Química y Minera de Chile research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sociedad Química y Minera de Chile's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com