American Woodmark (AMWD) Net Profit Margin Drops to 3.9%, Challenging Durable Earnings Narrative

American Woodmark (AMWD) just posted its Q2 2026 results, reporting revenue of $394.6 million and basic EPS of $0.42. Looking back, the company has seen revenue slide from $452.5 million in Q2 2025 to $394.6 million this quarter. EPS dropped from $1.81 to $0.42 over the same period. Margins compressed in the latest quarter, putting profitability in the spotlight for investors.

See our full analysis for American Woodmark.Next up, we will compare these results with prevailing narratives to see which stories hold up and where the numbers challenge common assumptions.

See what the community is saying about American Woodmark

Net Profit Margins Slide to 3.9%

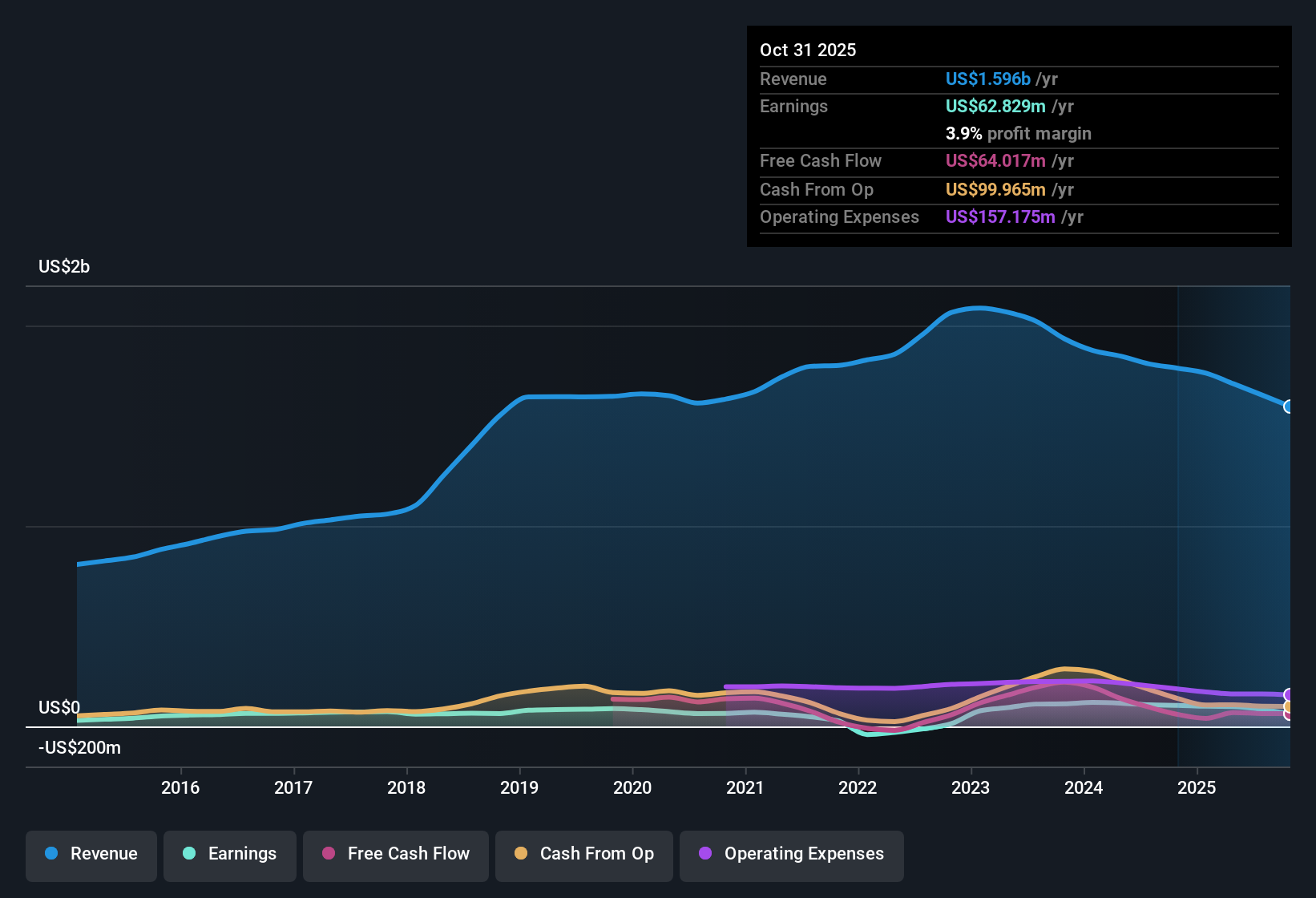

- American Woodmark's net profit margins dropped from 5.9% to 3.9% over the last twelve months, despite trailing twelve-month net income of $62.8 million on $1.6 billion revenue.

- Consensus narrative notes this decline highlights the company's ongoing struggle with cost pressures and inconsistent market conditions. This comes despite attempts to integrate operations post-merger.

- Profit growth, which averaged 22.4% annually over five years, reversed to negative growth this past year. This challenges the assumption that scale would automatically drive earnings durability.

- With analysts forecasting profit margins dropping further to 3.3% by 2028, persistent margin contraction raises questions about how much value can be unlocked from recent consolidation.

Consensus sees falling profitability as a warning sign for the narrative. Discover how analysts interpret margin risk in the full outlook. 📊 Read the full American Woodmark Consensus Narrative.

Valuation Discount to Peers Remains

- The company's price-to-earnings ratio sits at 12.8x, well below the peer average of 17x and the US market average of 18.6x. This potentially offers relative value to investors.

- According to the consensus view, while a lower PE ratio typically attracts value-oriented investors, it also reflects the market's caution amid negative forward earnings growth and ongoing challenges with revenue momentum.

- The share price is $55.36, a notable discount to the consensus analyst price target of $66.67. This suggests some believe the downside risks are being overemphasized in current pricing.

- However, analysts expect earnings to keep declining at an average pace of 32.3% per year. This underlines that cheapness alone may not provide a near-term catalyst.

Revenue Growth Lags Market Trends

- Revenue grew just 1.1% per year over the last twelve months, markedly slower than the US market average of 10.5% per year.

- Consensus narrative points out that American Woodmark's exposure to housing cycles and increased competitive pressures have hampered sales momentum. This challenges the optimistic view of a quick sector recovery.

- Forecasts expect revenue to remain flat, if not slightly decline, over the next three years, raising questions about the ability to meaningfully outpace industry headwinds.

- With the merged entity still heavily dependent on US housing demand, any recovery in broader market growth may not immediately translate into stronger results for the company.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for American Woodmark on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do these figures reveal a story you think others are missing? In just a few minutes, you can share your unique take and shape the conversation. Do it your way.

A great starting point for your American Woodmark research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

With margins under pressure, declining earnings, and sluggish sales, American Woodmark is struggling to deliver the steady growth investors often seek.

If dependable performance matters to you, check out stable growth stocks screener (2073 results) to spot companies consistently growing their revenue and earnings, even when others stumble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com