A Fresh Look at Monolithic Power Systems (MPWR) Valuation After Recent Share Price Gains

Monolithic Power Systems (MPWR) has been catching the attention of investors, with shares gaining nearly 2% over the past day and a solid 5% in the past week, despite a recent month-long dip. This trajectory prompts a closer look at the company’s fundamentals and how it is being valued in the current market.

See our latest analysis for Monolithic Power Systems.

The recent rebound in Monolithic Power Systems’ share price suggests that investors may be regaining confidence after last month’s slump. With a year-to-date share price return of nearly 56% and a one-year total shareholder return of 66%, there is clear evidence of both strong momentum and underlying growth potential amid the sector’s volatility.

If you’re inspired by MPWR’s surge, this could be a perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares rebounding and MPWR’s valuation sitting near record highs, investors must ask: is the recent surge a signal of undervaluation, or has the market already accounted for all of Monolithic Power Systems’ future growth potential?

Most Popular Narrative: 21.7% Undervalued

With Monolithic Power Systems closing at $924.95 and the most-followed narrative assigning a fair value of $1,180.93, there is a notable gap that is driving investor attention. Here is what is fueling that view, and why the next move is far from certain.

MPS's narrative of diversified customer exposure and supply chain resilience (including geographic diversification of capacity) underpins investor confidence in stable long-term growth. However, short ordering cycles, periodic inventory corrections, and potential customer concentration risk may introduce volatility to both revenues and near-term earnings that may not be reflected in current valuations.

Want to know the quantitative story behind this compelling valuation? The full narrative features bold growth projections, margin shifts, and a future profit multiple that could surprise even seasoned tech investors. Uncover the catalyst assumptions that have analysts this bullish and read the complete breakdown.

Result: Fair Value of $1,180.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain pressures or a slowdown in key product cycles could challenge the optimistic outlook and trigger a shift in market sentiment.

Find out about the key risks to this Monolithic Power Systems narrative.

Another View: Discounted Cash Flow Raises Caution

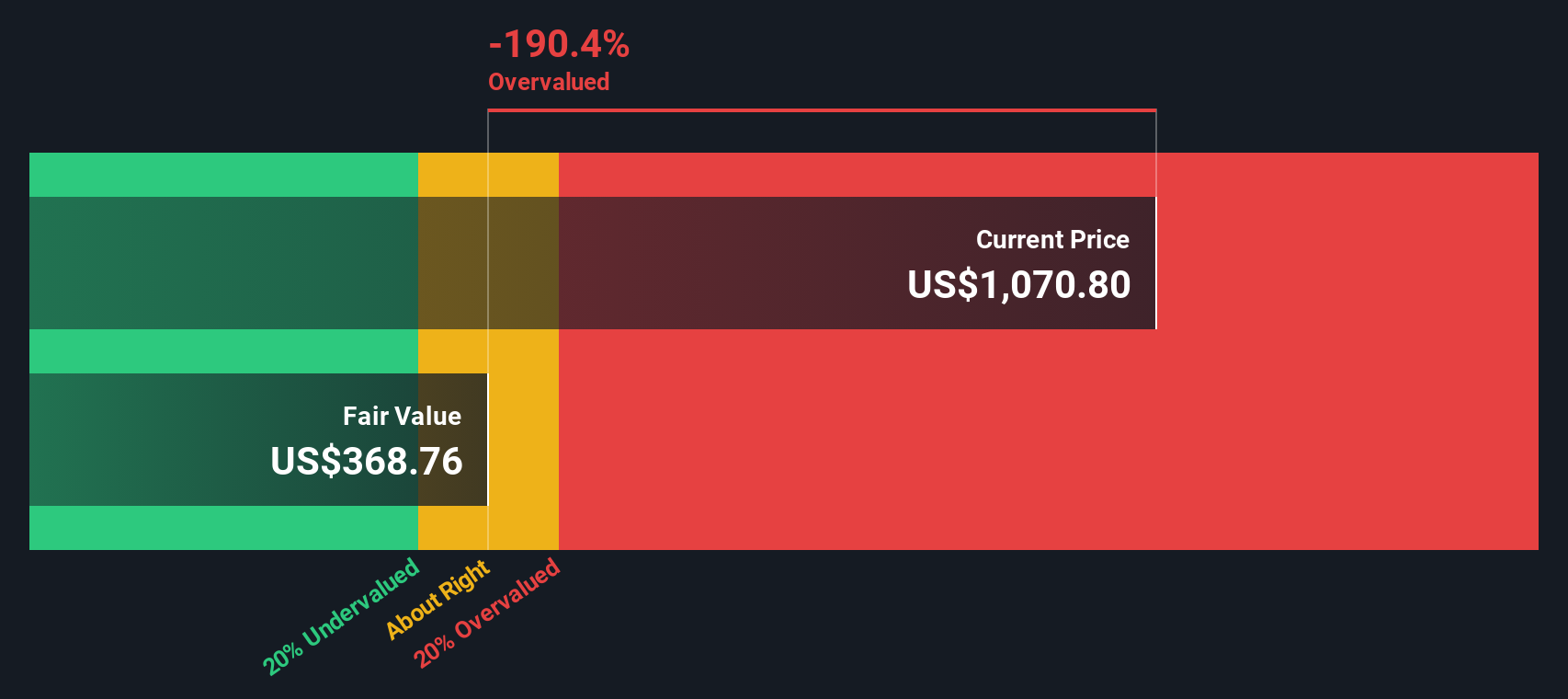

While analysts point to strong future growth, our DCF model suggests a far more conservative picture. Based on projected future cash flows, Monolithic Power Systems actually trades well above its estimated fair value. This may indicate the stock is overvalued on this measure. Could the market be overlooking some risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Monolithic Power Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Monolithic Power Systems Narrative

If you’re looking to challenge these conclusions or prefer hands-on analysis, you can quickly generate your own perspective in just a few minutes: Do it your way

A great starting point for your Monolithic Power Systems research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Smart Investment Moves?

Position yourself ahead of the crowd by exploring more targeted investing opportunities. The right stock idea can set you apart from average market returns.

- Capture attractive high yields by scanning for these 15 dividend stocks with yields > 3% that offer consistent income with above-average dividend payouts.

- Tap into breakthroughs in medical technology and artificial intelligence by evaluating these 30 healthcare AI stocks facilitating the next wave of healthcare innovation.

- Unlock hidden gems poised for strong returns using these 926 undervalued stocks based on cash flows that the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com