Calls for Greater Oversight of Data Center Deal Could Be a Game Changer for DTE Energy (DTE)

- In recent days, Michigan Attorney General Dana Nessel continued to challenge DTE Energy's efforts to fast-track approval of contracts to supply 1.4 gigawatts of power to a large data center planned for Saline Township, urging greater transparency and public scrutiny in the approval process.

- This heightened regulatory and public attention could impact how DTE Energy manages risks related to customer protections, environmental considerations, and its role as a utility for major technology projects.

- We’ll explore how these calls for regulatory scrutiny and public hearings might influence DTE Energy’s investment narrative and outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

DTE Energy Investment Narrative Recap

To believe in DTE Energy as a potential investment, an investor needs confidence in the company's ability to execute on its large-scale capital plans, especially as rising electricity demand from hyperscale data centers fuels long-term revenue opportunities. The recent political and regulatory scrutiny on the Saline Township data center contract brings short-term focus to regulatory approval risk, which is now a more material risk than before, potentially overshadowing the previously anticipated data center-driven catalyst in the near term.

One announcement particularly relevant to this development is DTE’s confirmed 2025 operating EPS guidance of US$7.09 to US$7.23, with an early look at 2026. This forward-looking guidance remains in place despite ongoing regulatory questions, offering some clarity for investors while the approval process for major new contracts attracts added attention.

Yet, investors should be aware that if regulatory pushback on large projects intensifies, it could mean...

Read the full narrative on DTE Energy (it's free!)

DTE Energy's narrative projects $15.3 billion revenue and $1.8 billion earnings by 2028. This requires 2.6% yearly revenue growth and a $0.4 billion earnings increase from the current $1.4 billion.

Uncover how DTE Energy's forecasts yield a $150.31 fair value, a 10% upside to its current price.

Exploring Other Perspectives

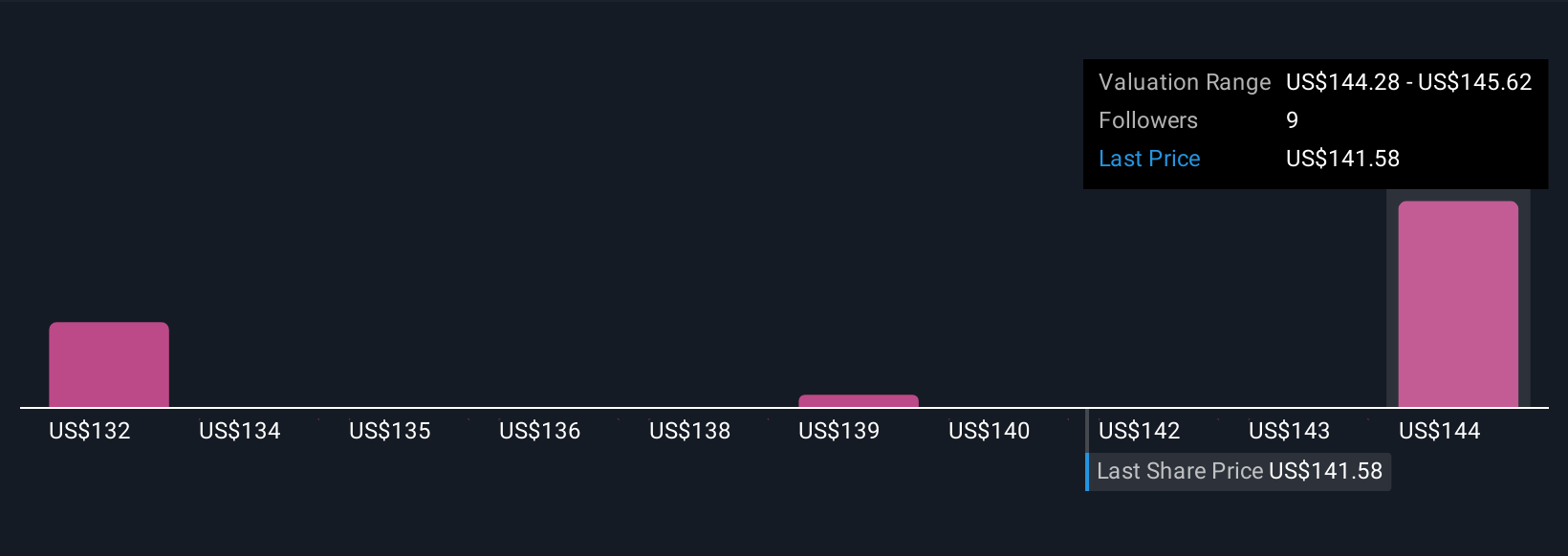

Simply Wall St Community members provided three fair value estimates for DTE Energy, spanning US$133.30 to US$150.31. Regulatory risk highlighted by recent scrutiny of high-profile contracts may shift market sentiment and affect future valuations, so consider a wide range of viewpoints before making decisions.

Explore 3 other fair value estimates on DTE Energy - why the stock might be worth as much as 10% more than the current price!

Build Your Own DTE Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DTE Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free DTE Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DTE Energy's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com