Does Recent Grid Modernization News Shift the Value Perspective for Public Service Enterprise Group?

- Thinking about whether Public Service Enterprise Group might be worth more than its current share price? You’re not alone, and the answer is more interesting than you might think.

- Shares have provided some modest upside recently, up 2.6% over the last week, but are still down 8.9% over the past year despite a longer-term gain of 70.7% over five years.

- News surrounding Public Service Enterprise Group has centered on evolving energy infrastructure deals and regulatory updates, key themes shaping investor sentiment. Headlines around grid modernization and state-level clean energy initiatives have been especially relevant to recent price shifts.

- Currently, the company scores just 2 out of 6 on standard valuation checks. This sets the stage for a deeper dive into how analysts take different approaches to valuing this stock, and why there may be an even better way to judge value by the end of this article.

Public Service Enterprise Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Public Service Enterprise Group Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates a company's intrinsic value by calculating the present value of its expected future dividend payments. This model is especially relevant for companies that pay consistent dividends, such as Public Service Enterprise Group.

Currently, Public Service Enterprise Group pays an annual dividend per share of $2.79. Its return on equity stands at 12.2%, with a dividend payout ratio of about 62%, suggesting the company returns a significant portion of earnings to shareholders. The DDM assumes a conservative long-term dividend growth rate, capped at 3.26% based on recent company performance and analyst expectations.

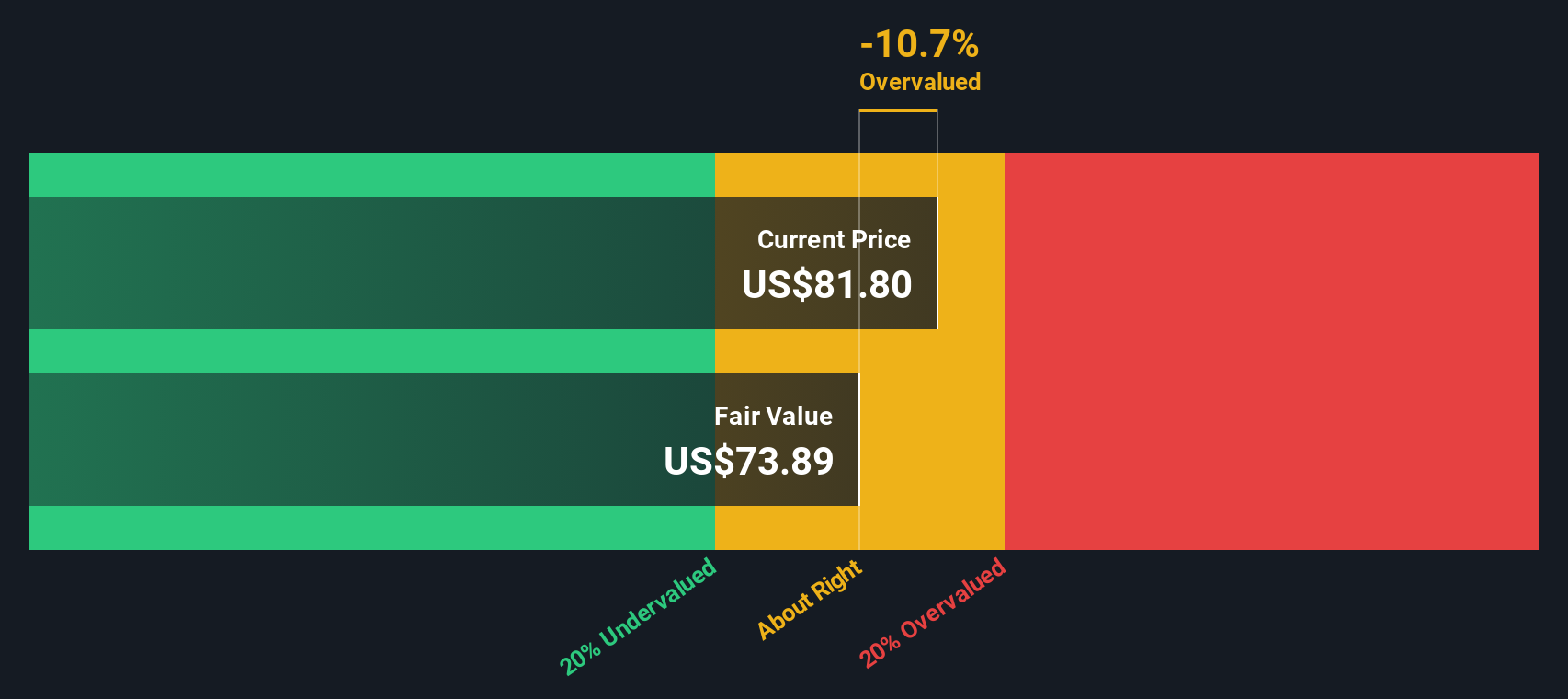

Taking these factors into account, the estimated intrinsic value of Public Service Enterprise Group shares using the DDM is $75.40. However, with the current share price trading about 10.4% higher than this intrinsic value, the stock appears to be overvalued according to this model.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Public Service Enterprise Group may be overvalued by 10.4%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Public Service Enterprise Group Price vs Earnings

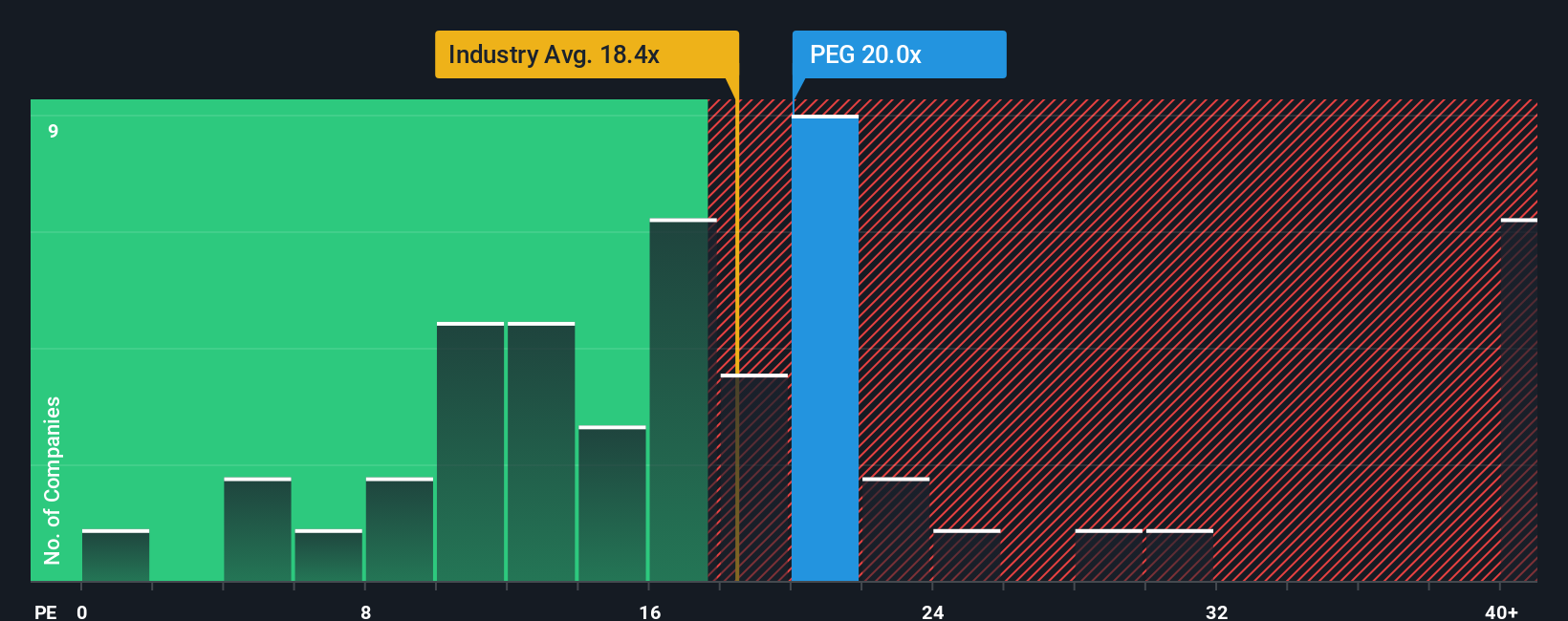

The Price-to-Earnings (PE) ratio is a time-tested way to value profitable companies like Public Service Enterprise Group, as it connects the share price directly to the company’s actual earnings. Investors lean on the PE ratio because it quickly shows how much they are paying for each dollar of company profit. In general, a higher PE suggests more robust growth expectations, while a lower PE reflects lower growth or higher risk.

Public Service Enterprise Group is currently trading at a PE ratio of 20x. Here is how that compares: its peer average is about 20x, and the broader Integrated Utilities industry trades at an average PE of roughly 18.6x. This suggests the market is valuing PEG on par with similar companies, possibly reflecting its stability and earnings profile.

Simply Wall St’s “Fair Ratio” metric for PEG stands at 21x. Unlike basic peer or industry comparisons, the Fair Ratio is a custom calculation that incorporates elements such as projected future growth, risk factors, profit margins, market capitalization, and the company’s place in the industry. This approach provides a more tailored view of what an appropriate multiple should be for a company with PEG’s characteristics and outlook.

With a current PE of 20x and a Fair Ratio of 21x, PEG’s valuation appears to be about right. The stock is trading nearly exactly where expectations would place it based on its financials and the assumptions built into its price.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Public Service Enterprise Group Narrative

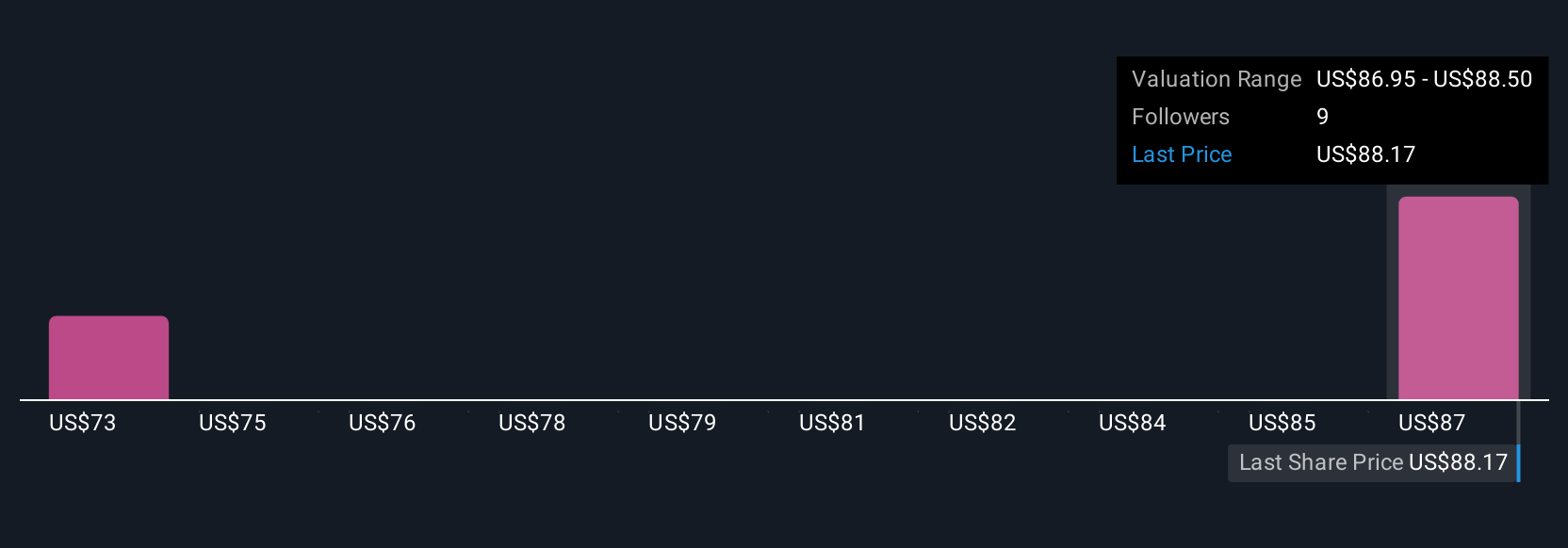

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple but powerful tool that lets investors combine their perspective on a company’s future, its story, with concrete financial forecasts like future revenue, earnings, and profit margins to estimate a fair value grounded in clear reasoning rather than just historical ratios.

By linking a company’s story to its numbers and then directly to a fair value, Narratives help you visualize and articulate why a stock might be worth more or less than today’s price. On Simply Wall St’s Community page, millions of investors use Narratives to decide when to buy or sell by comparing the resulting Fair Value to the current market price. Because these Narratives update automatically with the latest news and earnings, your view stays relevant without extra effort.

For example, some investors might build a Narrative for Public Service Enterprise Group based on aggressive growth in data center demand, projecting high future earnings and a bullish price target of $105.00. Others might focus on regulatory or political risks, leading to a more cautious fair value near $71.00, letting you choose which story and numbers match your own outlook.

Do you think there's more to the story for Public Service Enterprise Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com