How Should Investors View Agilent Technologies After Its Recent Life Sciences Partnerships?

- Curious if Agilent Technologies could be a value play or if it is starting to look expensive? You are not alone. Investors are increasingly turning their attention to quality stocks in a shifting market.

- Agilent’s share price has climbed by 6.9% in just the last week and is up 15.7% year-to-date. This suggests growing optimism or perhaps a new perception of risk and opportunity on the horizon.

- Recent news around Agilent includes its expanded partnerships in life sciences and ongoing advances in diagnostic technology, which have helped fuel renewed market enthusiasm and contributed to these stock gains. Industry headlines are focusing on how Agilent’s latest product launches could shake up competition and open new doors in emerging markets.

- When it comes to pure valuation, Agilent currently scores a 1 out of 6 on undervaluation checks, making it worth a closer look. Next, we will break down the traditional ways to value the stock. Be sure to explore further for an even more insightful approach by the end of this article.

Agilent Technologies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Agilent Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today’s dollars. This method helps investors gauge what a business is truly worth, making it a popular choice for evaluating stocks like Agilent Technologies.

According to the latest available data, Agilent Technologies reported a last twelve months Free Cash Flow (FCF) of $1.19 Billion. Looking ahead, analysts forecast steady growth, with free cash flows projected to reach $2.71 Billion by 2035. While detailed analyst estimates extend five years out, projections beyond that are based on systematic extrapolations.

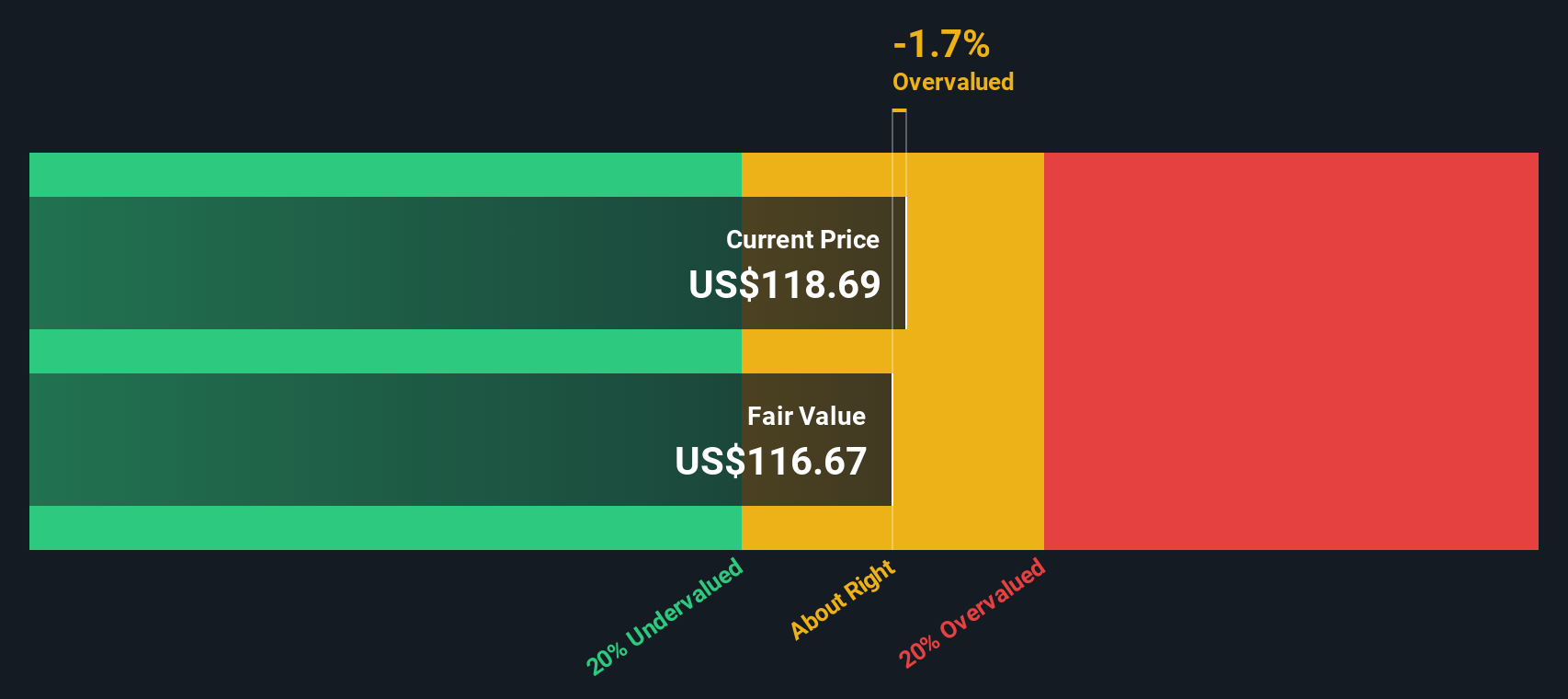

Using the 2 Stage Free Cash Flow to Equity model, the DCF analysis estimates Agilent’s intrinsic value at $146.58 per share. This figure is currently about 5.3% higher than its market price. According to this approach, the stock appears modestly overvalued.

In summary, Agilent’s share price almost matches its calculated intrinsic value, pointing to limited near-term upside or downside based on these cash flow projections.

Result: ABOUT RIGHT

Agilent Technologies is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Agilent Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested metric for assessing the valuation of profitable companies like Agilent Technologies. By measuring a company's share price relative to its per-share earnings, the PE ratio lets investors see how much they are paying for each dollar of profit. This is especially relevant for established companies with a steady earnings track record.

A company’s "normal" or "fair" PE ratio is influenced by expectations for future growth and the level of perceived risk. Higher growth prospects and lower risk profiles can justify a higher PE, while slow growth or elevated uncertainty can warrant a lower one.

Currently, Agilent Technologies trades at a PE ratio of 33.5x. This is right in line with the average for its peers (33.2x) and slightly below the broader Life Sciences industry average of 34.6x. However, Simply Wall St introduces a proprietary Fair Ratio for the company, which, in Agilent’s case, sits at 24.1x. The Fair Ratio distills many inputs such as earnings growth, profit margin, industry trends, market capitalization and risk, offering a more complete and nuanced picture than simple peer or industry comparisons.

This means that while Agilent’s PE is similar to competitors, it is above what is considered justified after accounting for more granular factors through the Fair Ratio. With a current PE of 33.5x against a Fair Ratio of 24.1x, Agilent Technologies appears overvalued using this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Agilent Technologies Narrative

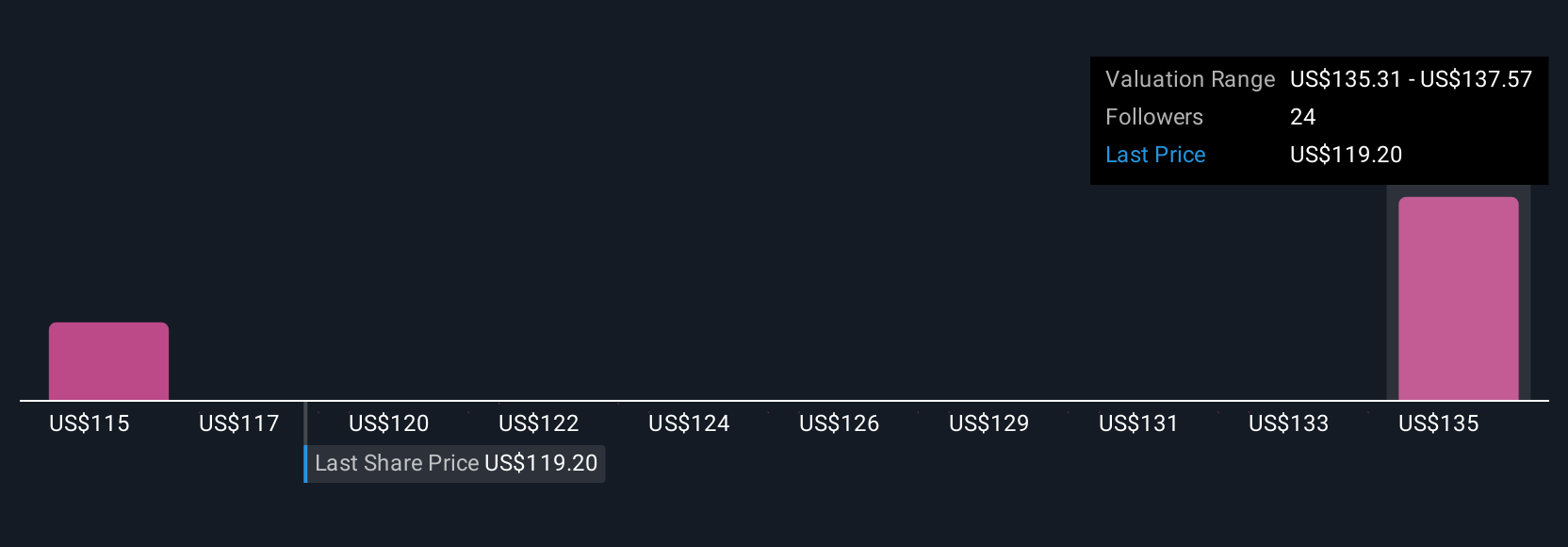

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear story you build around a company’s numbers. It’s your personal perspective that ties together financial forecasts, future revenue, earnings, margins, and a fair value, all grounded in what you believe will drive the business. Narratives bridge the gap between the company’s story and the numbers, helping you connect what’s happening in the real world with your investment decisions.

On Simply Wall St’s Community page, millions of investors access Narratives as an easy, highly visual tool. By building or following Narratives, you can anchor your buy and sell decisions in evolving scenarios, for example, comparing your calculated Fair Value to today’s Price, and adjusting when news or earnings updates change the picture. Narratives update automatically as new information comes in, giving you a dynamic way to act confidently as markets move.

For Agilent Technologies, one investor might see recurring revenues and innovation as signals for strong growth, supporting a high fair value of $165, while another takes a cautious outlook on tariffs and competition and lands at a lower fair value of $120. Narratives let you compare these perspectives, test your assumptions, and make smarter moves that fit your own view of Agilent’s future.

Do you think there's more to the story for Agilent Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com