Undervalued Small Caps With Insider Activity To Consider In November 2025

As the U.S. stock market experiences a notable upswing, with major indexes like the S&P 500 and Nasdaq on track for their best week since June, investors are turning their attention to small-cap stocks, which often offer unique opportunities during periods of broader market optimism. In this environment, identifying small-cap companies with strong fundamentals and insider activity can be particularly appealing as these factors may indicate potential for growth amid favorable economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.5x | 2.5x | 49.65% | ★★★★★★ |

| Shore Bancshares | 10.4x | 2.8x | 41.27% | ★★★★★☆ |

| Business First Bancshares | 10.2x | 2.6x | 49.56% | ★★★★★☆ |

| OneSpan | 8.0x | 1.9x | 44.37% | ★★★★★☆ |

| First United | 9.9x | 3.0x | 45.32% | ★★★★★☆ |

| Peoples Bancorp | 10.3x | 1.9x | 45.15% | ★★★★★☆ |

| S&T Bancorp | 11.3x | 3.9x | 37.94% | ★★★★☆☆ |

| Farmland Partners | 6.4x | 7.9x | -86.24% | ★★★★☆☆ |

| CNB Financial | 17.8x | 3.4x | 46.42% | ★★★☆☆☆ |

| Omega Flex | 17.0x | 2.7x | 7.78% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

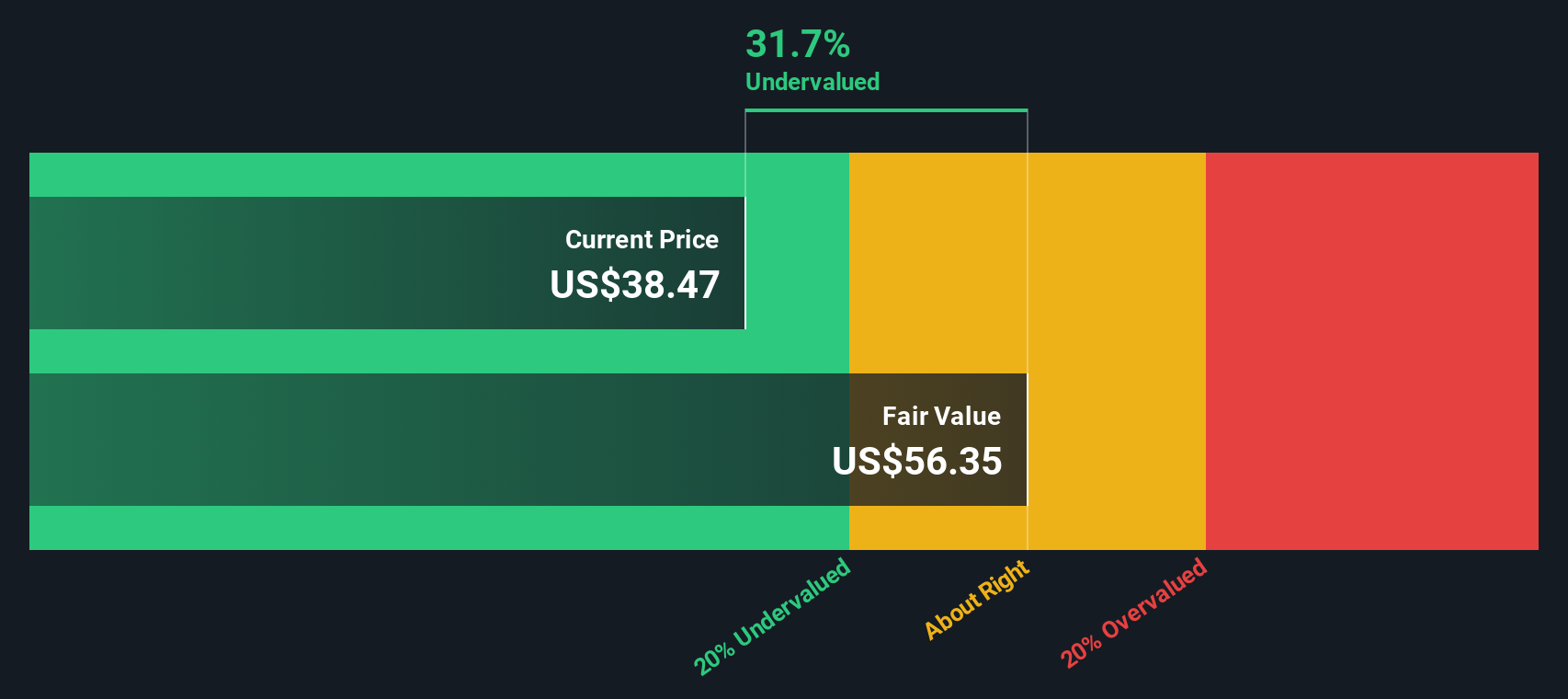

FMC (FMC)

Simply Wall St Value Rating: ★★★★★☆

Overview: FMC is a global agricultural sciences company that provides innovative solutions for crop protection, with a market cap of approximately $13.50 billion.

Operations: FMC's revenue is primarily derived from its Innovative Solutions segment, with recent figures showing a gross profit margin of 38.15%. The company has experienced fluctuations in net income margin, which reached -13.80% in the latest period ending September 2025. Operating expenses and non-operating expenses have been significant cost components affecting profitability over time.

PE: -3.5x

FMC, a smaller player in the U.S. market, recently reported a challenging third quarter with sales dropping to US$542.2 million from last year's US$1.07 billion and a net loss of US$569.3 million compared to prior profits. Despite these setbacks, insider confidence is evident as key figures have been purchasing shares throughout 2025, signaling potential optimism for future growth prospects amid expected earnings growth of 66% annually. However, funding remains risky due to reliance on external borrowing, and dividend reductions reflect ongoing financial adjustments.

- Click to explore a detailed breakdown of our findings in FMC's valuation report.

Assess FMC's past performance with our detailed historical performance reports.

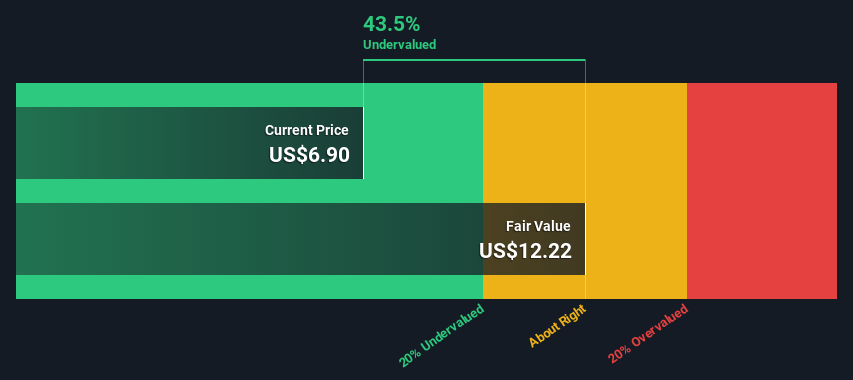

Herbalife (HLF)

Simply Wall St Value Rating: ★★★★★☆

Overview: Herbalife is a global nutrition company that develops and sells dietary supplements, weight management products, and personal care items, with a market capitalization of $1.46 billion.

Operations: Herbalife generates revenue across several key markets, including India and the United States, with significant contributions from other regions as well. The company experienced fluctuations in its gross profit margin, which was 50.51% in late 2014 and shifted to 45.28% by mid-2025. Operating expenses primarily consist of general and administrative costs, consistently forming a substantial part of the company's expenditures over time.

PE: 4.3x

Herbalife, a company with a strong presence in the nutrition industry, is navigating challenges amidst its small cap status. Recent insider confidence was evident as they increased their shareholdings over the past quarter, signaling potential optimism about future prospects. Despite earnings forecasted to decline by 2.5% annually over three years and interest payments not well covered by earnings, Herbalife's Liftoff product line continues to thrive in the growing US$41.4 billion energy drink market projected for 2033. The company's recent expansion into new flavors and its investment of US$7 million in a new research facility highlight ongoing efforts to innovate and maintain quality standards. However, external borrowing remains their primary funding source, which carries higher risk compared to customer deposits.

- Get an in-depth perspective on Herbalife's performance by reading our valuation report here.

Examine Herbalife's past performance report to understand how it has performed in the past.

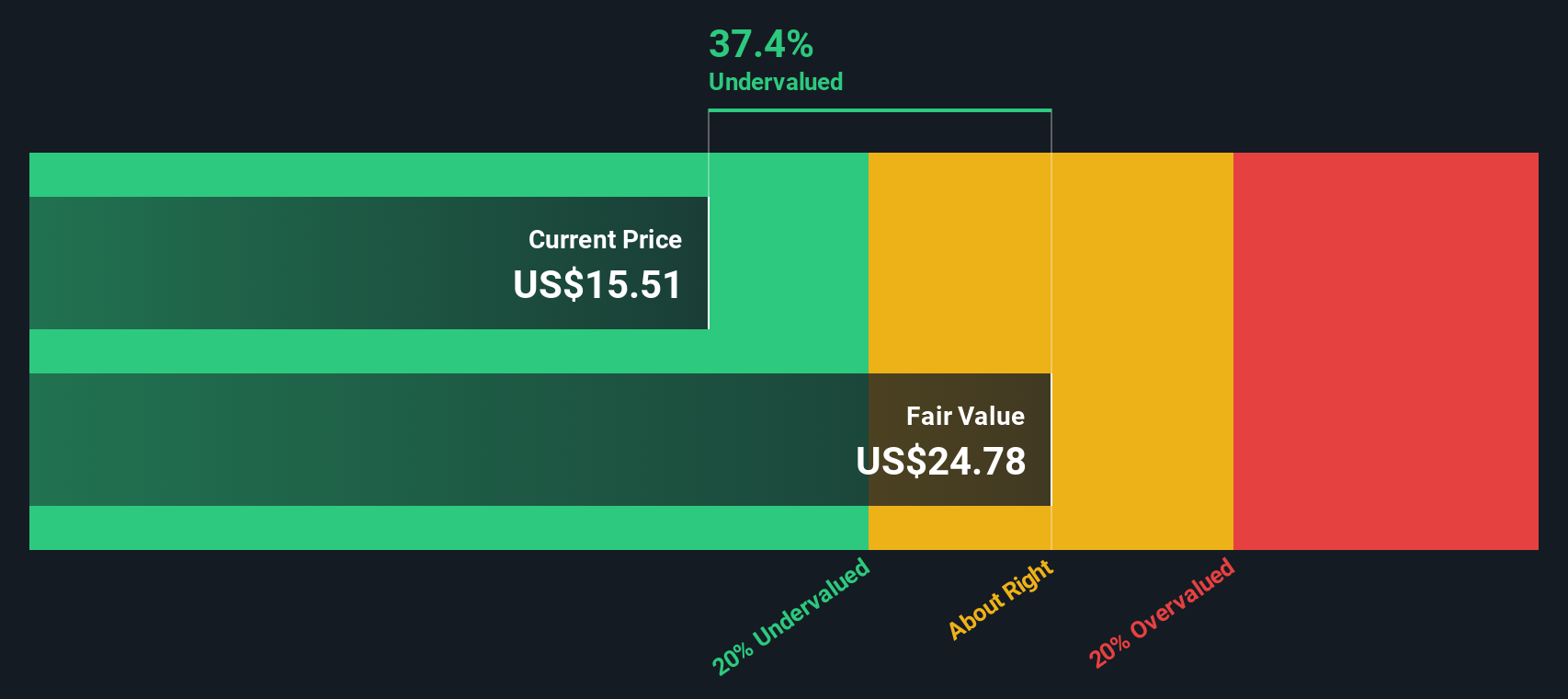

Sally Beauty Holdings (SBH)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sally Beauty Holdings operates as a specialty retailer and distributor of professional beauty supplies with two main segments, Sally Beauty Supply and Beauty Systems Group, and has a market capitalization of approximately $1.39 billion.

Operations: SBS and BSG are the primary revenue streams, contributing to a total revenue of $3.7 billion. The gross profit margin shows a notable trend, reaching 51.62% by September 2025. Operating expenses remain significant, with general and administrative costs being a major component at $1.54 billion as of the latest period.

PE: 8.2x

Sally Beauty Holdings, a smaller company in the beauty sector, recently reported annual sales of US$3.70 billion, slightly down from last year. However, net income rose to US$195.88 million from US$153.41 million, indicating improved profitability with earnings per share increasing to US$1.95 from US$1.48. The company repurchased 1.68 million shares for $20.45 million between July and September 2025 as part of a long-term buyback program totaling 36.72 million shares since August 2017, reflecting insider confidence in its future prospects despite high debt levels and reliance on external borrowing for funding needs.

- Dive into the specifics of Sally Beauty Holdings here with our thorough valuation report.

Gain insights into Sally Beauty Holdings' past trends and performance with our Past report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 77 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com