MACOM Technology Solutions Holdings (MTSI): Is There More Value Left After a 29.85% Year-to-Date Rally?

MACOM Technology Solutions Holdings (MTSI) stock is catching some attention lately, especially among those tracking semiconductor trends and recent company developments. Investors are stepping back to consider where the share price could head next in the current environment.

See our latest analysis for MACOM Technology Solutions Holdings.

After a strong stretch of gains, MACOM Technology Solutions Holdings' share price has climbed 29.85% year-to-date and recently hit $168.06. This reflects growing optimism in the semiconductor space even as investors stay alert to shifting risk sentiment. Looking longer term, with a total shareholder return of 27.64% over the past twelve months and 275% over five years, momentum certainly appears to be building.

If you want to see which other tech stocks are gaining market traction, it's a great time to explore the opportunities in our See the full list for free.

But with the stock up nearly 30% this year and trading close to analyst targets, investors are left wondering if MACOM Technology Solutions is still undervalued or if the market has already priced in all its future growth.

Most Popular Narrative: 8.2% Undervalued

Based on the most closely followed narrative, MACOM Technology Solutions Holdings' fair value is estimated at $183 per share. That is nearly 9% above its recent closing price of $168.06, underscoring renewed optimism driven by technology megatrends and management’s execution.

MACOM is set to benefit from accelerating demand in AI-driven cloud computing and hyperscale data center buildouts, as evidenced by strong revenue growth from high-speed optical interconnects, photodetectors, LPO chipsets, and upcoming PCIe equalizer solutions. This positions the company for sustained top-line growth as AI workloads proliferate.

Ever wondered what is driving that lofty price target just above today’s levels? The answer lies in bold growth assumptions and big expectations for margin expansion. Only by reading the full narrative can you discover exactly which numbers analysts are betting on and whether this bullish scenario might actually play out.

Result: Fair Value of $183 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin headwinds and reliance on volatile end markets could quickly shift sentiment if execution or demand falls short of current expectations.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.

Another View: Looking at Sales Multiples

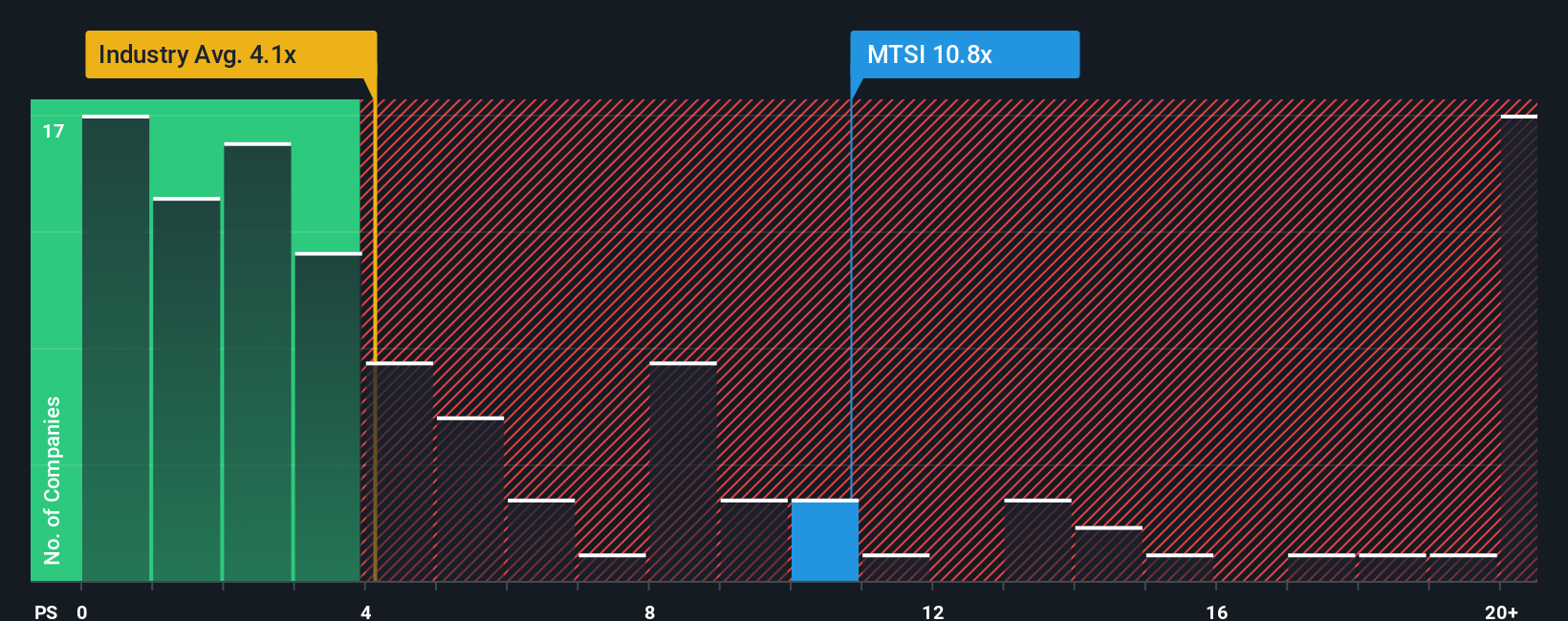

While the current narrative finds MACOM Technology Solutions undervalued, a quick glance at its sales ratio tells a very different story. The company is trading at a sales multiple of 13 times, meaning investors are paying a significant premium compared to the US semiconductor industry average of 4.5 times, the peer average of 6.8 times, and even the estimated fair ratio of 6.1 times. This suggests the market is pricing in aggressive growth; however, it raises the question of whether there is room for upside or if there is increased risk should expectations not be met.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MACOM Technology Solutions Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own investment story in just a few minutes with our easy tools. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding MACOM Technology Solutions Holdings.

Looking for More Investment Ideas?

Why limit yourself when you could be on the path to finding your next standout investment? Let Simply Wall Street’s powerful screener show you hidden gems and emerging trends that others might miss.

- Tap into market upswings by reviewing these 926 undervalued stocks based on cash flows that are positioned to bounce back with strong projected cash flows and compelling valuations.

- Secure consistent income potential and steady returns when you check out these 15 dividend stocks with yields > 3% with yields above 3% and resilient business models.

- Be at the forefront of innovation as you assess these 30 healthcare AI stocks that are transforming patient care and diagnostics with breakthrough artificial intelligence solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com