Is McKesson’s 41.7% Price Surge Backed by Its Specialty Drug Expansion?

- Ever wondered if McKesson’s rapid ascent means it is still a good buy, or if the best opportunities are already in the rearview mirror?

- In just the past year, McKesson’s stock jumped a striking 41.7%, with especially strong gains of 3.7% in the last week and 8.9% over the past month. This hints at both momentum and increased market attention.

- Recent headlines have been filled with updates on McKesson’s expansion of its specialty drug distribution and an industry-wide interest in healthcare logistics. These factors have fueled fresh optimism and contributed to the latest share price surge.

- When measured on our valuation scorecard, McKesson comes in at 4 out of 6 for being undervalued. Before we break down how we arrive at that number using multiple valuation methods, stick around for an even deeper approach to understanding a stock’s true value by the end of this article.

Approach 1: McKesson Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This approach is widely used to determine whether a stock is undervalued or overvalued based on expected financial performance.

For McKesson, the most recent annual Free Cash Flow stands at $6.0 billion. Analysts forecast a steady increase in free cash flow over the coming years, projecting it to reach $7.2 billion by 2030. The initial five-year cash flow estimates come directly from multiple analyst sources, while later projections are extrapolated. According to this model, McKesson’s cash flows are expected to remain robust and growing, which supports the company’s strong financial outlook.

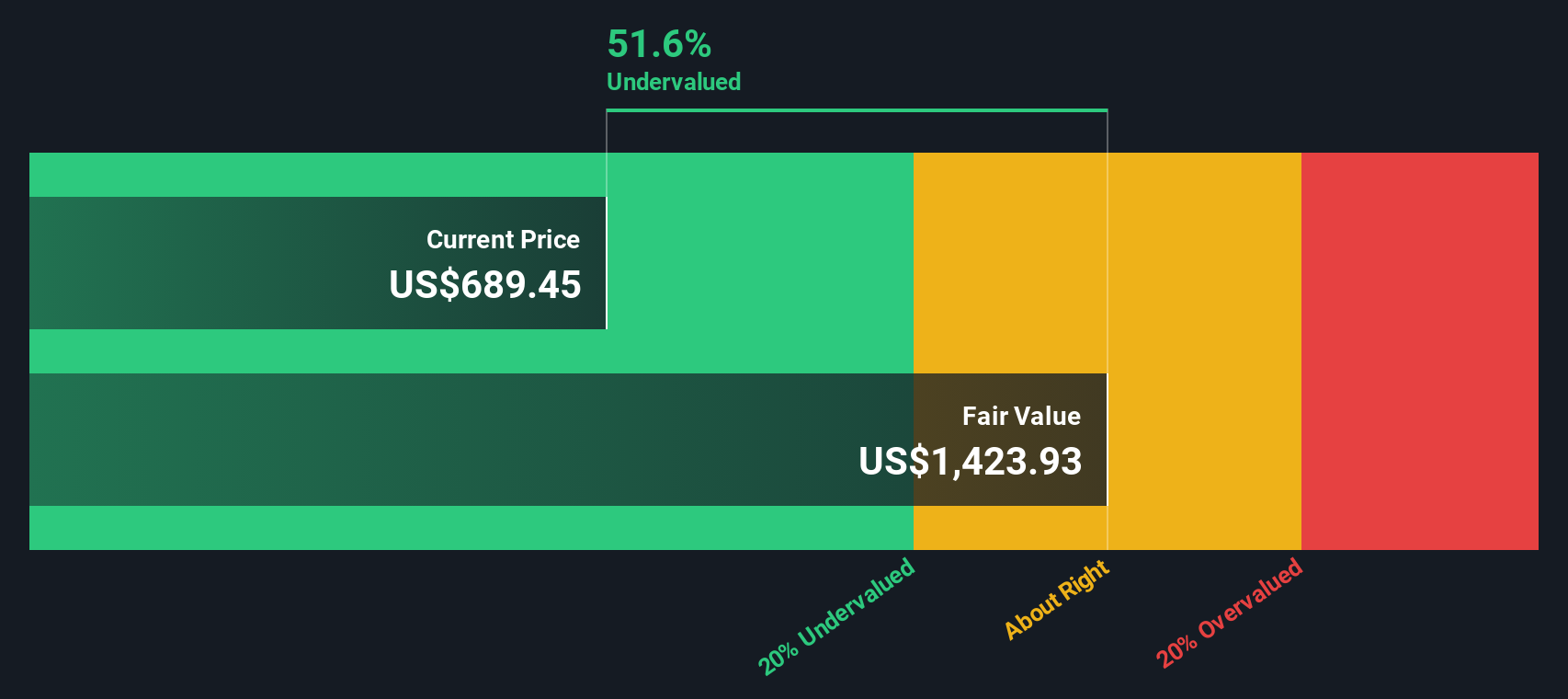

Based on these cash flow projections, the estimated intrinsic value for McKesson comes to $1,399.40 per share. The DCF model indicates a 36.9% discount to the current share price, which suggests the stock may be undervalued by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests McKesson is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: McKesson Price vs Earnings

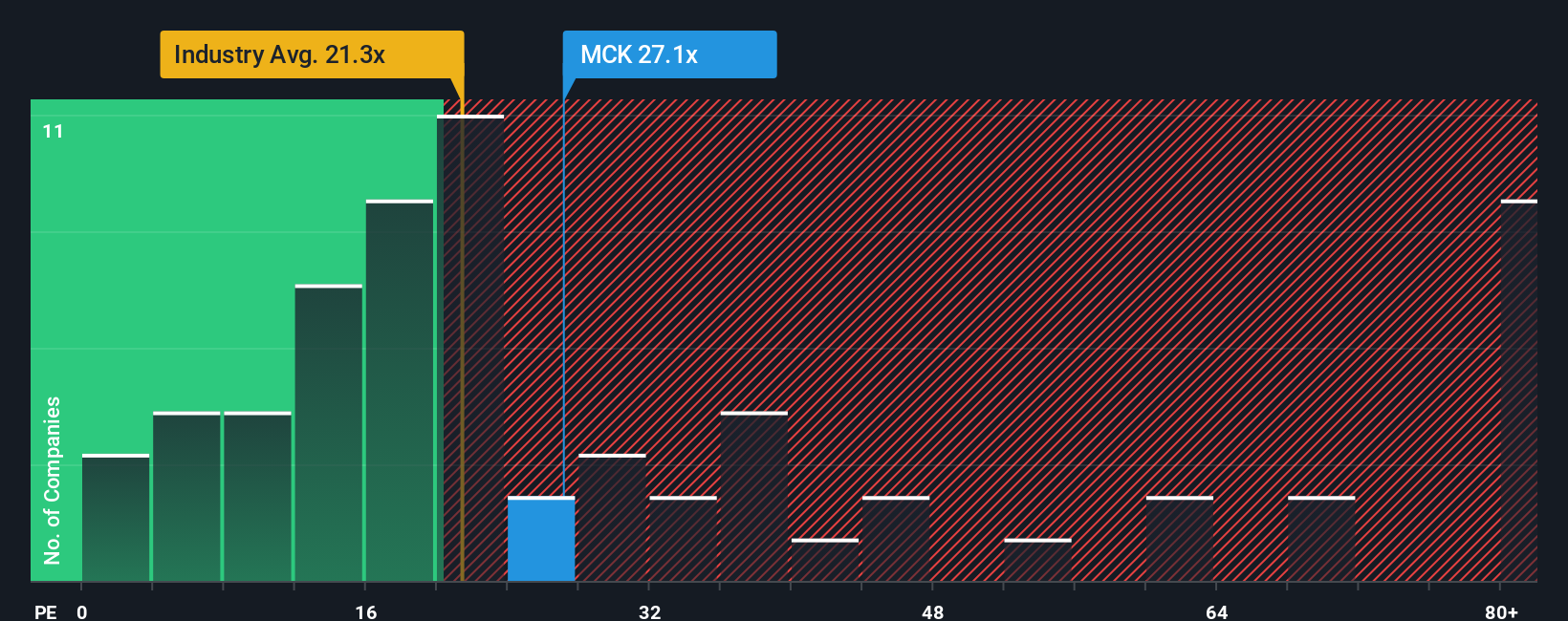

For profitable companies like McKesson, the Price-to-Earnings (PE) ratio is often the preferred valuation tool. The PE ratio helps investors gauge how much they are paying for each dollar of earnings, which is especially relevant when a company is generating consistent profits like McKesson.

Growth expectations and risk are key drivers of what makes a "normal" or "fair" PE ratio. Faster-growing companies can justify higher PE multiples, while firms facing elevated risks or more modest prospects usually trade at lower multiples.

Currently, McKesson trades at a PE ratio of 27.0x. This is below the average PE of its industry peers at 29.7x, but above the wider healthcare industry average of 22.8x. On Simply Wall St’s valuation scorecard, McKesson’s Fair Ratio is calculated at 33.1x. This proprietary multiple goes beyond simple peer or industry averages by incorporating critical factors such as the company’s earnings growth, profit margins, risks, industry, and market cap to arrive at a more tailored benchmark.

Comparing McKesson’s Fair Ratio of 33.1x to its current PE of 27.0x suggests the stock could be undervalued, as it trades well below its calculated fair value multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your McKesson Narrative

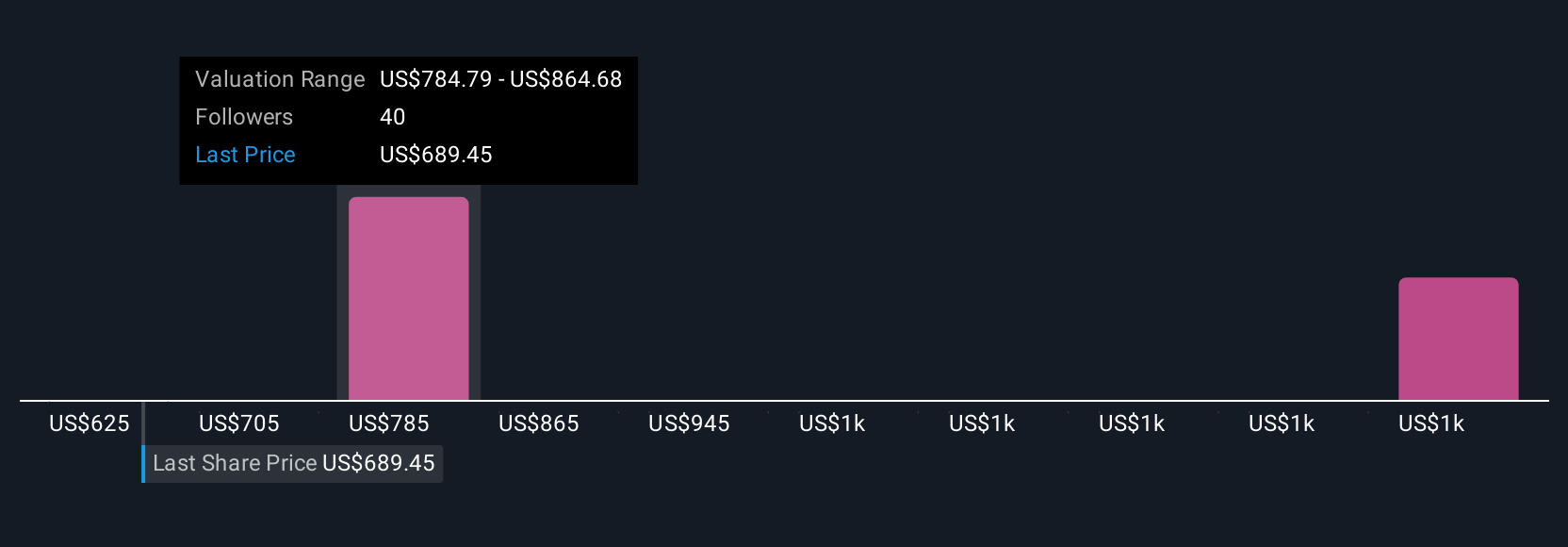

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative goes beyond the numbers and is your own story or perspective on a company’s future. It combines your assumptions for fair value, revenue growth, earnings, and profit margins to create a meaningful investment thesis. With Simply Wall St’s Community page, crafting a Narrative is straightforward and accessible to all investors. This empowers you to connect McKesson’s business story with your financial forecasts and see how these lead to a fair value. Narratives make it simple to compare your ideas with the community and act confidently by matching your fair value estimate to McKesson’s current price, which can help you identify opportunities. In addition, Narratives update automatically as new earnings reports or major news are released, so you always have a fresh, informed view. For example, some McKesson investors may believe its revenue growth, margin improvements, and industry leadership justify a fair value above $830 per share. Others may focus on regulatory risks and slower expansion, assigning values closer to $640. With Narratives, you can see these different outlooks side by side and decide what resonates most for your strategy.

Do you think there's more to the story for McKesson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com