Should Robust Infrastructure Demand in Louisiana and Texas Prompt Action From United States Lime & Minerals (USLM) Investors?

- In the past quarter, Diamond Hill Capital's Small Cap Strategy highlighted United States Lime & Minerals, Inc. as a top contributor, crediting sales growth to heightened demand from construction, environmental, and steel customers in key markets like Louisiana and Texas.

- An interesting insight is that ongoing infrastructure efforts and strong bidding activity are expected to foster consistently high demand for the company's products in these regions.

- We'll explore how robust infrastructure activity in Louisiana and Texas influences United States Lime & Minerals' overall investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is United States Lime & Minerals' Investment Narrative?

Owning shares of United States Lime & Minerals means believing in the continued strength of core markets like Louisiana and Texas, where infrastructure and construction spending are driving much of the company’s demand. The recent acknowledgement from Diamond Hill Capital signals that the short-term catalyst, sustained infrastructure activity, is still in play, potentially improving the near-term outlook compared to earlier expectations. While previous analysis highlighted moderation risks such as index removals, insider selling, and share price underperformance, the robust Q3 sales growth and confirmation of strong regional demand may help offset some of these headwinds, at least for now. That said, USLM remains relatively expensive compared to the broader industry, which could limit upside if demand trends were to soften unexpectedly. The latest news situates USLM at an interesting juncture, where positive momentum is balanced by familiar valuation and execution risks.

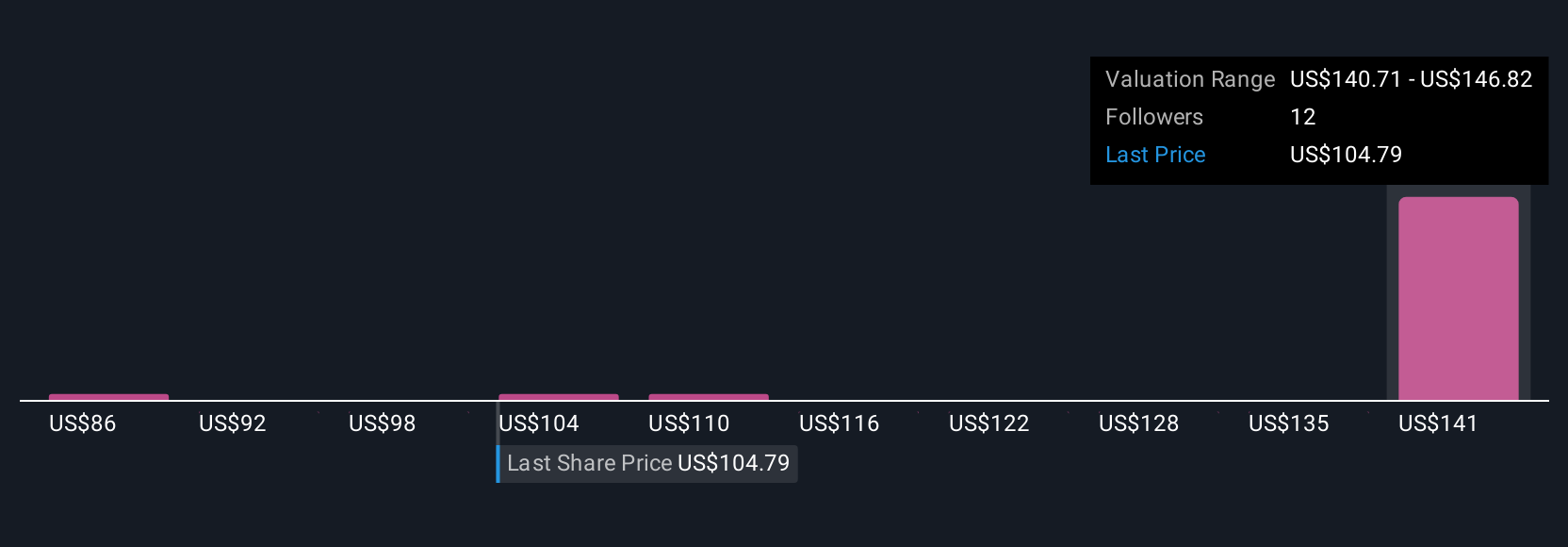

Unlike recent sales momentum in core markets, insider selling remains a risk investors should watch closely. United States Lime & Minerals' shares have been on the rise but are still potentially undervalued by 26%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on United States Lime & Minerals - why the stock might be worth as much as 35% more than the current price!

Build Your Own United States Lime & Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United States Lime & Minerals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United States Lime & Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United States Lime & Minerals' overall financial health at a glance.

No Opportunity In United States Lime & Minerals?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com