Is Advanced Drainage Systems Fairly Priced After Sustained Growth and Expanding U S Infrastructure Investments?

- Wondering if Advanced Drainage Systems could be undervalued or is living up to its price tag? You are not alone, as many investors are weighing whether there is room to run or if now is the time to reconsider.

- The shares have climbed 7.1% in the past week, are up 34.3% year-to-date, and have returned an impressive 119.1% over the last five years. These movements reflect shifting market optimism and long-term potential.

- Recent headlines have highlighted the company's continued expansion in sustainable water management, along with growing infrastructure investments in the U.S. These developments have fueled both confidence in Advanced Drainage Systems and a fresh wave of interest in its stock.

- Despite surging interest, the company's value score sits at 0 out of 6, signaling that by our valuation checks, the company is not currently undervalued. However, as you’ll see, valuation is not always so straightforward. Up next, we will break down the traditional approaches and reveal a smarter way to look at value at the end of this article.

Advanced Drainage Systems scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Advanced Drainage Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and then discounting them back to their present value. This approach provides an estimate of what investors might reasonably pay for the company now, based on its future earning power.

For Advanced Drainage Systems, the most recent reported Free Cash Flow is $536 million. Over the next ten years, cash flows are forecast to remain strong, with analysts providing annual estimates for the first five years and further years extrapolated by Simply Wall St. By 2027, Free Cash Flow is projected to be $517.2 million and by 2035 it is expected to reach $581.7 million.

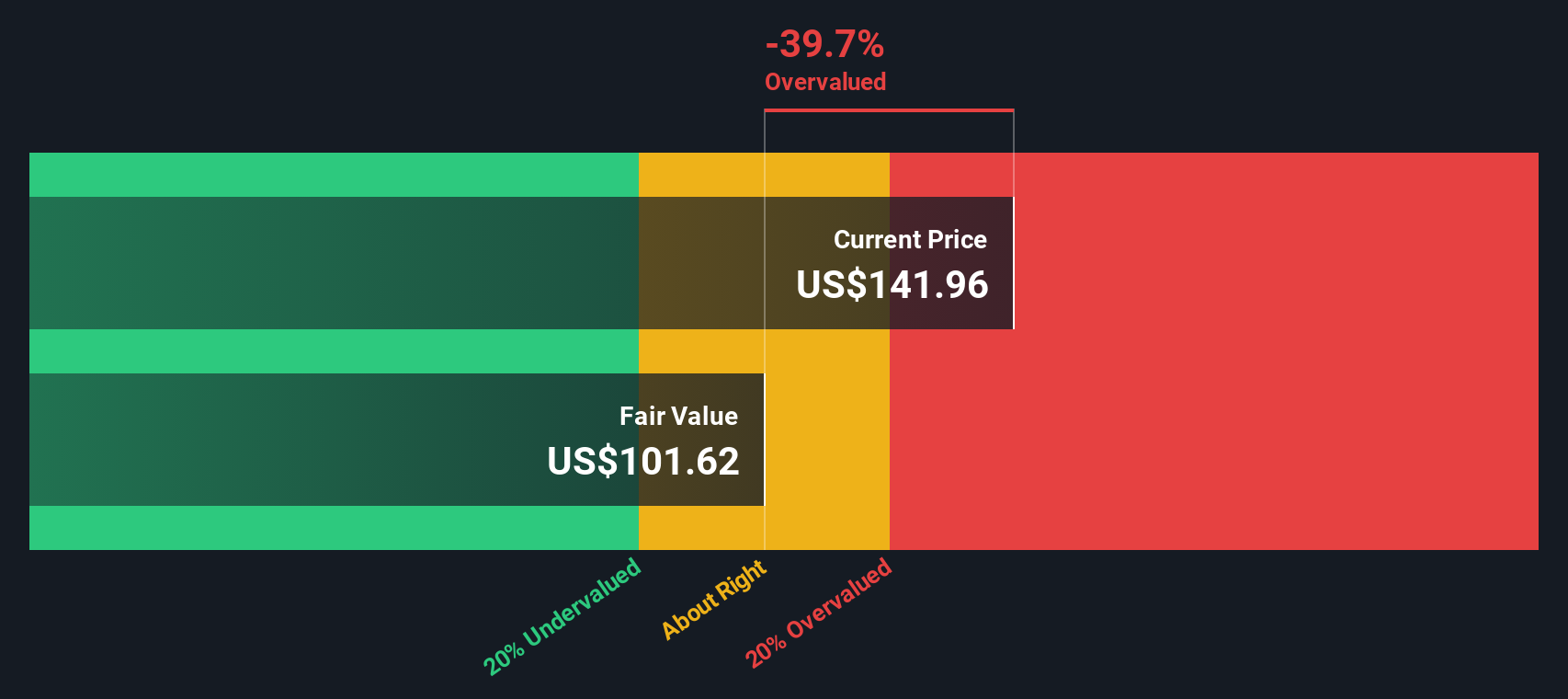

The DCF model calculates an intrinsic value of $108.76 per share. Comparing this to the current market price reveals an implied discount of -41.1%, meaning the stock is trading well above its projected fair value. According to this approach, Advanced Drainage Systems shares appear significantly overvalued at today's prices.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Advanced Drainage Systems may be overvalued by 41.1%. Discover 928 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Advanced Drainage Systems Price vs Earnings

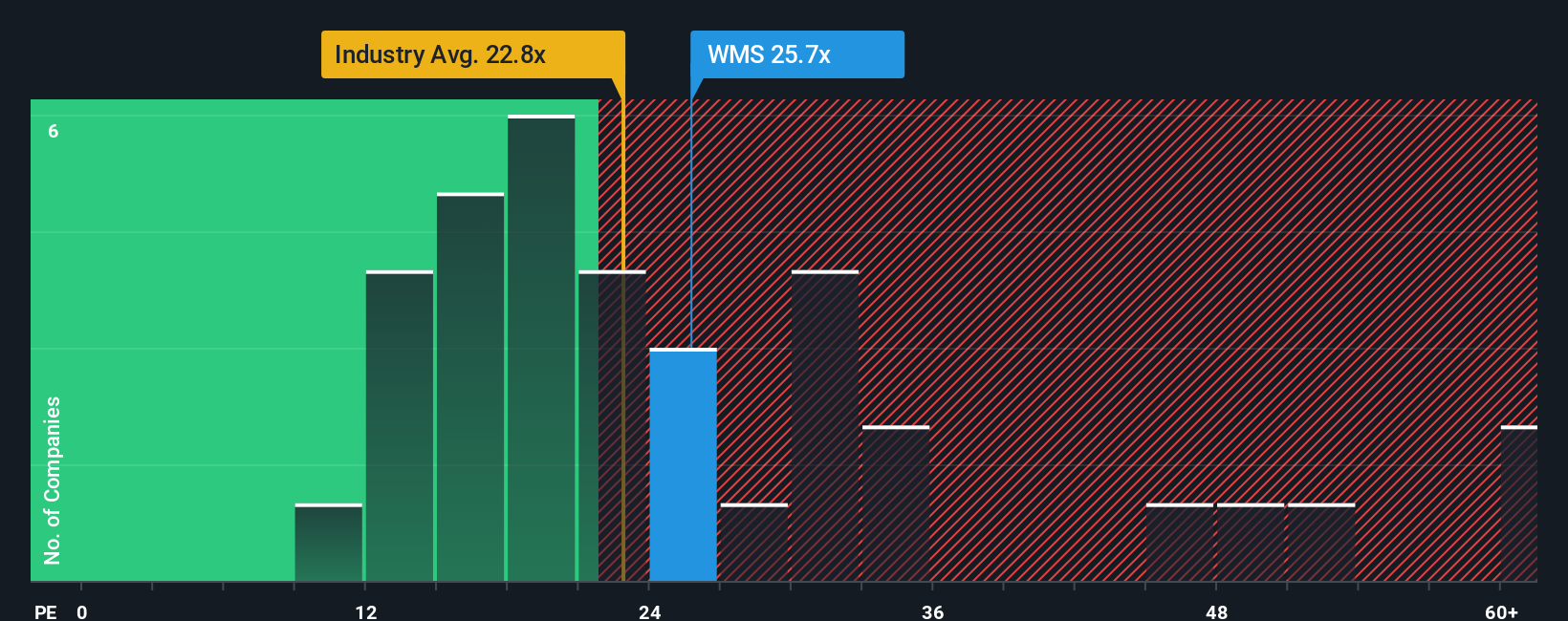

For profitable companies, Price-to-Earnings (PE) is a widely used metric to gauge valuation since it directly relates a company's current price to its earnings power. This makes the PE ratio especially suitable for assessing established businesses like Advanced Drainage Systems, which consistently generate profits.

Interpreting what constitutes a "fair" PE ratio depends on factors such as expected growth rates and risk. Generally, companies boasting higher earnings growth or lower perceived risks can justify a premium, or higher PE multiple, compared to slower-growing or riskier firms in the same sector.

Looking at the numbers, Advanced Drainage Systems trades at a PE of 26x, which is notably above the Building industry average of 19x and its peer average of 18x. On the surface, this suggests the stock is priced at a premium to both its direct competitors and the broader sector.

However, Simply Wall St introduces the “Fair Ratio,” which reflects a more nuanced PE based on the company’s own growth outlook, profitability, risk profile, market capitalization, and industry context. Unlike basic peer or sector comparisons, the Fair Ratio presents a tailored benchmark that answers whether a premium or discount is actually warranted for this specific business.

In this case, Advanced Drainage Systems’ Fair Ratio is 26x, which almost exactly matches its current PE multiple. This alignment indicates the market is valuing the company fairly, considering its prospects, financial strength, and risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Advanced Drainage Systems Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a simple yet powerful tool that helps you craft a clear story behind the numbers: you state your own view of a company’s future, such as its fair value, projected revenue, earnings, and profit margins, based on how you interpret its outlook and risks. By linking a company's story to a financial forecast and then to a fair value, Narratives let investors move beyond static numbers and make dynamic, conviction-based decisions.

Available in the Simply Wall St Community page, Narratives make investing easy and collaborative, with millions already using them. They update automatically as new news or earnings are released, helping you see at a glance if your story still fits the latest facts and whether the current price offers opportunity. For example, some Advanced Drainage Systems investors might build a bullish Narrative by projecting margin expansion and a fair value of $172, while more cautious peers see risks in cyclical demand and set their fair value closer to $130. Narratives empower you to choose the story (and value) that matches your belief and act decisively when price and thesis diverge.

Do you think there's more to the story for Advanced Drainage Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com