Can Analyst Optimism on CTOS Signal a Turning Point for Its Cash Flow and Debt Strategy?

- Earlier this week, Stifel Nicolaus reiterated its Buy rating on Custom Truck One Source following meetings with company leadership, highlighting confidence in the company’s recovery prospects and operational outlook.

- An interesting insight is that Stifel identifies ongoing recovery in the Transmission & Distribution segment and opportunities for cash flow and debt reduction as key reasons for their constructive view.

- We’ll explore how renewed analyst optimism, underscored by the leadership meetings, could influence Custom Truck One Source’s investment case going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Custom Truck One Source Investment Narrative Recap

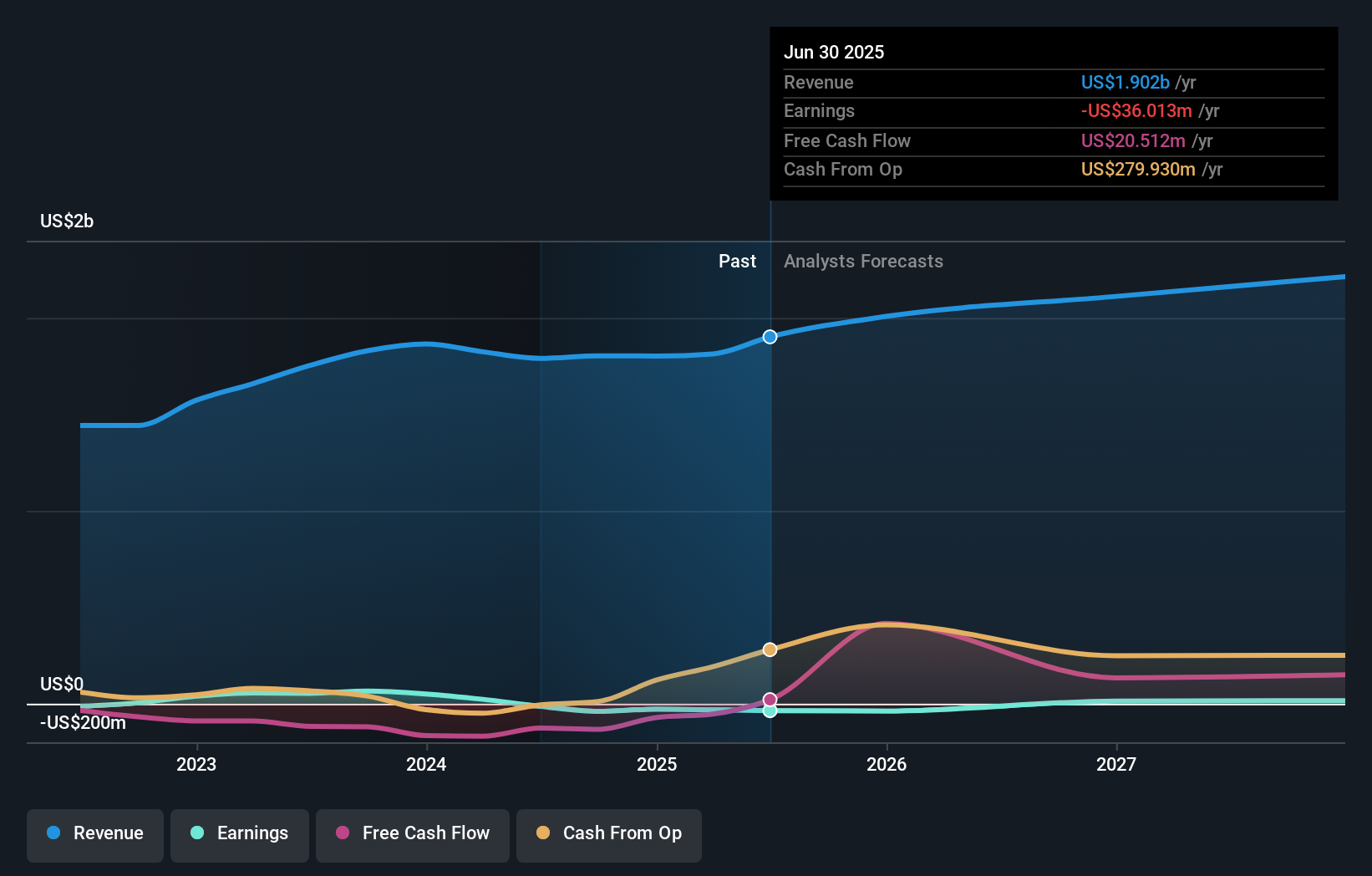

To be a shareholder in Custom Truck One Source, you need to believe in the durability of utility and infrastructure demand, as well as the company’s path to improved cash flow and debt reduction. The recent analyst support from Stifel Nicolaus highlights renewed optimism around recovery in key business segments, but it does not materially change the most important short-term catalyst, increasing free cash flow, or the largest current risk, which stems from the company’s relatively high leverage and sensitivity to interest rate pressure. A recent earnings announcement remains the most relevant update for investors watching this stock, as Custom Truck One Source posted higher year-over-year revenue and a narrowed net loss, while reaffirming its full-year revenue guidance. This financial progress provides fresh context to analyst confidence in the company’s ability to improve its balance sheet and accelerate recovery if demand trends hold. However, investors should also be aware that, even with these positive signals, debt levels remain elevated...

Read the full narrative on Custom Truck One Source (it's free!)

Custom Truck One Source's narrative projects $2.3 billion in revenue and $28.6 million in earnings by 2028. This requires 6.6% yearly revenue growth and a $64.6 million increase in earnings from the current -$36.0 million.

Uncover how Custom Truck One Source's forecasts yield a $7.67 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates for Custom Truck One Source between US$5.50 and US$7.67, drawing on two distinct forecasts. With ongoing operational recovery but leverage remaining a significant concern, these diverse viewpoints reflect the factors shaping the company's future and invite you to review multiple outlooks side by side.

Explore 2 other fair value estimates on Custom Truck One Source - why the stock might be worth 15% less than the current price!

Build Your Own Custom Truck One Source Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Custom Truck One Source research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Custom Truck One Source research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Custom Truck One Source's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com