Tyson Foods (TSN) Shuts Nebraska Plant and Cuts Texas Operations Will Streamlining Stem Beef Segment Losses?

- Earlier this month, Tyson Foods announced it would close its Lexington, Nebraska beef processing plant and reduce operations at its Amarillo, Texas facility in response to historically low U.S. cattle supplies and persistent losses in its beef segment.

- The decision is expected to cut U.S. beef processing capacity by 7% to 9%, affecting thousands of workers and raising questions about the broader impact on the company's future profitability and local economies.

- We'll explore how Tyson's effort to streamline its beef operations amid continued segment losses influences the company's investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Tyson Foods Investment Narrative Recap

For investors considering Tyson Foods, confidence in the company’s ability to adapt its protein portfolio and manage through industry headwinds is essential. The recent beef plant closure and shift reduction are direct responses to ongoing cattle supply constraints, which remain the single most significant risk to near-term earnings. In the short term, these operational changes may not materially change the core challenge facing Tyson: the sustained pressure on beef margins from tight supply and elevated input costs.

One of the most relevant recent announcements is Tyson’s guidance for 2026, expecting sales growth of 2% to 4% despite recent disruptions in its beef operations. This outlook will likely draw investor attention to the resilience of Tyson’s chicken and prepared foods businesses, which could help offset ongoing weakness in beef and influence how the company navigates through this restructuring period.

But while the company works to position itself for long-term gain, investors should be aware that even bold restructuring moves may not quickly resolve the ongoing risk of...

Read the full narrative on Tyson Foods (it's free!)

Tyson Foods' narrative projects $57.7 billion in revenue and $2.3 billion in earnings by 2028. This requires 2.1% yearly revenue growth and a $1.5 billion increase in earnings from the current $784.0 million.

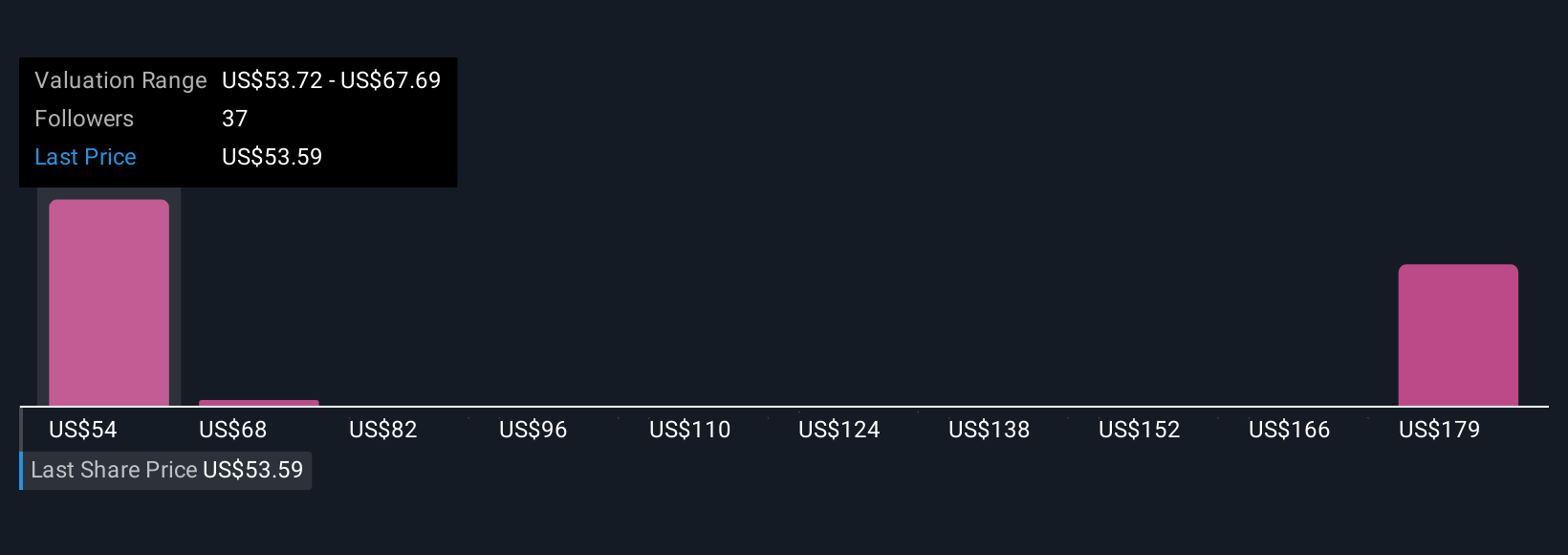

Uncover how Tyson Foods' forecasts yield a $62.67 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community put Tyson's worth between US$45 and US$92.58 per share. With opinions ranging this widely, some see opportunity, but persistent cattle supply constraints remain a key consideration for the company's future performance and invite you to weigh alternative views.

Explore 8 other fair value estimates on Tyson Foods - why the stock might be worth as much as 60% more than the current price!

Build Your Own Tyson Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tyson Foods research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Tyson Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tyson Foods' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com