Atlas Energy’s Megawatt Market Expansion Might Change the Case for Investing in AESI

- Atlas Energy Solutions recently announced its entry into the megawatt market with an initial 240MW order, aiming to deploy about 400MW by early 2027, incorporating 190MW of newly acquired Moser assets, and targeting demand from data centers, commercial, industrial, and oil and gas sectors.

- While revenue exceeded forecasts, challenges in the oilfield services segment led Atlas to report a 30% EBITDA miss and a net loss, giving investors a mixed picture of operational progress and profitability.

- We'll explore how Atlas's entry into the large-scale power market may reshape its investment appeal amid ongoing segment challenges.

Find companies with promising cash flow potential yet trading below their fair value.

Atlas Energy Solutions Investment Narrative Recap

For investors considering Atlas Energy Solutions, the key thesis centers on whether the company's diversification into the megawatt power market can offset ongoing weakness in its oilfield services segment. While the recent 240MW power order highlights Atlas's push beyond its core sand business, these efforts have yet to fully address the most pressing short-term catalyst, rebounding activity and pricing in Permian Basin sand, and do not materially reduce the core risk of structurally lower demand if energy services remain subdued.

The company's major power generation equipment order, announced alongside Q3 results, stands out for its potential to broaden Atlas's customer base into data centers and industrials. However, the continued suspension of dividends and recent executive departures underscore that operational and financial recovery in oilfield services remains critical to near-term shareholder confidence.

But with industry demand volatility still weighing on Atlas's core revenues, investors should be aware of...

Read the full narrative on Atlas Energy Solutions (it's free!)

Atlas Energy Solutions is projected to reach $1.2 billion in revenue and $148.5 million in earnings by 2028. This outlook assumes a 2.2% annual revenue growth rate and an earnings increase of $134.5 million from the current earnings of $14.0 million.

Uncover how Atlas Energy Solutions' forecasts yield a $12.50 fair value, a 50% upside to its current price.

Exploring Other Perspectives

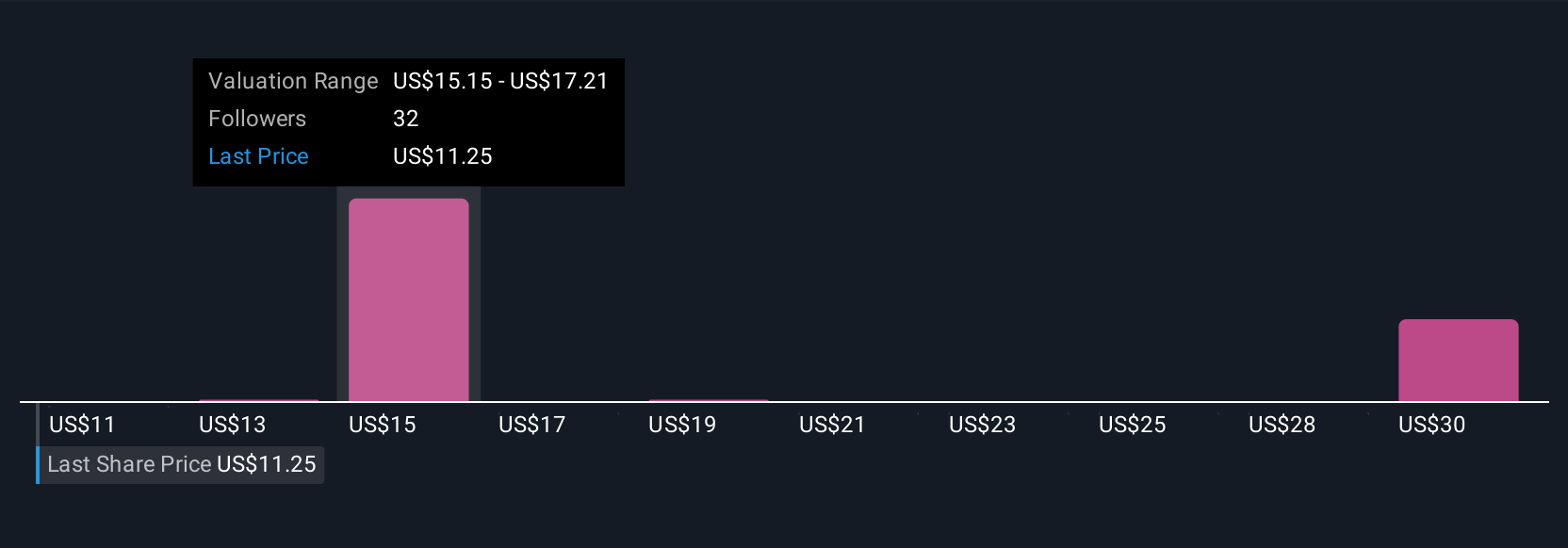

Simply Wall St Community members estimate Atlas’s fair value between US$10 and US$51.41, based on nine independent perspectives. While opinions diverge, ongoing uncertainty in oil and gas activity highlights how sensitive Atlas’s future may be to core end-market trends, you can compare these viewpoints before deciding where you stand.

Explore 9 other fair value estimates on Atlas Energy Solutions - why the stock might be worth over 6x more than the current price!

Build Your Own Atlas Energy Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Atlas Energy Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atlas Energy Solutions' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com