How Interparfums’ (IPAR) New 2026 Guidance and Margin Miss May Shift Its Investment Story

- Interparfums, Inc. recently issued earnings guidance for the fiscal year ending December 31, 2026, forecasting net sales of US$1.48 billion and diluted EPS of US$4.85.

- While the company’s quarterly revenue met expectations and EBITDA surpassed estimates, a significant miss on gross margin estimates highlights ongoing challenges relating to cost pressures or shifts in product mix.

- We’ll examine how Interparfums’ gross margin performance and new 2026 guidance could influence its longer-term investment narrative and earnings outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Interparfums Investment Narrative Recap

To be a shareholder in Interparfums, you need to believe in the company's ability to defend and grow its portfolio of licensed prestige fragrance brands despite shifts in consumer tastes and global market dynamics. The recent 2026 guidance reinforces management's confidence in top-line stability, but with gross margin misses drawing attention, the biggest short-term catalyst, execution on margin recovery, remains under pressure, while the most important risk continues to be potential volatility if cost or mix issues persist; for now, the news does not materially alter this equation.

Among recent developments, the company’s latest guidance for fiscal 2026 is most immediately relevant, projecting US$1.48 billion in net sales and US$4.85 diluted EPS. This announcement signals management’s continued focus on expansion, but highlights the need for ongoing margin improvement to support near-term earnings momentum.

In contrast, persistent margin pressure introduces operational questions investors should be aware of, particularly if...

Read the full narrative on Interparfums (it's free!)

Interparfums' narrative projects $1.7 billion revenue and $206.2 million earnings by 2028. This requires 5.0% yearly revenue growth and a $45.2 million earnings increase from $161.0 million.

Uncover how Interparfums' forecasts yield a $103.60 fair value, a 28% upside to its current price.

Exploring Other Perspectives

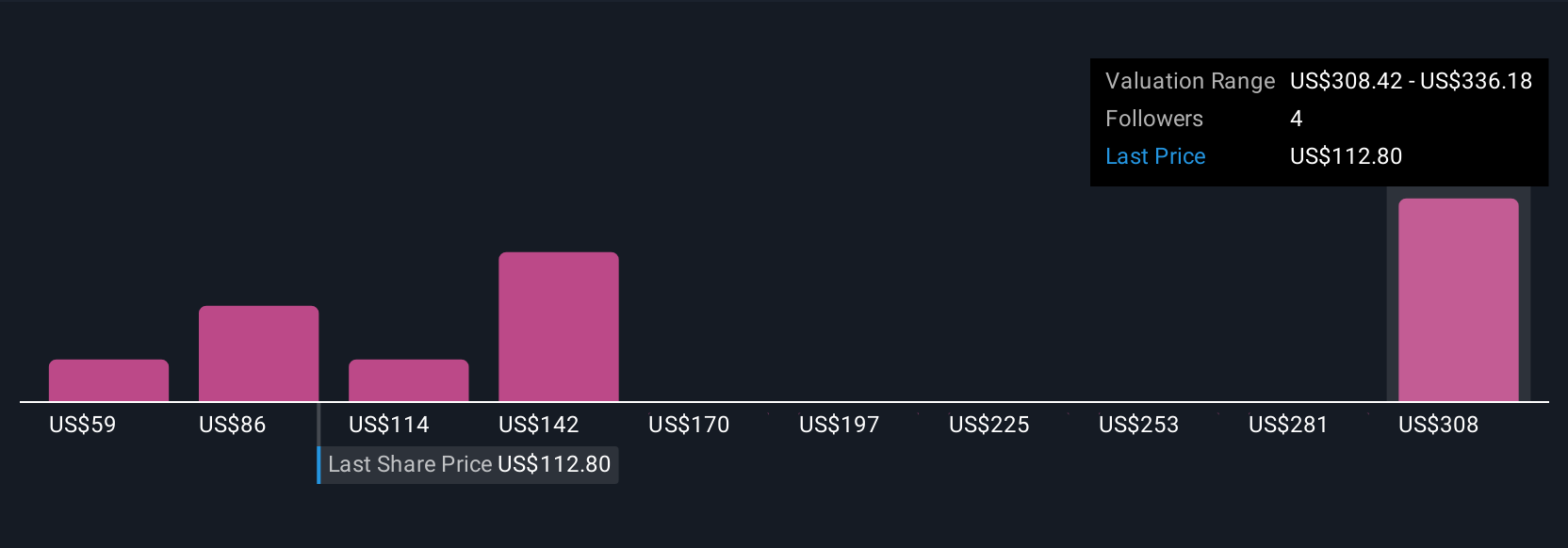

Nine members of the Simply Wall St Community estimate fair values ranging widely from US$52.71 to over US$14,448 per share. Coupled with ongoing gross margin challenges, this spread reflects just how differently market participants view the company’s future and invites you to explore several viewpoints.

Explore 9 other fair value estimates on Interparfums - why the stock might be a potential multi-bagger!

Build Your Own Interparfums Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interparfums research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interparfums research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interparfums' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com