Will Option Care Health's (OPCH) Revenue Beat and Steady Guidance Shift Its Investment Story?

- Option Care Health recently reported quarterly revenues that exceeded analyst expectations by 1.4%, while maintaining its full-year earnings per share guidance in line with estimates.

- This outcome underscores continued operating strength in a segment benefiting from healthcare innovations and demographic shifts, despite ongoing industry challenges.

- With revenue surpassing forecasts, we'll examine how this performance shapes Option Care Health's investment narrative and outlook.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Option Care Health Investment Narrative Recap

To be comfortable holding shares of Option Care Health, investors need to believe in the long-term growth of infusion therapies as demographic trends expand the addressable market and as healthcare pivots toward alternate site care. The latest earnings beat supports this broad narrative but does not materially alter the near-term risk of margin pressure from shifts in therapy mix or the importance of preserving strong payer and pharma contracts. Among recent announcements, the completion of another share repurchase tranche, 2,158,218 shares for US$62.5 million, underscores management’s ongoing confidence in the company’s outlook and may offer incremental support to the stock. It’s a relevant step in the context of top-line performance but does not substantially change the short-term earnings catalysts tied to technology investment or new payer relationships. However, investors should still keep a close eye on the shifting therapy mix and its impact on net margins…

Read the full narrative on Option Care Health (it's free!)

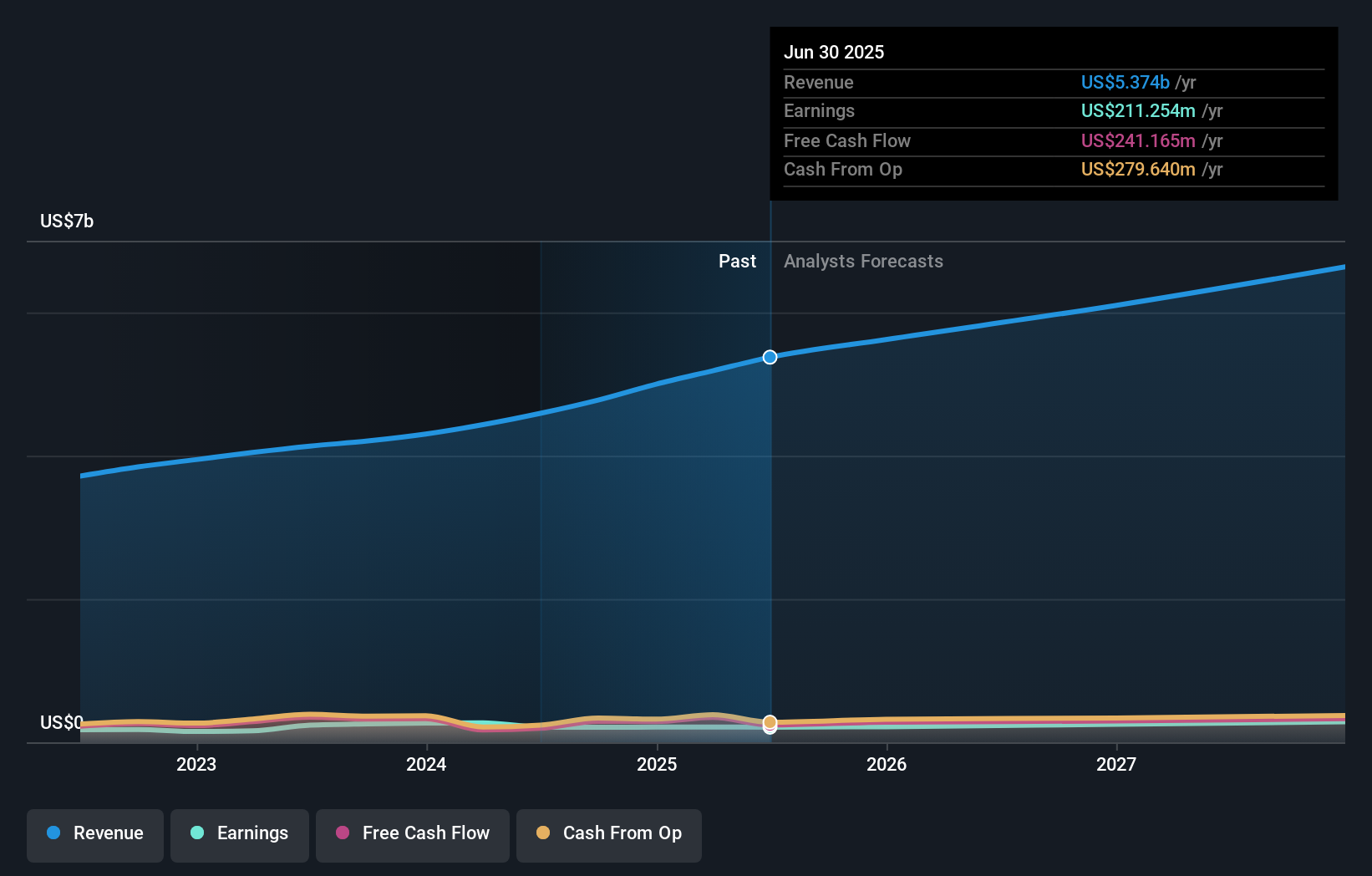

Option Care Health's outlook anticipates $6.9 billion in revenue and $306.2 million in earnings by 2028. Achieving this would require an annual revenue growth rate of 8.8% and an earnings increase of $94.9 million from the current $211.3 million.

Uncover how Option Care Health's forecasts yield a $35.30 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Fair value assessments from two Simply Wall St Community members range from US$35.30 to US$61.53 per share. Views differ widely, especially as changes in therapy mix could influence future margins and reshape expectations.

Explore 2 other fair value estimates on Option Care Health - why the stock might be worth as much as 98% more than the current price!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com