Will Monolithic Power Systems’ (MPWR) Governance Shift Enhance Shareholder Influence or Risk Stability?

- On November 19, 2025, Monolithic Power Systems’ Board of Directors approved amended bylaws that reduce the ownership threshold for stockholders to call a special meeting from 30% to 25% of shares, following stockholder feedback and a review of industry practices.

- This adjustment reflects a balance between shareholder advocacy and input from major investors who favored a higher threshold than proposed in a recent non-binding vote.

- We’ll explore how this change in governance, which adjusts shareholder influence, impacts Monolithic Power Systems’ investment narrative and future outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Monolithic Power Systems Investment Narrative Recap

To be a shareholder in Monolithic Power Systems, an investor must trust in the company’s position at the center of structural growth trends in AI, automotive, and power management, and its ability to sustain diversified revenue across multiple end markets. The recent reduction in the ownership threshold for calling a special meeting is largely a governance change and does not materially affect the current catalyst, which remains the accelerating demand in AI data center and automotive segments; however, the largest business risk continues to be any unforeseen legal or compliance challenges that could distract management or impact earnings momentum in the near term.

Among recent announcements, the ongoing patent infringement lawsuit filed by Reed Semiconductor stands out as especially relevant given the current attention on shareholder rights. Legal headwinds may pose risks to the company's ability to focus fully on the fast-evolving AI and auto segments that underpin investor expectations for future growth.

However, before considering any investment, readers should be aware of how these unresolved legal matters could...

Read the full narrative on Monolithic Power Systems (it's free!)

Monolithic Power Systems is projected to reach $3.9 billion in revenue and $1.0 billion in earnings by 2028. This outlook assumes a 15.5% annual revenue growth rate, but a decrease in earnings of $0.9 billion from the current $1.9 billion.

Uncover how Monolithic Power Systems' forecasts yield a $1181 fair value, a 28% upside to its current price.

Exploring Other Perspectives

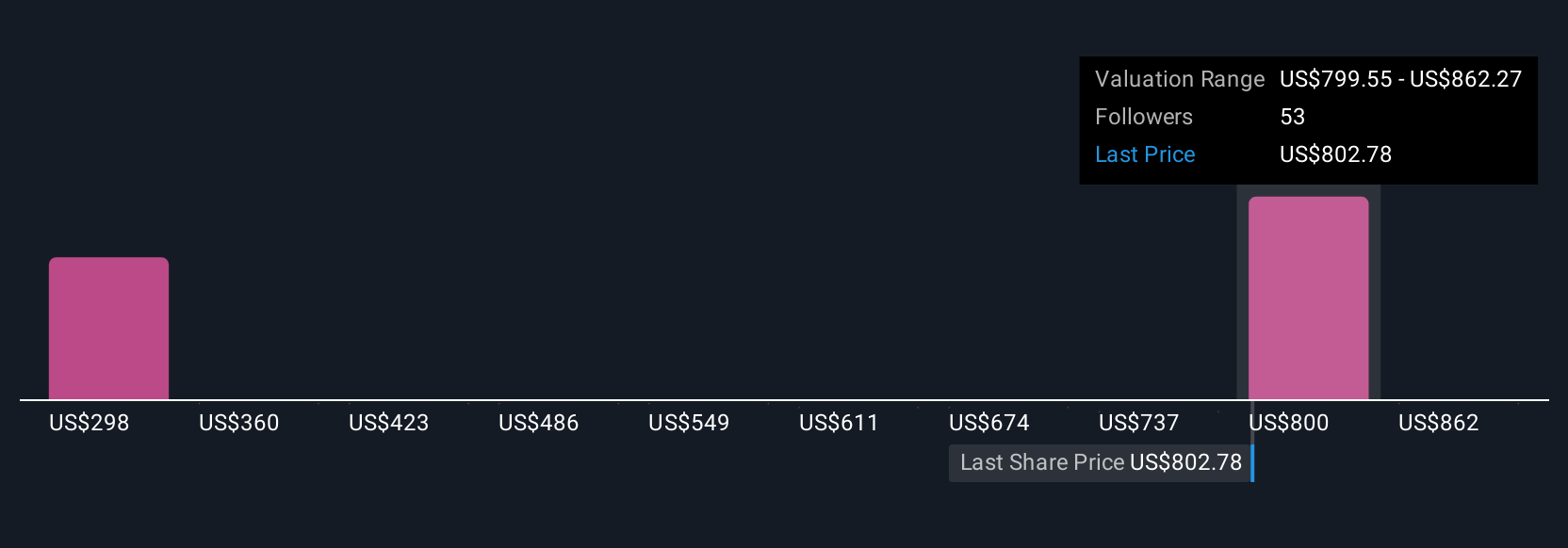

Fair value estimates from the Simply Wall St Community span from US$341.75 to US$1,180.93 based on 12 different investor views. With such diverse analyses, especially as legal headwinds persist, you can see how perspectives on Monolithic Power Systems’ future performance can differ widely, consider exploring several viewpoints before drawing conclusions.

Explore 12 other fair value estimates on Monolithic Power Systems - why the stock might be worth as much as 28% more than the current price!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com