Can Columbia’s Innovation Drive Justify Its Stock Price After a 34.7% Slide in 2025?

- Ever wondered if Columbia Sportswear is finally priced right, or if there is hidden value just beneath the surface? Let’s break down what is really happening with this well-known activewear company.

- After a long stretch of decline, shares are showing subtle signs of life. Columbia is up 1.3% over the last week and 3.9% over the past month, though it is still down a hefty 34.7% year to date.

- Recent headlines reveal the company is doubling down on innovation and global expansion, drawing investor attention and possibly setting the stage for a shift in momentum. Strategic product launches and a renewed focus on international markets are helping to shape fresh expectations for the path ahead.

- Currently, Columbia Sportswear’s valuation score stands at just 1 out of 6, suggesting there is a lot to unpack before calling the stock undervalued. Next, we will walk through the standard approaches to stock valuation and why the most meaningful insights might still be to come by the end of our analysis.

Columbia Sportswear scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Columbia Sportswear Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) estimates the intrinsic value of a stock by projecting all future dividends and discounting them back to their present value. This model is especially useful for companies that pay steady and predictable dividends, focusing on both the sustainability of those dividends and their expected growth rate.

For Columbia Sportswear, recent data shows a dividend per share (DPS) of $1.15, with a return on equity (ROE) of 12.93% and a payout ratio of 29.38%. The model applies a conservative future dividend growth rate, capped at 3.26%, even though historical estimates suggested a higher figure. Analysts expect an average annual earnings growth of around 9.1%.

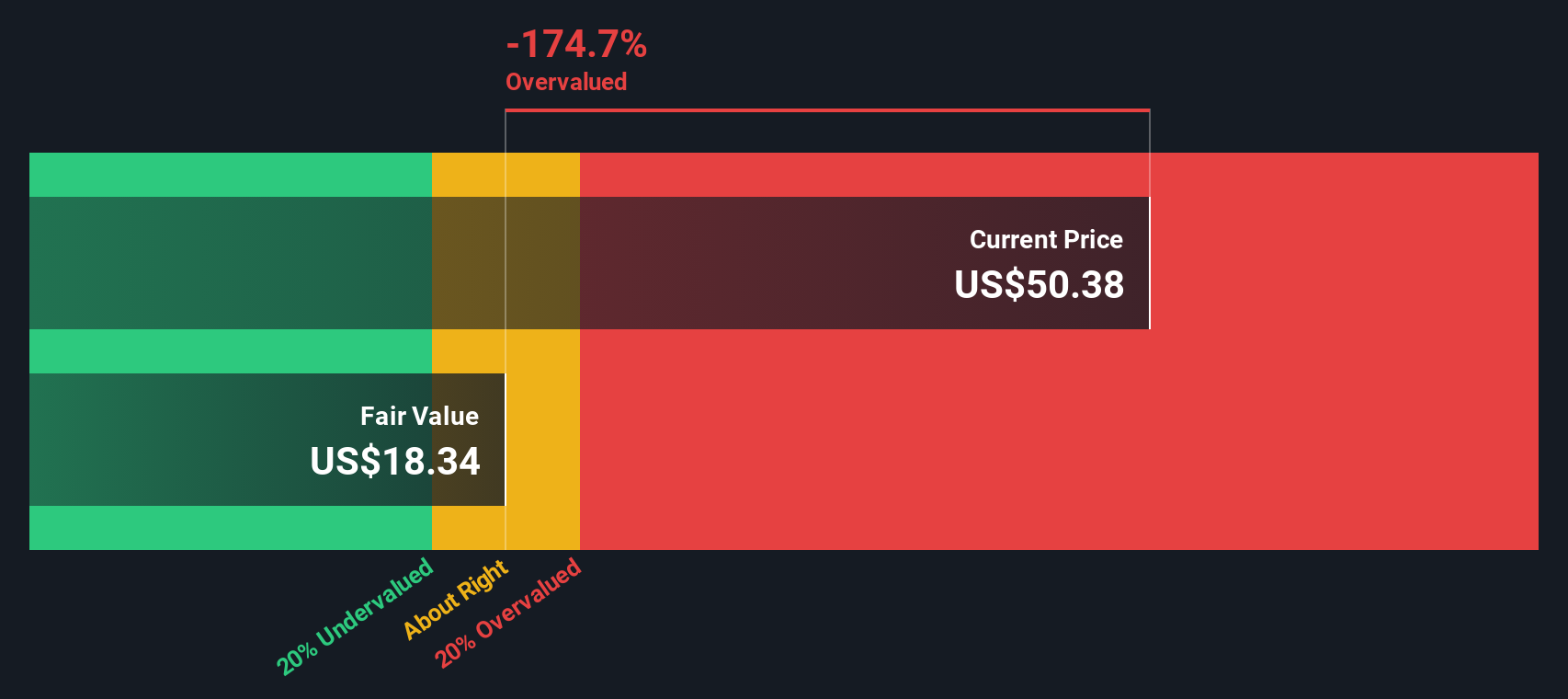

Applying the DDM, the estimated intrinsic value for Columbia Sportswear comes out to just $17.87 per share. When compared to its current share price, the model indicates the stock is 202.4% overvalued based on projected dividend payments and growth. This significant gap indicates that dividends alone do not justify today’s stock price.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Columbia Sportswear may be overvalued by 202.4%. Discover 928 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Columbia Sportswear Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to benchmark for valuing mature, profitable companies like Columbia Sportswear. This metric helps investors understand how much they are paying for each dollar of current earnings. Since Columbia continues to deliver consistent profits, using the PE ratio lets us directly relate its valuation to its ongoing earning power.

A "normal" or fair PE ratio for any stock depends not just on its profitability, but also on expectations for future growth and the overall risk profile. Companies expected to grow faster or face less risk typically command higher PE ratios, while those with slower growth or more uncertainty trade at lower multiples.

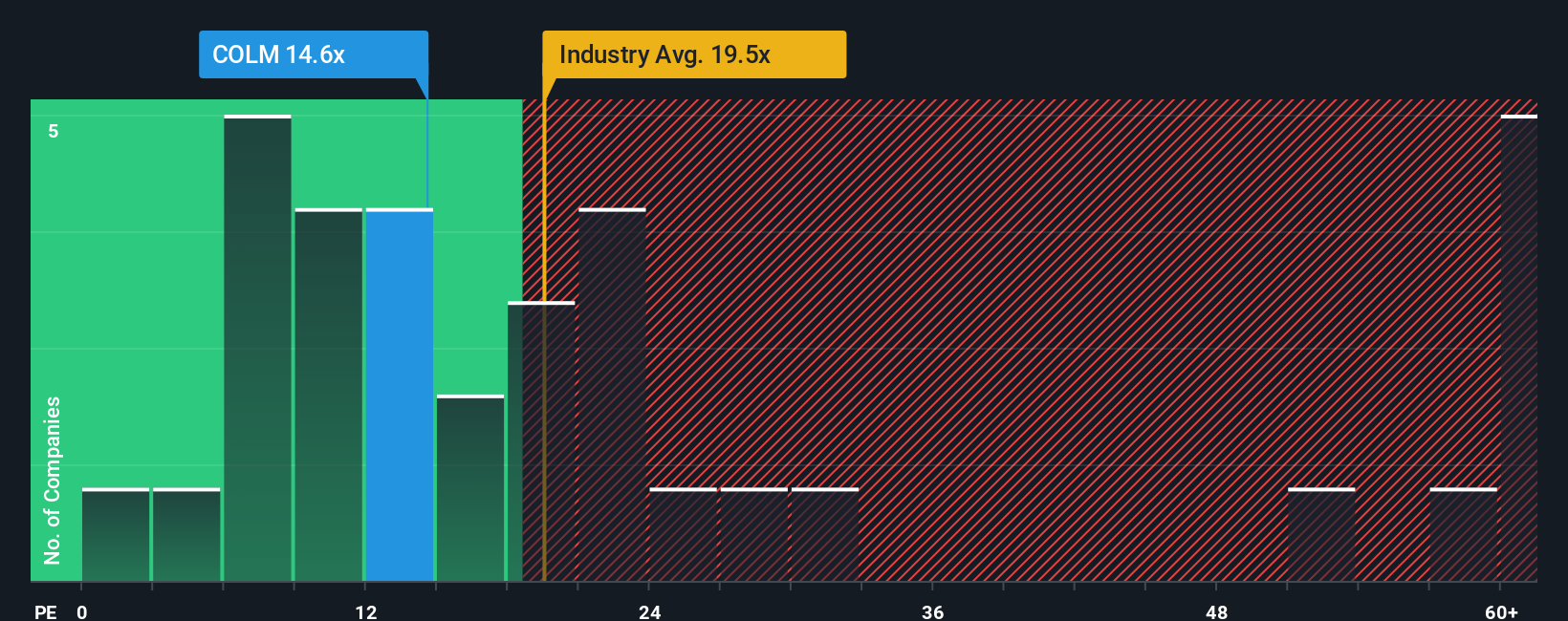

Currently, Columbia Sportswear trades at a PE ratio of 15.6x. Compared to the average industry PE of 20.2x and a peer average of 14.5x, Columbia looks relatively in line with the broader sector. However, Simply Wall St’s proprietary “Fair Ratio” considers factors like Columbia’s anticipated earnings growth, profit margins, risk, and position within the luxury segment, and comes in at 12.3x. This Fair Ratio goes deeper than a simple comparison with industry or peer averages and provides a tailored benchmark that accounts for what actually matters to a company’s valuation.

Because Columbia’s actual PE ratio of 15.6x sits noticeably above its Fair Ratio of 12.3x, the stock appears somewhat overvalued using this method.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Columbia Sportswear Narrative

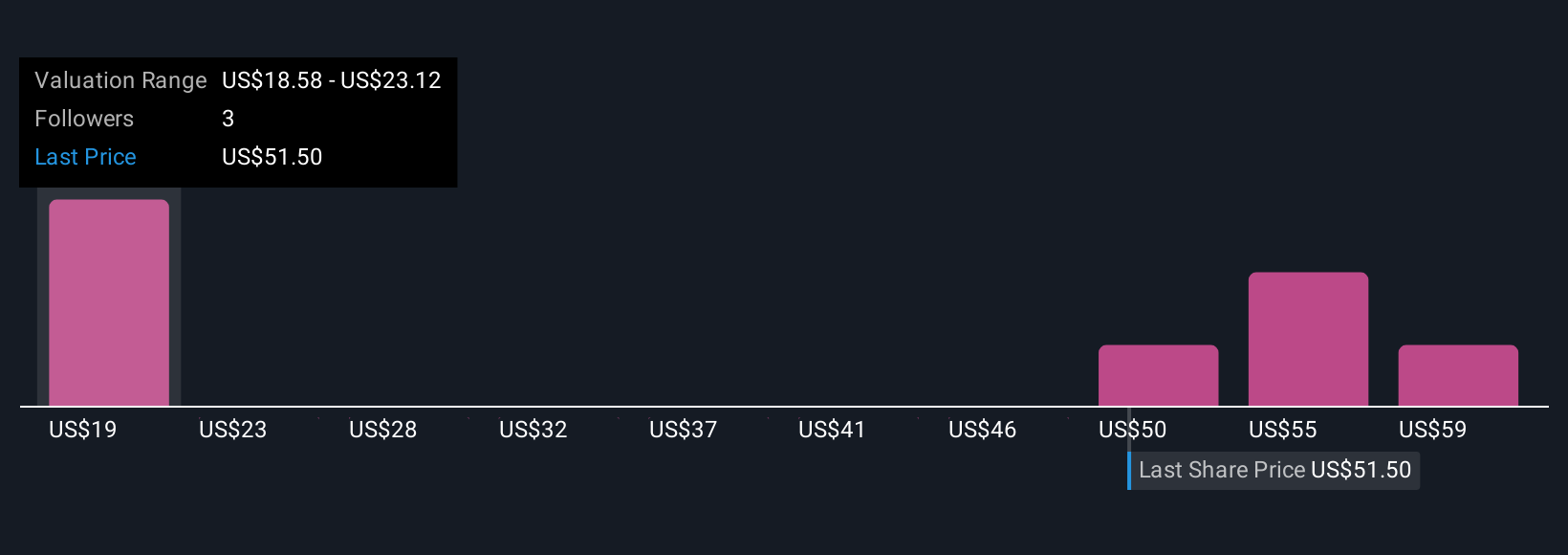

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story behind the numbers. It lets you map out your own view of Columbia Sportswear’s future, including key assumptions around revenue, earnings, and profit margins, then see how that perspective leads to a fair value estimate for the stock.

Narratives bridge a company’s business outlook with financial forecasts, helping you connect what you believe about Columbia’s prospects directly to your valuation. They are quick and easy to create on Simply Wall St’s popular Community page, making professional-grade investing tools accessible to everyone.

With Narratives, you can quickly compare your personalized fair value for Columbia Sportswear to its current share price, making buy or sell decisions far more grounded and transparent. Plus, as new developments or company results emerge, your Narrative can be updated in real time, so your investment case always reflects the latest available information.

For example, some investors build Narratives focused on rising costs and competitive pressure, landing at a bearish fair value near $40. Others highlight international expansion and digital innovation, pointing toward a bullish target above $79. These are different stories and different outlooks, all backed by data and logic.

Do you think there's more to the story for Columbia Sportswear? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com