A Closer Look at Williams-Sonoma’s (WSM) Valuation After Strong Q3 Results and Reaffirmed 2024 Outlook

Williams-Sonoma (WSM) caught investor attention after reporting higher sales and net income for the third quarter, standing out in a tough economic climate. The company also reaffirmed its full-year earnings guidance, which underlines confidence in its ongoing strategy.

See our latest analysis for Williams-Sonoma.

Despite softer patches for the broader retail sector, Williams-Sonoma’s reaffirmed guidance and consistent results have underpinned its stock, with a recent total shareholder return of nearly 7% over the past year and a remarkable 229% total return over three years. This momentum signals enduring confidence from long-term investors.

If you’re interested in uncovering what else is driving the market right now, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading just below their average analyst price targets and the company continuing to post growth despite industry headwinds, the question remains: is Williams-Sonoma undervalued at current levels, or is the market already pricing in its next phase of expansion?

Most Popular Narrative: 8.6% Undervalued

The most popular narrative values Williams-Sonoma shares at $198.21, which stands above the last close of $181.12. This suggests there could be potential for further upside if projections play out as expected.

Continued investment and advances in AI-powered tools and digital platforms are driving higher conversion rates, improved customer experience, and measurable productivity gains. These factors support both revenue growth and expanded operating leverage at the margin level.

Want to know what fuels this narrative’s bullish outlook? A blend of persistent growth, high-margin bets, and decisive technology investments create the backbone of this valuation. What hidden assumptions and bold financial leaps justify this price stage? Jump in to explore the forecasted numbers that could send expectations even higher.

Result: Fair Value of $198.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariffs and persistent weakness in housing demand remain key risks. Each has the potential to challenge Williams-Sonoma’s upbeat profit and expansion story.

Find out about the key risks to this Williams-Sonoma narrative.

Another View: Peer Comparisons Offer a Different Take

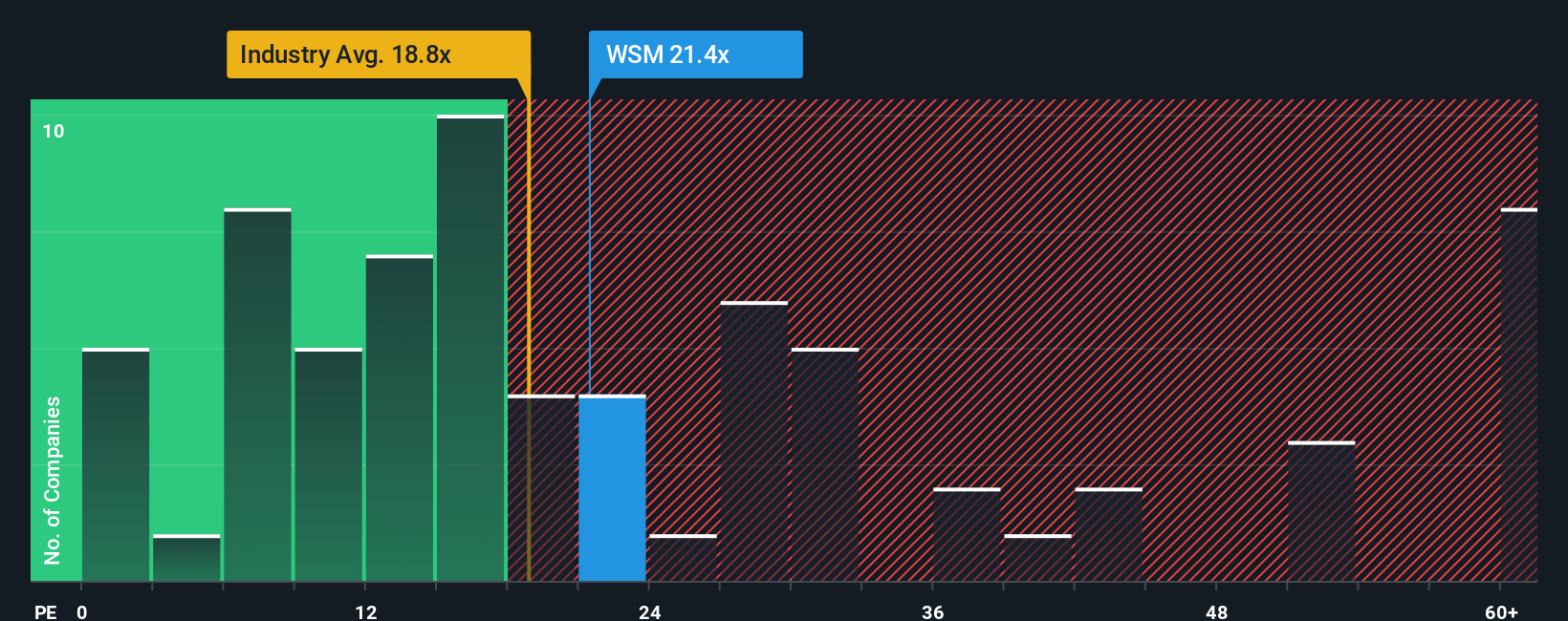

Stepping away from fair value estimates, let’s look at how Williams-Sonoma compares on its key price-to-earnings ratio. Currently, it trades at 19.1x, which is above both the fair ratio of 17.2x and the broader Specialty Retail industry average of 18x. However, it is below the peer group average of 23.6x. This gap highlights a nuanced risk: the market may be expecting higher growth, or its price could move closer to the fair ratio if sentiment changes. Does this present a reason for caution, or a value opportunity if expectations remain steady?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

If you’re the type who trusts your own research or questions the consensus, it only takes a few minutes to build and test your unique Williams-Sonoma outlook. Do it your way.

A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Secure your edge by tapping into winning stock trends before everyone else. Uncover investment possibilities that could transform your portfolio outcomes with these hand-picked opportunities:

- Supercharge your earnings and target reliable passive income. Unlock the potential of attractive yields by reviewing these 15 dividend stocks with yields > 3%.

- Get ahead of the next wave in artificial intelligence. Maximize your upside by checking out these 25 AI penny stocks fueling breakthroughs in automation and smart technologies.

- Catch undervalued gems others might miss. Seize your shot by evaluating these 923 undervalued stocks based on cash flows that offer compelling value and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com