Should Investors Reconsider Amdocs After Recent 9.6% Dip?

- Wondering if Amdocs stock is a bargain right now? Let's break down what savvy investors should know about its current value.

- Despite a steady long-term climb of 25.6% over the last five years, Amdocs dipped by -9.6% in the past month and is down -10.2% for the year. These changes could signal either opportunity or caution, depending on your outlook.

- Several analysts have pointed to broader trends in the software sector and recent contract wins as key reasons behind these price shifts. At the same time, continued strategic partnerships and market expansions have kept Amdocs in the spotlight, fueling fresh debates about its upside.

- Amdocs currently boasts a valuation score of 6/6, the highest ranking based on our value checks. We will explore what that means through a close look at traditional and alternative valuation methods, and provide a unique perspective on what truly drives a good value pick at the end of the article.

Find out why Amdocs's -10.2% return over the last year is lagging behind its peers.

Approach 1: Amdocs Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's dollars. For Amdocs, this involves extrapolating expected cash generation and comparing it to current price levels.

According to the latest data, Amdocs reported Free Cash Flow (FCF) of $644.2 million over the last twelve months. Analyst projections estimate a steady climb, with FCF expected to reach $960.9 million by 2030. Five-year FCF forecasts are based directly on analyst input, while longer-term estimates are extrapolated from these trends. All values are presented in US dollars for clarity.

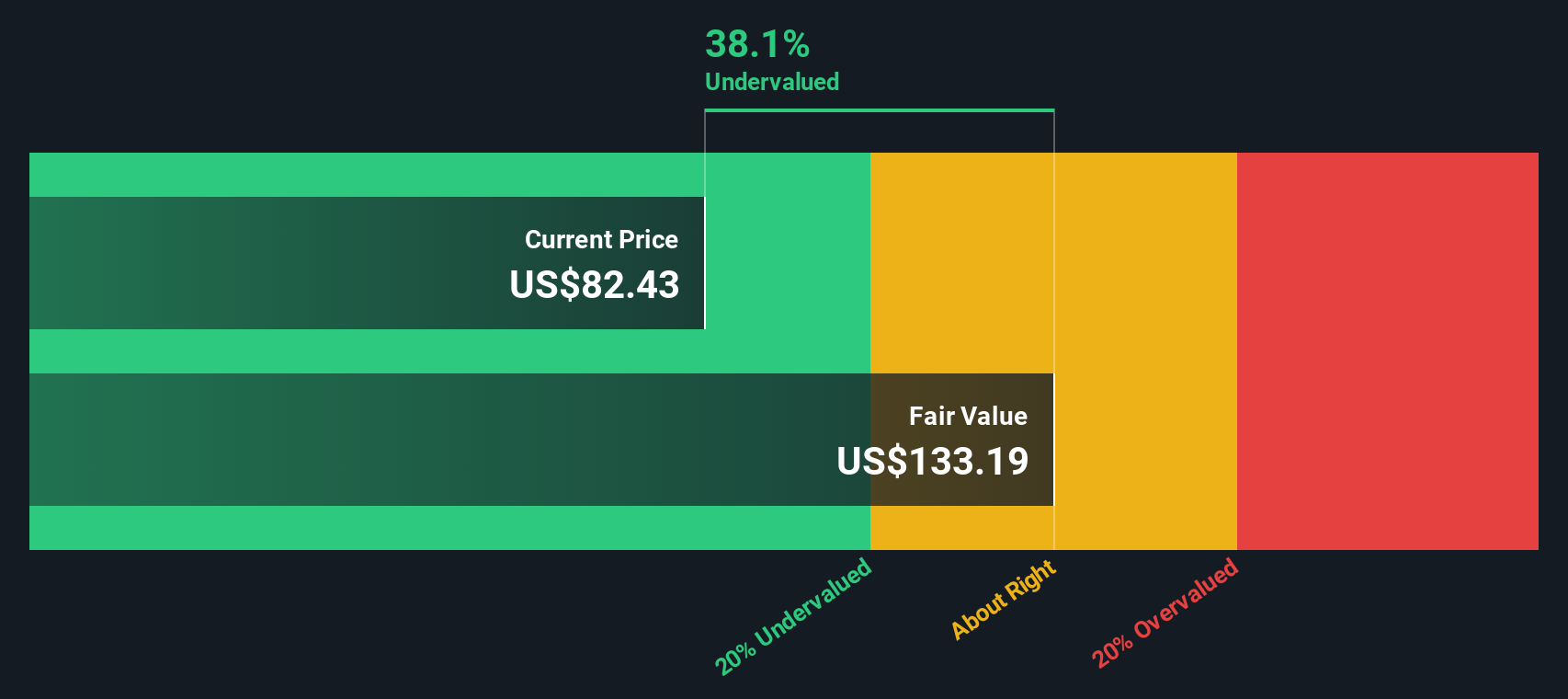

By applying a 2 Stage Free Cash Flow to Equity model, the estimated fair value for Amdocs stock is $128.87. This suggests the stock is currently trading at a 41.0% discount to its projected intrinsic value. In practical terms, this model indicates a significant undervaluation based on Amdocs' ability to generate future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amdocs is undervalued by 41.0%. Track this in your watchlist or portfolio, or discover 923 more undervalued stocks based on cash flows.

Approach 2: Amdocs Price vs Earnings

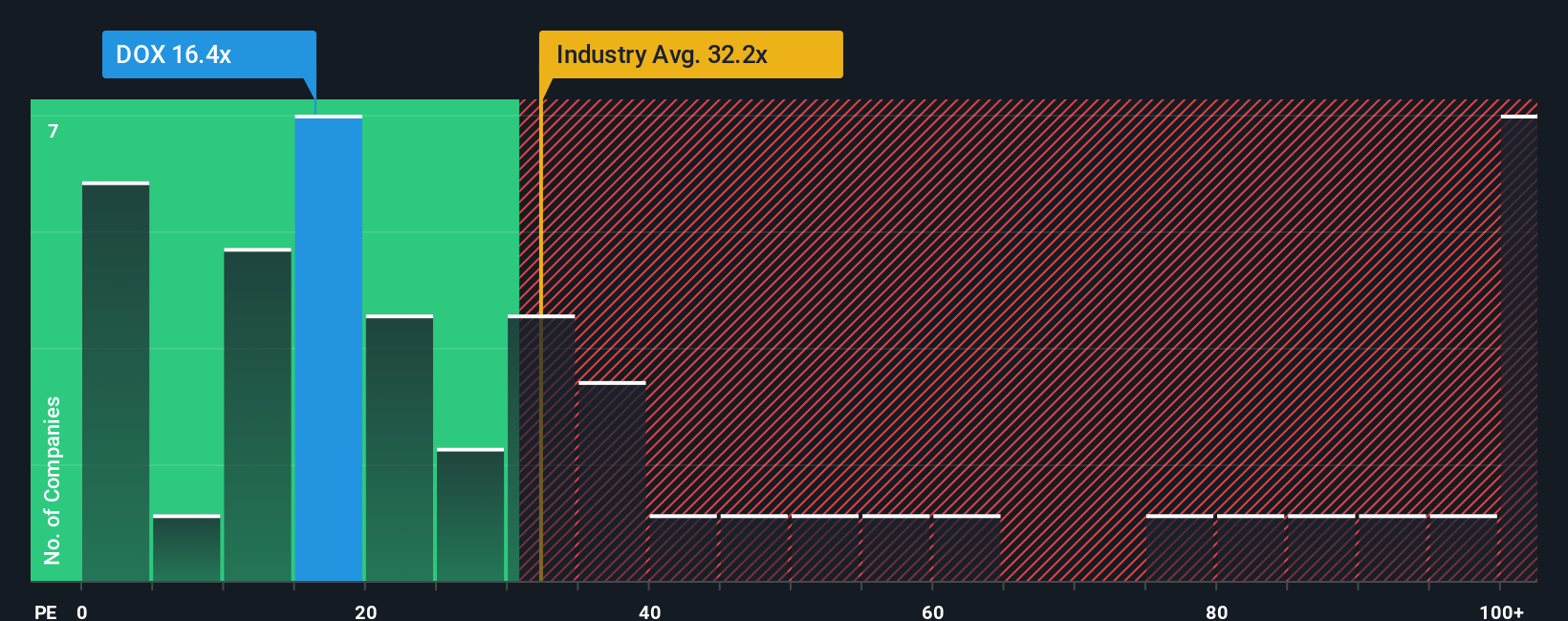

The price-to-earnings (PE) ratio is a widely used valuation multiple for profitable companies like Amdocs, as it directly connects the company's share price to its bottom-line earnings performance. For established firms with reliable profits, the PE ratio helps investors gauge how much they are paying for each dollar of earnings. It is a sensible and straightforward measure of value.

The “right” PE ratio for a stock is shaped by factors such as growth expectations and risk. Companies expected to grow earnings quickly or with less volatility often deserve a higher PE, while slower growth or added risk can justify a lower one. Comparing Amdocs, the current PE ratio stands at 14.8x, which is meaningfully below both the IT industry average of 27.8x and the average of its listed peers at 22.1x. This could suggest Amdocs is trading at a discount to what the market typically pays for similar earnings power.

To move beyond differences in industry and peer profiles, Simply Wall St assesses a proprietary “Fair Ratio.” In this case, it is 24.8x. This figure factors in Amdocs' unique growth outlook, profit margins, risk profile, and overall market capitalization, making it a more precise benchmark than broad industry or peer averages. Comparing Amdocs’ actual PE against its Fair Ratio, the stock’s current valuation looks notably attractive, as shares trade at a significant discount to their calculated fair value multiple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amdocs Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an approach that combines the story you believe about a company with the numbers behind its future revenue, earnings, and margins, all leading to an assumed fair value.

A Narrative is more than a gut feeling or a chart; it is your reasoned perspective, pieced together from concrete business trends, major risks, and your outlook for the future, which you can build and explore right on Simply Wall St’s Community page.

With Narratives, millions of investors can link their company story to a financial forecast, then see the fair value that emerges from those specific assumptions. This process makes it much easier to decide whether to buy or sell by comparing Fair Value to today’s share price.

Narratives update automatically as market news or earnings emerge, helping you stay informed so your investment decisions reflect the latest information.

For Amdocs, one investor might believe that rapid cloud and AI adoption will drive years of stable, growing earnings and justify a higher fair value near $104, while another could focus on client dependence and slower SaaS adoption, resulting in an estimate closer to $86. This demonstrates that there is more than one story and valuation behind every stock.

Do you think there's more to the story for Amdocs? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com