A Look at Best Buy's (BBY) Valuation Following Upbeat Earnings and Upgraded Outlook

Best Buy saw its stock climb after reporting quarterly results that beat analyst expectations, as stronger same-store sales and healthy demand across categories like computers, gaming, and mobile phones contributed to the performance. The company also raised its full-year revenue and profit outlook, signaling renewed confidence in its growth trajectory.

See our latest analysis for Best Buy.

Best Buy’s strong quarter gave the stock a much-needed boost, with shares rising nearly 6% over the past week as investors reacted to upbeat guidance and renewed confidence in consumer demand. While the 1-year total shareholder return is still negative at -5.4%, recent momentum suggests buyers are warming up again after a tough stretch, which could be a sign of fresh optimism for the months ahead.

If this recovery story has you curious about what else is on the move, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares on the rise and a brighter outlook ahead, the big question now is whether Best Buy stock remains undervalued with more room to run or if the market has already priced in this return to growth.

Most Popular Narrative: 3.5% Undervalued

According to the most closely followed valuation narrative, Best Buy’s fair value estimate has ticked higher than the last close. This suggests the market may not be fully reflecting renewed profit growth and a streamlined strategy. Here is what could be driving this optimism.

Initiatives around new product categories and retail media operations are seen as key drivers of future earnings growth and expanding profit streams. Recent earnings beats and improved comparable sales, particularly in computing, mobile, and gaming, reinforce the company’s ability to outperform expectations, even in a challenging retail environment.

Want to crack the code behind this value call? The top narrative relies on sustained margin recovery and bold shifts in earnings and market positioning. Curious why the projected profit rebound and a future multiple tighter than the industry average might be game changers? The answer lies in the narrative’s core financial assumptions. Find out what sets them apart by reading the full story.

Result: Fair Value of $83.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures from lower-value product categories and intensifying competition online could quickly challenge this optimistic outlook for Best Buy.

Find out about the key risks to this Best Buy narrative.

Another View: What Do Market Ratios Reveal?

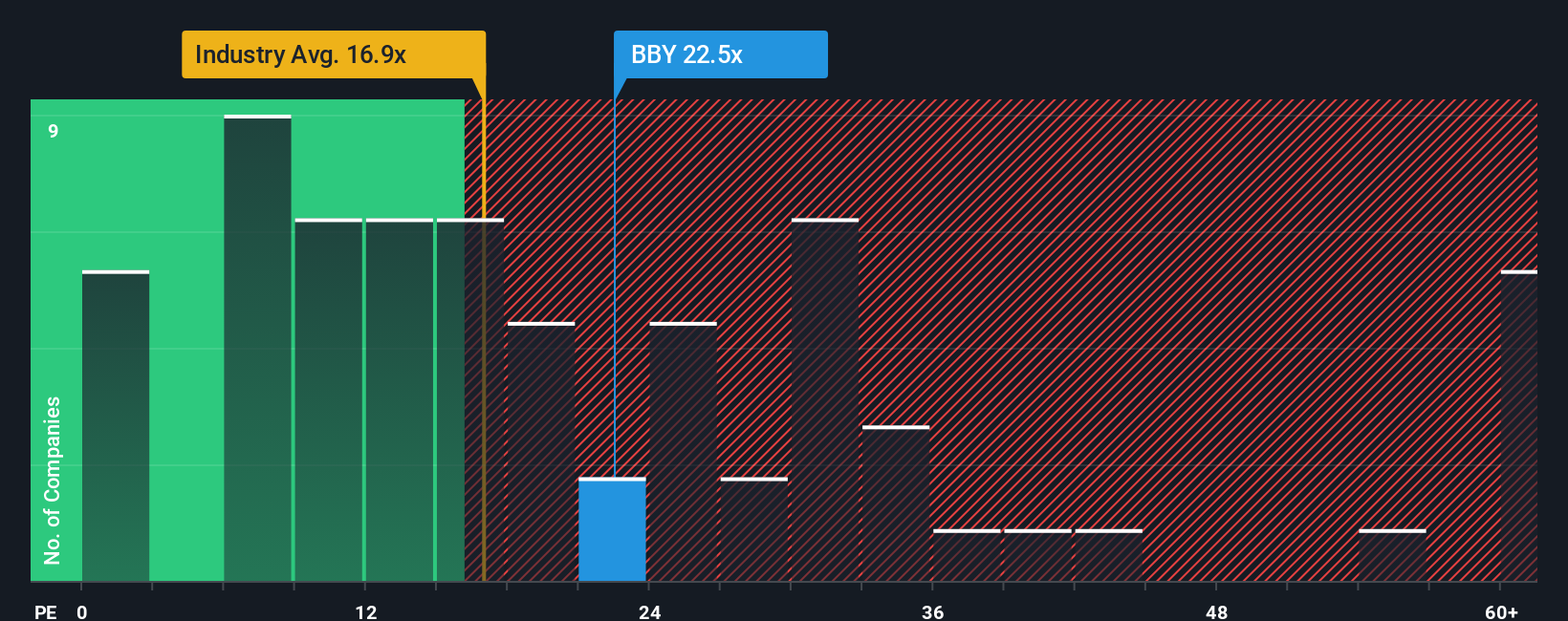

Taking a look at Best Buy’s price-to-earnings ratio, the stock trades at 26.4x. This figure is noticeably higher than both its peer average of 21.8x and the US specialty retail sector at 18x. Compared to a fair ratio of 22.6x, this premium suggests investors are paying up for a bright future. However, it also exposes them to valuation risk if growth expectations falter. How comfortable are you with the market factoring in so much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Best Buy Narrative

If you see things differently or want to take a hands-on approach, you can dig into the numbers and build your own narrative in just a few minutes. Do it your way

A great starting point for your Best Buy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio and stay ahead by targeting stocks that align with powerful trends, overlooked opportunities, and investor-favorite characteristics. Don’t let the next big winner pass you by.

- Spot growth before the crowd by tapping into these 25 AI penny stocks, which are reshaping industries with artificial intelligence breakthroughs and transformative new business models.

- Boost your income and add stability by scanning these 15 dividend stocks with yields > 3% for reliable yields above 3%, which can be ideal for building resilience in uncertain markets.

- Stay a step ahead by monitoring these 28 quantum computing stocks, where groundbreaking quantum computing potential could help identify tomorrow's standout opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com