Will Leadership Changes and Private Markets Launch Shift Piper Sandler's (PIPR) Strategic Narrative?

- Piper Sandler Companies recently appointed Michael Piper as head of fixed income, effective early 2026, while also hiring three senior professionals to launch private markets trading focused on private company equities.

- These leadership changes highlight the company's commitment to strengthening its capabilities in both fixed income and private markets as part of a broader strategic shift.

- We'll examine how the launch of private markets trading could shape Piper Sandler's investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Piper Sandler Companies' Investment Narrative?

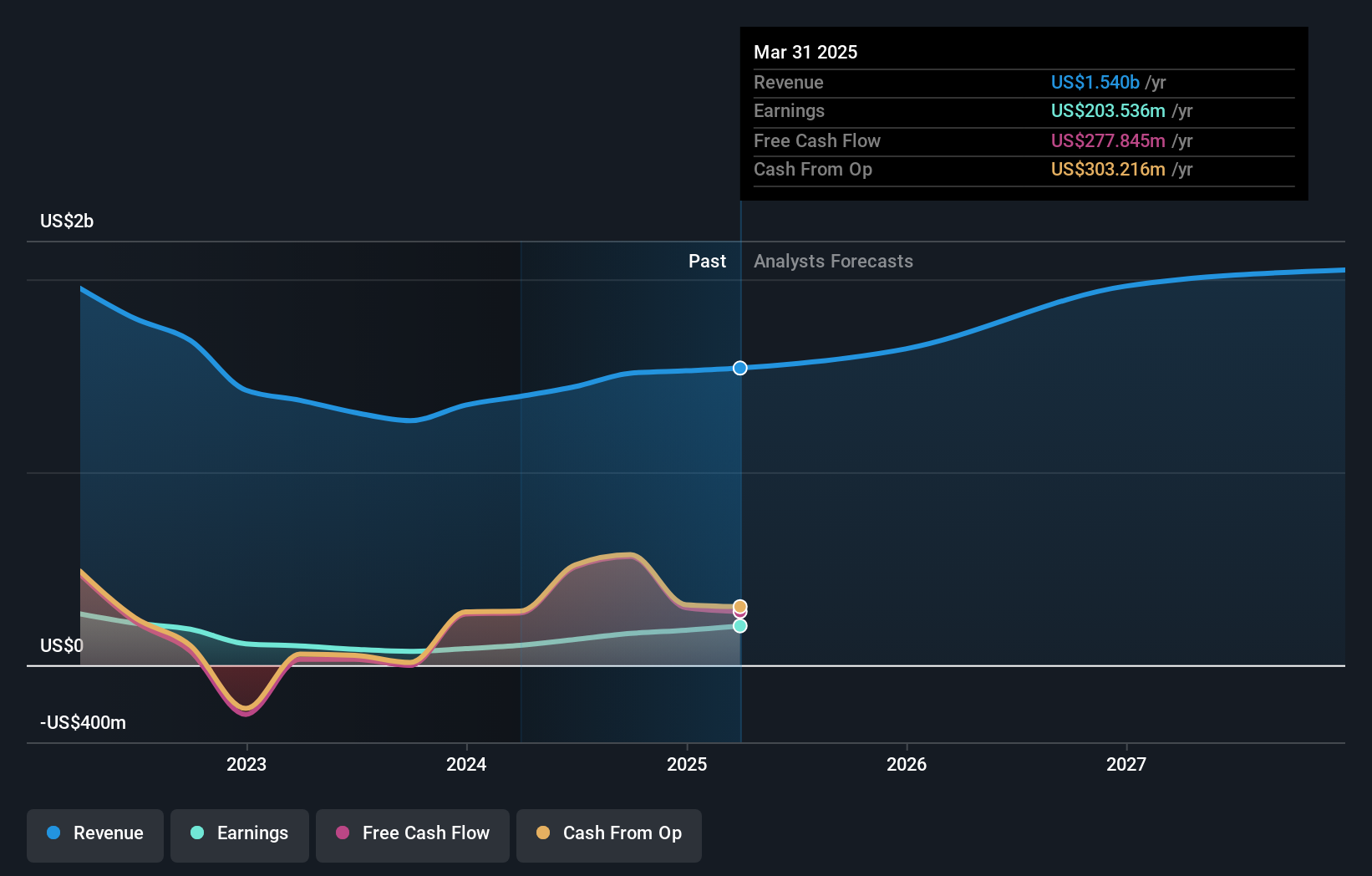

To own Piper Sandler Companies as a shareholder, one should believe in its ability to continuously adapt across the deeply competitive capital markets space. The recent appointment of Michael Piper as head of fixed income and the firm's push into private markets trading underline an ambition to broaden revenue sources and deepen client relationships. In the short term, these moves could reposition Piper Sandler’s key catalysts away from cyclical M&A activity and focus more on capturing opportunities in fast-growing private markets, as well as unlocking fixed income growth under new leadership. Still, the direct impact on the top and bottom line may take time to materialize, and ongoing risks remain, such as increased competition, integration of new hires, and margin pressure from the cost of expansion. While the news signals long-term intent, it does not appear to shift near-term risks and catalysts in a material way when compared to earlier expectations. Recent price movements suggest the market remains focused on execution and concrete results from these strategic steps. But with every new initiative, execution risk is something investors should be aware of.

Piper Sandler Companies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Piper Sandler Companies - why the stock might be a potential multi-bagger!

Build Your Own Piper Sandler Companies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Piper Sandler Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Piper Sandler Companies' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com