Builders FirstSource (BLDR): Evaluating Valuation as Discount Sparks Renewed Investor Optimism

Builders FirstSource (BLDR) is catching attention among value-focused investors as the stock continues to trade at a discount compared to its industry peers. Recent activity points to renewed optimism surrounding its near-term potential.

See our latest analysis for Builders FirstSource.

Despite some turbulence, Builders FirstSource has seen its share price rebound 9.97% over the past seven days and is now trading at $111.75. While the 1-year total shareholder return stands at -40.07%, its five-year total return of 216.57% highlights the significant long-term momentum that can exist for investors interested in potential turnaround stories in the building materials sector.

If you’re exploring what other movers the market has to offer, this could be the ideal moment to broaden your search and discover fast growing stocks with high insider ownership

So as Builders FirstSource draws investor interest with its discounted valuation and solid fundamentals, the question remains: is the stock genuinely undervalued, or has the market already priced in its growth prospects? Could this be a real buying opportunity?

Most Popular Narrative: 16.9% Undervalued

Builders FirstSource currently sits well below the most popular narrative's fair value estimate of $134.41, compared to the last close of $111.75. This clear gap frames the narrative’s optimistic stance and highlights why many are looking for answers in the fine print.

The company is investing heavily in digital transformation and value-added solutions (for example, digital tools, ERP integration, prefabricated components). These initiatives are expected to drive higher-margin growth, increase operating efficiency, and strengthen customer relationships as the market recovers, which could improve both future revenue and net margins.

What is fueling this bold fair value? From digital disruption to game-changing revenue and profit assumptions, one crucial lever underpins the potential upside. Think you know what drives the narrative’s target? Step inside to see the surprising forecast behind the valuation.

Result: Fair Value of $134.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high market competition and possible prolonged weakness in housing demand could challenge the recovery narrative and limit Builders FirstSource’s potential upside.

Find out about the key risks to this Builders FirstSource narrative.

Another View: Earnings Multiple Paints a Different Picture

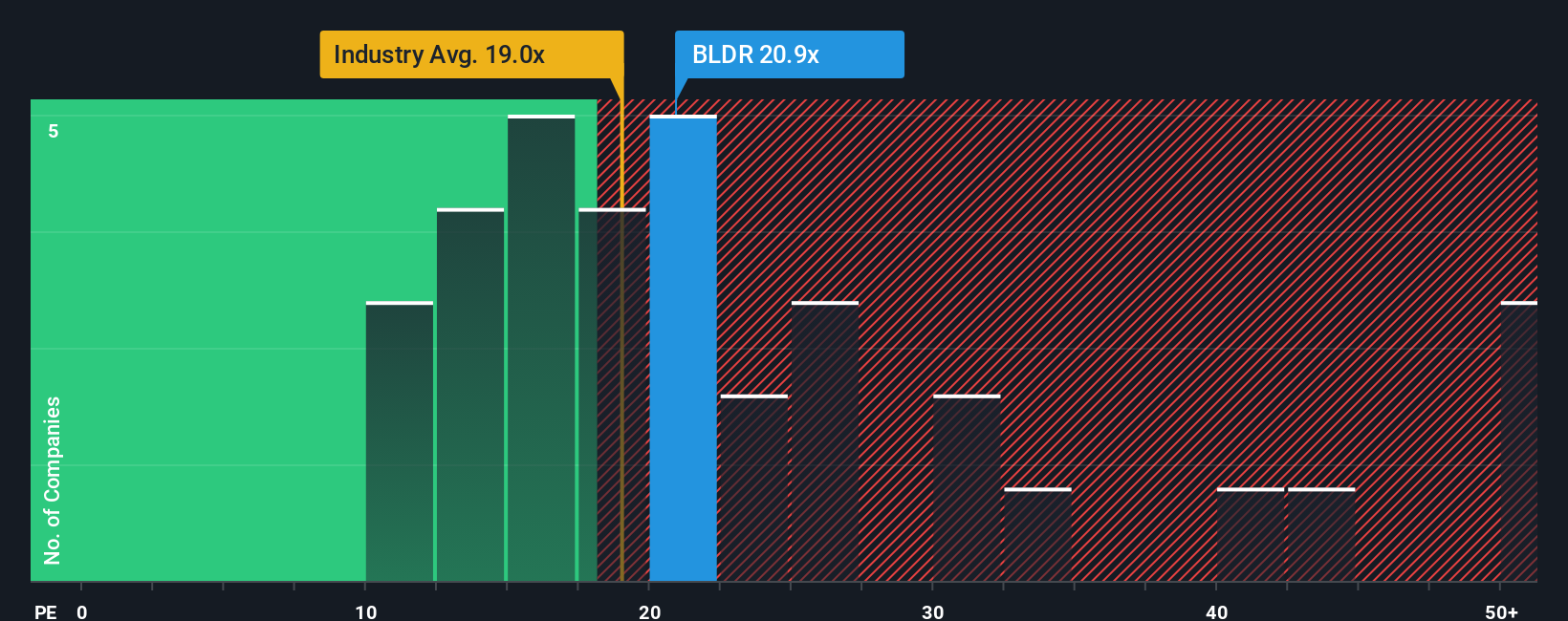

Taking a look through the lens of the price-to-earnings ratio, Builders FirstSource currently trades at 20.8x, which is higher than peers at 19.2x and above the US Building industry average of 18.9x. However, it still trades below its fair ratio of 27.8x, which the market could gravitate toward if sentiment improves. Does this premium reflect justified optimism or a risk of overpayment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Builders FirstSource Narrative

If you feel differently about these valuations or want to dig into the numbers yourself, you can craft your own outlook for Builders FirstSource in just a few minutes. Do it your way

A great starting point for your Builders FirstSource research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors keep their horizons open. Uncover unique opportunities and take charge of your portfolio. These are not picks you want to miss out on.

- Capture tomorrow’s tech growth early by scanning these 25 AI penny stocks leading advancements in artificial intelligence integration and transformative software solutions.

- Boost your income stream this year by reviewing these 15 dividend stocks with yields > 3% that offer robust yields and a consistent track record of payouts.

- Capitalize on market inefficiencies by targeting these 922 undervalued stocks based on cash flows with strong financials and untapped upside as identified by rigorous fundamental analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com