How a Year of Insider Selling at Mueller Industries (MLI) Challenges Its Investment Narrative

- On November 25, 2025, Mueller Industries Director Scott Jay Goldman sold 4,234 shares, continuing a series of insider sales over the past year.

- This sustained pattern of insider sales, without any insider purchases, stands out even as the company maintains regular dividend payments and receives positive analyst ratings.

- We'll examine how repeated insider selling shapes Mueller Industries' investment narrative amid ongoing dividends and favorable analyst opinions.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Mueller Industries' Investment Narrative?

For those considering Mueller Industries as a long-term holding, confidence in the company’s disciplined balance sheet, robust cash flow, and consistent dividends forms a strong foundation. The latest insider sale by Director Scott Jay Goldman comes after a year of similar transactions, contrasting with no insider buying. While insider selling can cause concern, especially as it diverges from the ongoing dividend growth and positive analyst ratings, recent price gains suggest the market does not treat these sales as a critical catalyst or warning sign. Short term, performance is tied more closely to earnings resilience and margin control, as seen in recent results, rather than insider activity. Looking ahead, risks remain around sustained insider selling and questions about the board’s refreshment, but the core investment case, steadily growing profits, shareholder returns, and a value-oriented valuation, appears intact for now. However, continued insider selling could merit a closer look from anyone tracking board confidence.

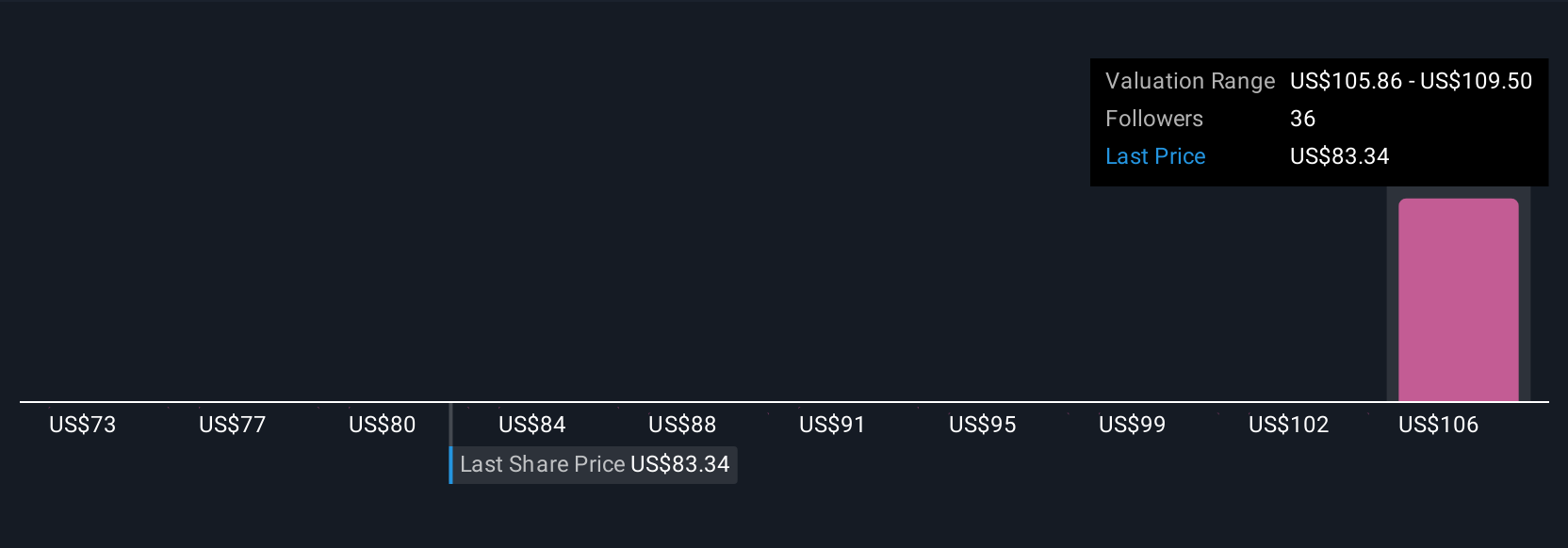

Mueller Industries' shares are on the way up, but they could be overextended by 10%. Uncover the fair value now.Exploring Other Perspectives

Explore 9 other fair value estimates on Mueller Industries - why the stock might be worth as much as 18% more than the current price!

Build Your Own Mueller Industries Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mueller Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mueller Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mueller Industries' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com