Aon (AON) Valuation in Focus After Moody’s Upgrades Outlook on Improved Financial Strength

Moody’s has revised its outlook on Aon (NYSE:AON) to positive, a move that signals growing confidence in the company’s financial health. The change follows Aon’s progress in reducing debt and delivering steady earnings growth after acquiring NFP Corp.

See our latest analysis for Aon.

Aon’s share price has picked up momentum recently, with an 8.5% 1-month gain. This performance outpaces most of its year-to-date results. While the 1-year total shareholder return remains in negative territory at -8.9%, long-term holders have still seen a solid 74% total return over five years. New executive appointments and bold moves in sustainability are keeping the story interesting as the market reevaluates Aon's growth narrative.

If you're curious what else is gaining market attention, now is a great time to broaden your view and discover fast growing stocks with high insider ownership

Yet with shares rebounding and analysts forecasting upside from current levels, the real question surfaces: Is Aon trading below its true value, or are investors already paying a premium for its future growth prospects?

Most Popular Narrative: 12.1% Undervalued

With Aon's last close at $353.92 and the most widely followed narrative fair value at $402.67, analysts see considerable upside at today's price. This sets up a compelling debate on whether robust earnings and margin expansion are enough to warrant the valuation premium.

The analysts are assuming Aon's revenue will grow by 5.6% annually over the next 3 years. Analysts assume that profit margins will increase from 15.5% today to 19.5% in 3 years' time.

Want to understand why this insurance powerhouse is priced as a growth story? Future earnings, expanding margins, and industry-leading ratios are at the heart of the narrative. Find out which number analysts believe will make or break the case for Aon's premium valuation.

Result: Fair Value of $402.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic volatility or a downturn in key commercial insurance markets could quickly challenge the optimistic outlook for Aon's share price.

Find out about the key risks to this Aon narrative.

Another View: High Multiples Signal Premium Risks

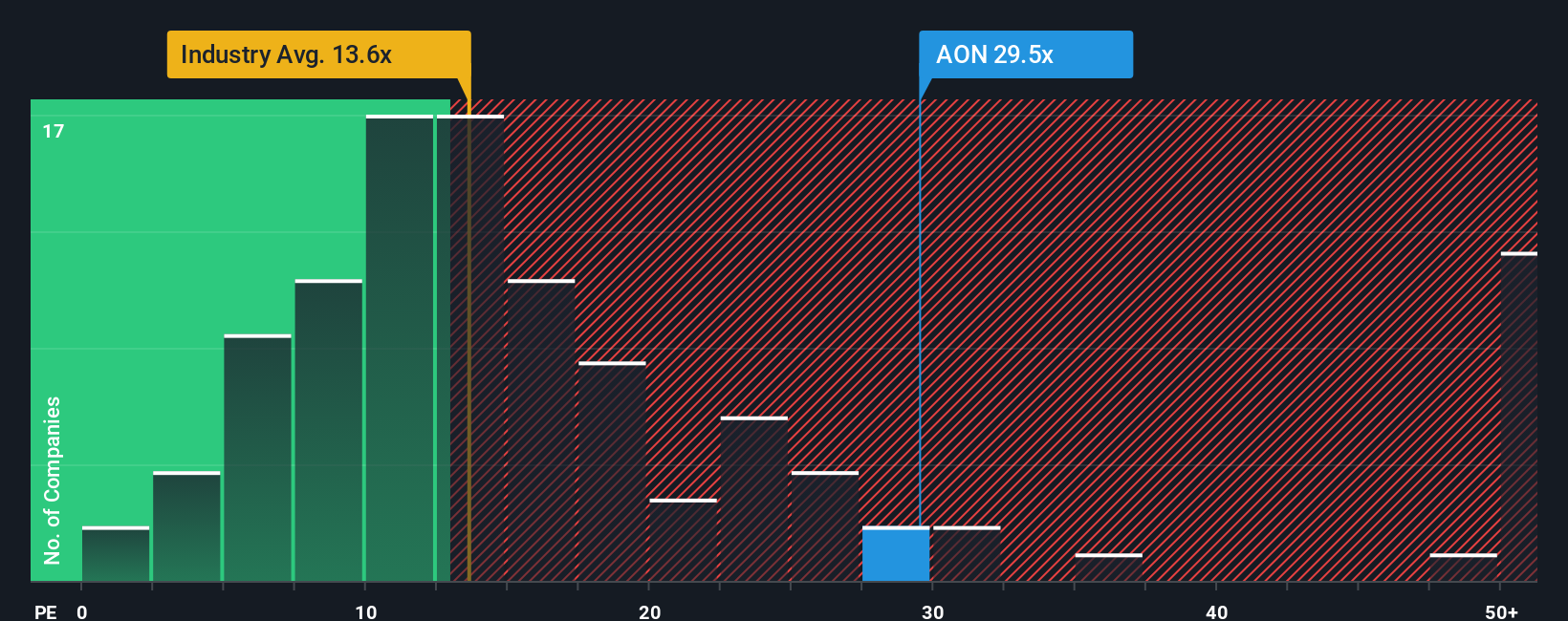

Looking past fair value models, Aon's shares are trading at a lofty 28x earnings, significantly higher than both peers (26x) and the industry average (13x). The fair ratio suggests that 16.6x is more reasonable. Such a premium can offer upside if momentum persists. However, if sentiment changes, the risks may become more apparent.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

You might see things differently or want to back your own insights with the facts. Why not explore the numbers and shape your own perspective in just a few minutes? Do it your way

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t limit yourself to a single stock when there are so many promising ideas available. The best investors are always on the lookout for opportunities others may overlook, so give yourself the edge with these targeted screeners:

- Tap into future growth by checking out these 920 undervalued stocks based on cash flows trading well below their estimated intrinsic value. Potential bargains await those who act early.

- Earn steady income and beat low interest rates with these 15 dividend stocks with yields > 3% offering reliable yields above 3%.

- Stay ahead of tomorrow’s breakthroughs by evaluating these 30 healthcare AI stocks that merge medical innovation with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com