How Strong Q3 Results and New Product Launches at MSA Safety (MSA) Have Changed Its Investment Story

- Earlier this week, MSA Safety reported strong third-quarter 2025 results, highlighting net sales growth driven by strategic initiatives and the integration of the M&C TechGroup acquisition.

- An interesting development is MSA’s unveiling of the ALTAIR io 6 Multigas Detector in Europe, expanding its connected safety product offerings and reinforcing the company’s innovation trajectory.

- We’ll now examine how robust quarterly earnings and continued product innovation may reshape MSA Safety’s investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

MSA Safety Investment Narrative Recap

To be a shareholder in MSA Safety, you need to trust in the company's ability to adapt its core safety product portfolio to meet evolving industry standards, capitalize on connected solutions, and maintain resilient demand across global markets. The recent third-quarter earnings beat and ongoing focus on innovation reinforce the near-term growth catalyst of robust adoption for new connected safety offerings; however, the single small insider share sale by a company executive this week appears immaterial to these drivers or to MSA’s primary risks, such as margin pressures and industrial end-market exposure.

Among recent corporate developments, the debut of the ALTAIR io 6 Multigas Detector in Europe stands out for its relevance to MSA’s connected product strategy. As a key catalyst, this launch highlights the company’s continued investment in advanced workplace safety solutions, a trend likely to support organic growth, even as external headwinds like tariffs and input costs remain in focus.

Yet, in contrast, investors should also be aware of ongoing gross margin pressures linked to tariffs and...

Read the full narrative on MSA Safety (it's free!)

MSA Safety's narrative projects $2.1 billion in revenue and $377.8 million in earnings by 2028. This requires 5.2% yearly revenue growth and a $100.9 million earnings increase from the current $276.9 million.

Uncover how MSA Safety's forecasts yield a $187.40 fair value, a 16% upside to its current price.

Exploring Other Perspectives

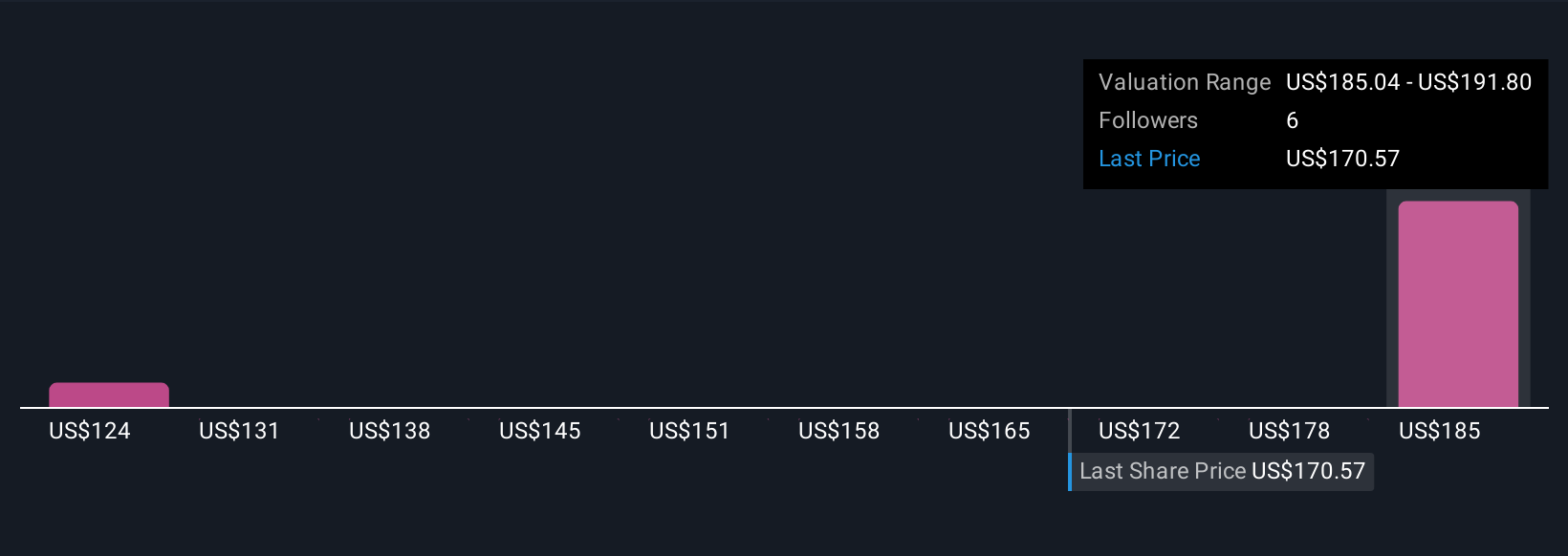

Simply Wall St Community members provided three fair value estimates for MSA ranging from US$124.23 to US$207.99 per share before the latest news. While opinions differ, many remain attentive to the risks of sustained cost inflation and exchange rate headwinds that could affect future returns, consider multiple viewpoints before making decisions.

Explore 3 other fair value estimates on MSA Safety - why the stock might be worth as much as 29% more than the current price!

Build Your Own MSA Safety Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MSA Safety research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MSA Safety research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MSA Safety's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com