St. Joe (JOE) Is Up 5.2% After Q3 Earnings Beat Analyst Estimates – What's Driving Momentum

- The St. Joe Company recently reached a new 52-week high following its third quarter 2025 financial results, which saw earnings per share surpass analysts’ expectations.

- This performance signals strong investor confidence, reflecting both the company’s recent strategic moves and the broader strength of the real estate development sector.

- With third quarter earnings exceeding projections, we'll explore how St. Joe's financial momentum shapes its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is St. Joe's Investment Narrative?

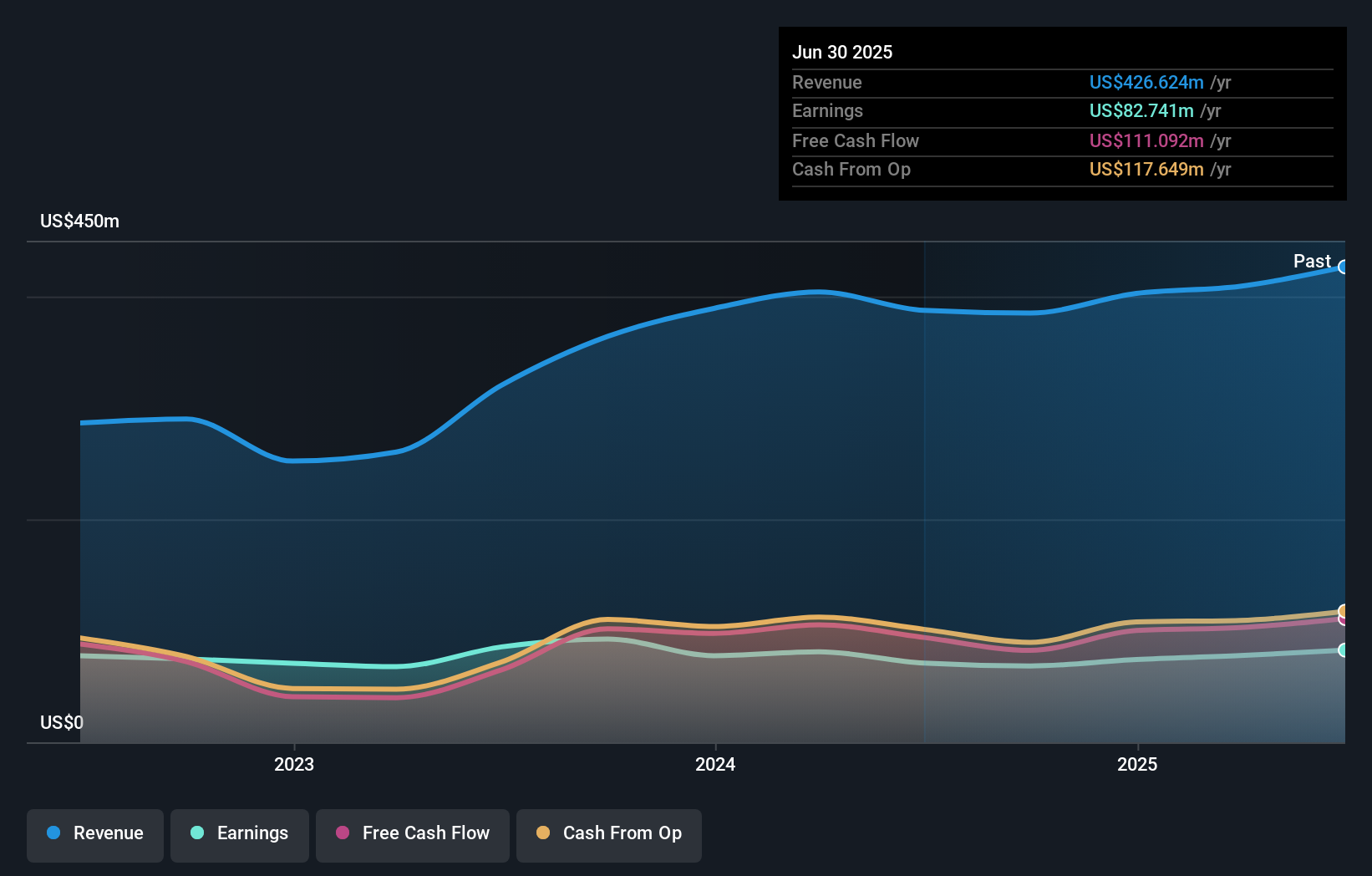

For those getting to know St. Joe, the core investment thesis often centers on belief in the company's ability to expand its Florida property developments and unlock value through projects like Watersound Town Center. The latest 52-week high following strong third quarter results reinforces this narrative, suggesting management is delivering on growth plans and the $0.16 per share dividend increase underlines their confidence. The immediate catalyst remains sustained leasing momentum and ongoing hospitality, healthcare, and entertainment initiatives. Previously, high debt levels and premium valuation metrics versus industry averages have been flagged as risks. However, the recent earnings beat and share price run-up may ease some concerns about financial leverage and execution, though long-term reliance on new tenant demand and regional economic health persists. This news shifts the focus to whether St. Joe can maintain this pace without amplifying risk exposure. Yet, despite positive momentum, debt levels remain a key topic for watchful investors.

St. Joe's shares have been on the rise but are still potentially undervalued by 24%. Find out what it's worth.Exploring Other Perspectives

Explore another fair value estimate on St. Joe - why the stock might be worth as much as 31% more than the current price!

Build Your Own St. Joe Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your St. Joe research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free St. Joe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate St. Joe's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com