The Bull Case For Autodesk (ADSK) Could Change Following Q3 Earnings Beat and Upgraded Guidance—Here’s Why

- Autodesk recently announced its third-quarter 2025 earnings, reporting revenue of US$1.85 billion and net income of US$343 million, both higher than the prior year, alongside increased earnings guidance for the full fiscal year ending January 2026.

- An interesting aspect is the company’s emphasis on AI-powered design and automation, highlighted as a core factor in its ongoing business momentum and growth outlook.

- We’ll see how Autodesk’s raised guidance and momentum in AI adoption influence its overall investment narrative in light of these results.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Autodesk Investment Narrative Recap

To be a shareholder in Autodesk, you generally need to believe in its ongoing leadership in design software, its ability to integrate AI and automation across industries, and its retention of pricing power as it shifts to cloud-based and subscription models. The recent Q3 earnings beat, followed by raised full-year guidance, helps reinforce confidence in recurring revenue from AEC and cloud services. However, this does not materially change the near-term risk stemming from rapid innovation in AI and competitive threats from emerging technology challengers.

The most relevant recent announcement is Autodesk’s update to its full-year guidance, now forecasting revenue between US$7,150 million and US$7,165 million, and GAAP EPS of US$5.16 to US$5.33. This move highlights growing business momentum and offers important context for the outlook on recurring revenue growth as the company continues to leverage cloud and AI technology in its core markets.

By contrast, investors should also be aware of the potential consequences if Autodesk’s pace of AI innovation...

Read the full narrative on Autodesk (it's free!)

Autodesk's narrative projects $9.3 billion revenue and $2.0 billion earnings by 2028. This requires 12.0% yearly revenue growth and a $1.0 billion increase in earnings from $1.0 billion today.

Uncover how Autodesk's forecasts yield a $364.52 fair value, a 20% upside to its current price.

Exploring Other Perspectives

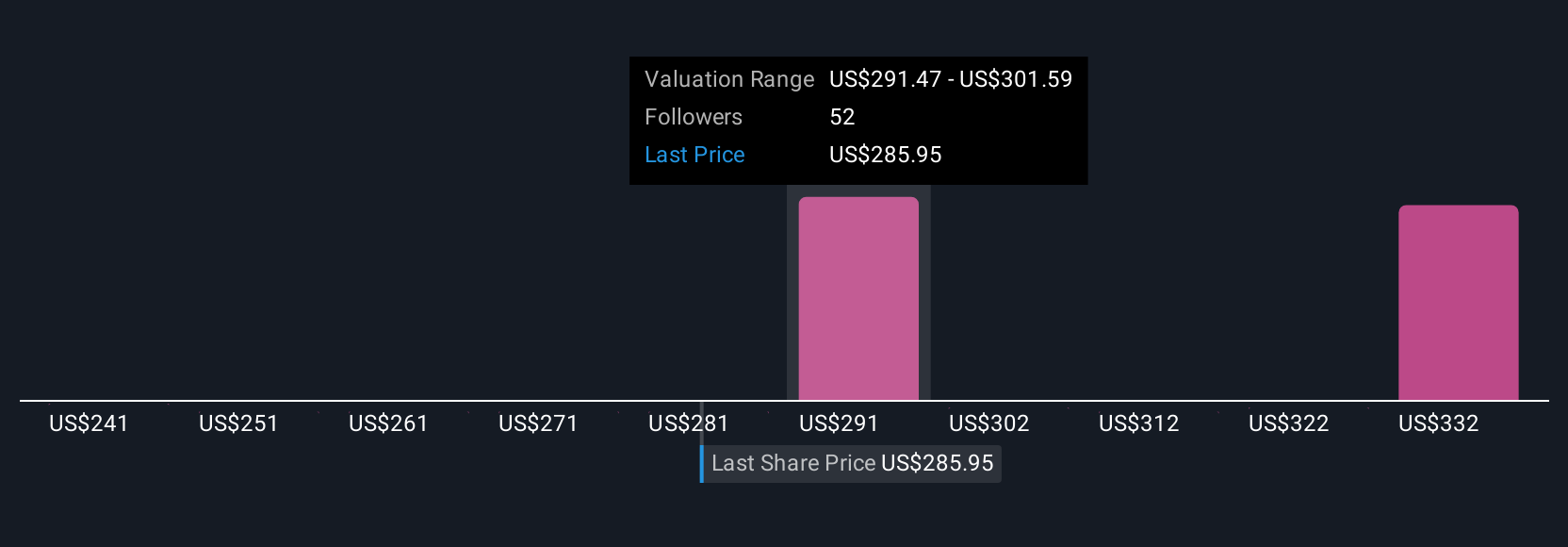

Private investors in the Simply Wall St Community have published fair value estimates for Autodesk ranging from US$283 to US$365, based on four unique approaches. While AI integration remains a key focus for management, opinions on future value and risks can differ significantly, explore alternative perspectives to make informed decisions.

Explore 4 other fair value estimates on Autodesk - why the stock might be worth 7% less than the current price!

Build Your Own Autodesk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autodesk research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Autodesk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autodesk's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com