Does Kimbell Royalty Partners (KRP) Face a Shifting Competitive Landscape as Larger Rivals Advance?

- Earlier this week, KeyBanc downgraded Kimbell Royalty Partners, LP from 'Overweight' to 'Sector Weight' due to a volatile oil price environment and limited growth prospects in the Permian basin.

- This downgrade highlights increasing pressure on smaller mineral rights companies as they compete with larger, better-capitalized peers in the acquisition market.

- We’ll explore how concerns about competition from larger players may influence the investment outlook for Kimbell Royalty Partners.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kimbell Royalty Partners Investment Narrative Recap

To be a shareholder of Kimbell Royalty Partners right now, you need to believe in the long-term value of diversified oil and gas royalty interests, supported by ongoing production and disciplined acquisitions. The recent downgrade by KeyBanc emphasizes increased competition and limited growth in the Permian, which poses a risk to near-term M&A-driven growth but does not materially shift the main short-term catalyst: successfully executing acquisitions to offset natural production declines. The biggest risk remains the ability to acquire high-yielding mineral interests as competition from larger entities intensifies. A key announcement tying into this risk is Kimbell’s recent dividend decline, with the Q3 cash distribution falling to $0.35 per unit as the partnership directed 25% of available cash to debt repayment. This move follows consecutive quarterly dividend reductions this year and correlates with the current pressure on acquisition economics and distributable cash flow, an area investors are watching closely amid weaker energy pricing. But the real concern that investors should keep front of mind is the growing difficulty of finding attractively priced, high-quality mineral interests as...

Read the full narrative on Kimbell Royalty Partners (it's free!)

Kimbell Royalty Partners' outlook anticipates $379.9 million in revenue and $80.8 million in earnings by 2028. This forecast is based on a 6.7% annual revenue growth rate and an increase in earnings from -$0.5 million today to $80.8 million, representing an $81.3 million improvement.

Uncover how Kimbell Royalty Partners' forecasts yield a $17.20 fair value, a 38% upside to its current price.

Exploring Other Perspectives

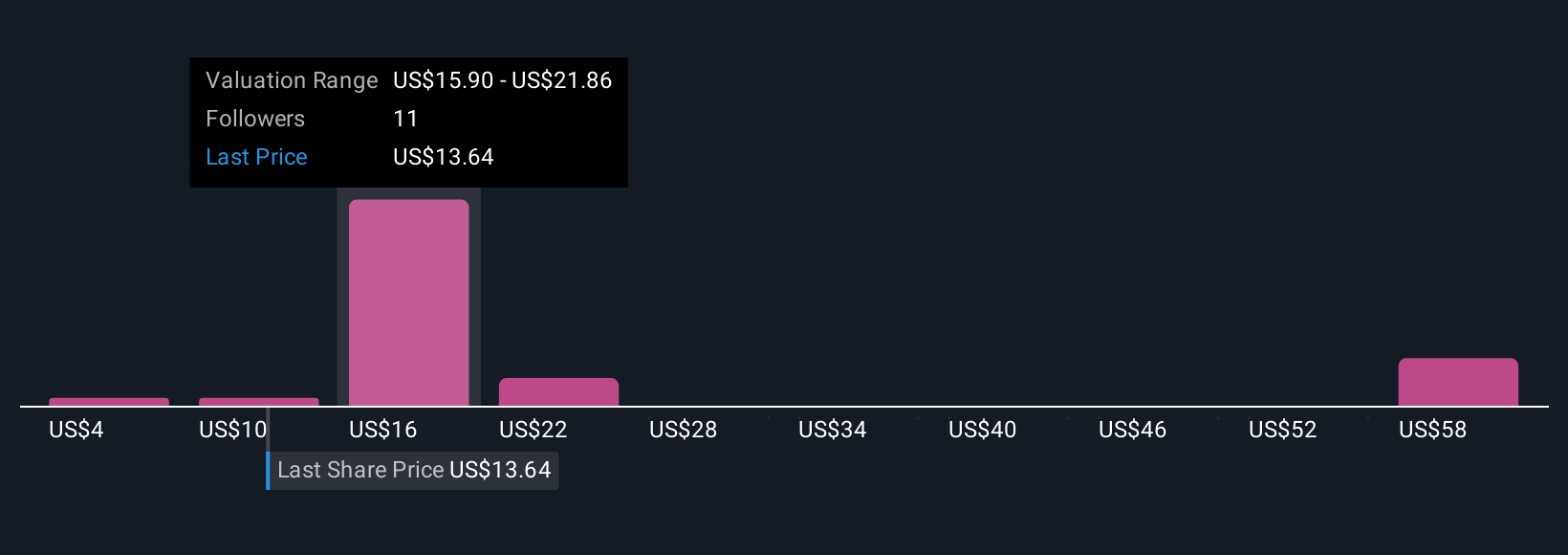

Simply Wall St Community user estimates for Kimbell Royalty Partners’ fair value span widely from US$4 to nearly US$60 across six perspectives. In light of increasingly competitive M&A conditions, you can see how opinions on the path ahead may differ, consider exploring several viewpoints to inform your own outlook.

Explore 6 other fair value estimates on Kimbell Royalty Partners - why the stock might be worth over 4x more than the current price!

Build Your Own Kimbell Royalty Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kimbell Royalty Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Kimbell Royalty Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kimbell Royalty Partners' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com