StoneX Group (SNEX): Net Profit Margin Decline Challenges Earnings Growth Narrative

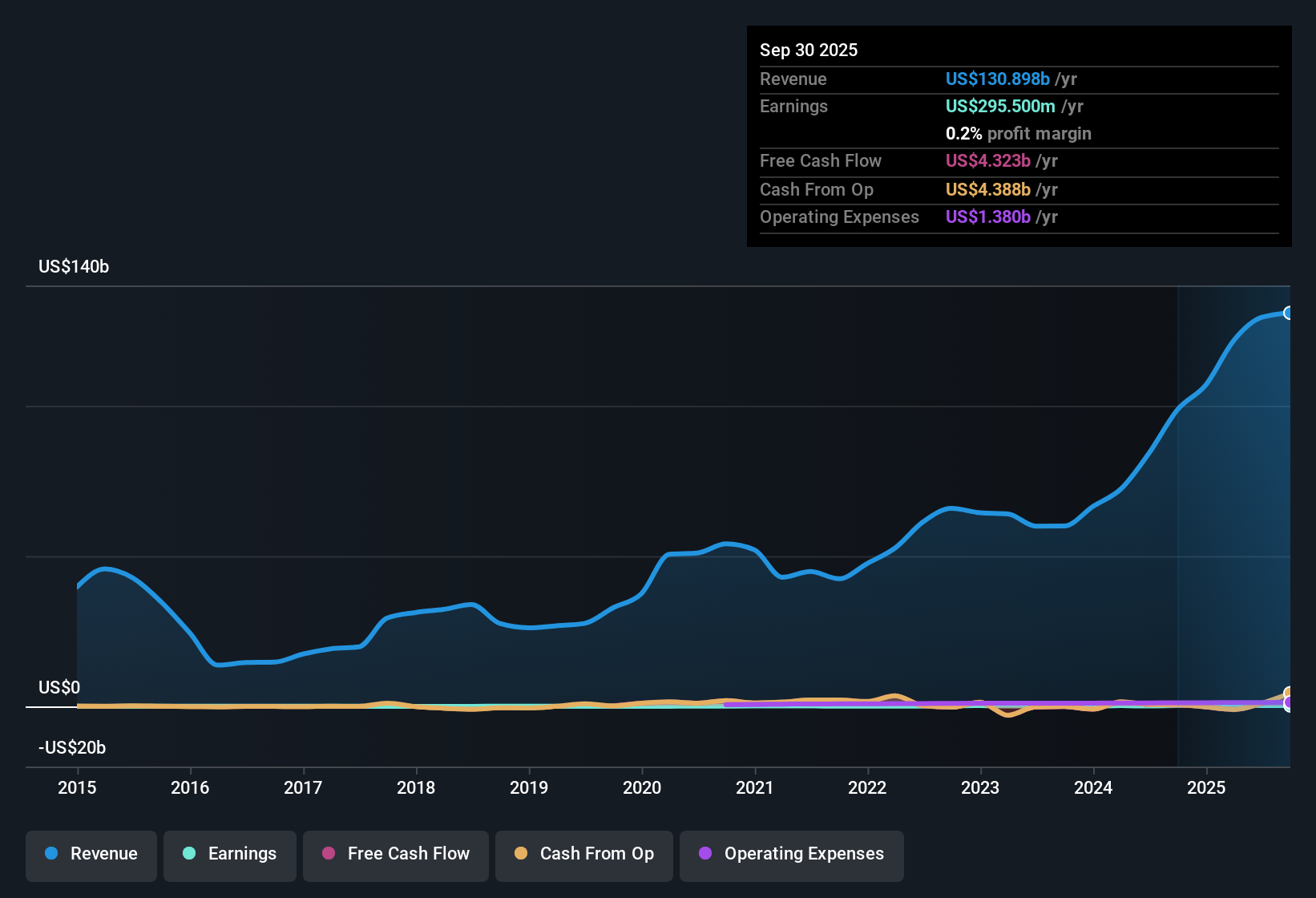

StoneX Group (SNEX) has just posted its latest results for FY 2025, reporting $32.3 billion in revenue and basic EPS of $1.67 for the fourth quarter, with net income at $82.6 million. Zooming out, the company has seen rolling twelve-month revenue advance from $98.7 billion to $130.9 billion, while EPS moved from $5.49 to $6.23 over the same span. This represents a 17.4% lift in earnings over the last year. Investors are watching closely as margins show some pressure even as bottom-line growth continues to outpace the company's historical norm.

See our full analysis for StoneX Group.Next up, we’ll see how these headline numbers stack up against the prevailing narratives. Some familiar stories are up for debate after this latest update.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Slides as Profits Grow

- Net profit margin slipped from 0.3% to 0.2% year-over-year, even as net income climbed to $295.5 million over the last twelve months.

- What stands out here is that profit growth has outpaced the five-year average (17.4% annual vs. 14%), yet the thinner margin points to increased costs or fee pressure:

- This margin compression, despite rising net income, challenges the idea that all top-line expansion translates directly into stronger profitability.

- While robust net income supports the generally positive outlook, investors may keep an eye on how these margin pressures develop through the year.

Valuation Lags Industry Peers

- StoneX’s price-to-earnings (P/E) ratio of 16x undercuts both the US Capital Markets industry average of 23.8x and the peer group average of 17.7x.

- Consensus narrative highlights how this below-average valuation multiple paired with solid earnings growth creates a value argument:

- Trading below the industry and broad market average P/E can make StoneX more attractive to value-focused investors than pricier peers.

- This relatively low multiple stands out more given the continued consistency in profit generation and lack of flagged risks.

Earnings Momentum Below Market Pace

- Earnings are forecast to increase at 13.78% per year, which is slower than the projected 16.1% annual EPS growth for the US market.

- Consensus narrative calls attention to this softer forecast as a sign that while StoneX has delivered steady growth, its outlook trails the sector’s most optimistic names:

- Sturdy historic growth combined with a slowdown in projections makes performance appear reliable, but possibly less exciting than peers with brighter forecasts.

- This gap in growth rates can matter for investors seeking high-momentum opportunities within financial services.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on StoneX Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

StoneX’s reliable performance comes with slower projected earnings growth compared to the broader market and high-momentum financial peers.

If you want exposure to companies forecast to deliver much stronger earnings gains ahead, discover high growth potential stocks screener (48 results) that could better match your growth ambitions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com