How Contrasting Views From Cramer and Baron Are Shaping Iron Mountain's (IRM) Data Center Investment Story

- In recent days, Jim Cramer issued a pessimistic outlook on Iron Mountain and recommended selling on any rally, while the Baron Real Estate Fund publicly disclosed a new position in Iron Mountain, highlighting its valuation and potential in data centers.

- This sharp contrast between a prominent analyst's negative stance and fresh institutional investment has heightened market focus on Iron Mountain’s future direction.

- We'll explore how Baron’s interest in Iron Mountain’s data center growth prospects could influence the company's long-term investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Iron Mountain Investment Narrative Recap

To be a shareholder in Iron Mountain, you need to believe in the company’s ability to profitably expand beyond its core records storage business and capture sustained demand in its data center and asset lifecycle management segments. The recent divergence between Jim Cramer’s bearish comments and Baron Real Estate Fund’s optimistic purchase has not materially changed the most important short-term catalyst, demand for new data center capacity, or the largest current risk, which remains elevated leverage tied to data center expansion.

Of the company’s recent announcements, Iron Mountain’s 10% dividend increase is particularly relevant, as it signals confidence in ongoing cash flow even as the company takes on fresh debt to pursue new development. This move, alongside robust growth reported in its latest earnings, underlines management’s continued focus on balancing capital returns to shareholders with large investments in future growth areas.

By contrast, investors should closely watch how rising interest payments could affect cash flows and refinancing options if...

Read the full narrative on Iron Mountain (it's free!)

Iron Mountain's narrative projects $8.3 billion in revenue and $775.8 million in earnings by 2028. This requires 9.0% yearly revenue growth and a $734.5 million earnings increase from $41.3 million today.

Uncover how Iron Mountain's forecasts yield a $116.73 fair value, a 35% upside to its current price.

Exploring Other Perspectives

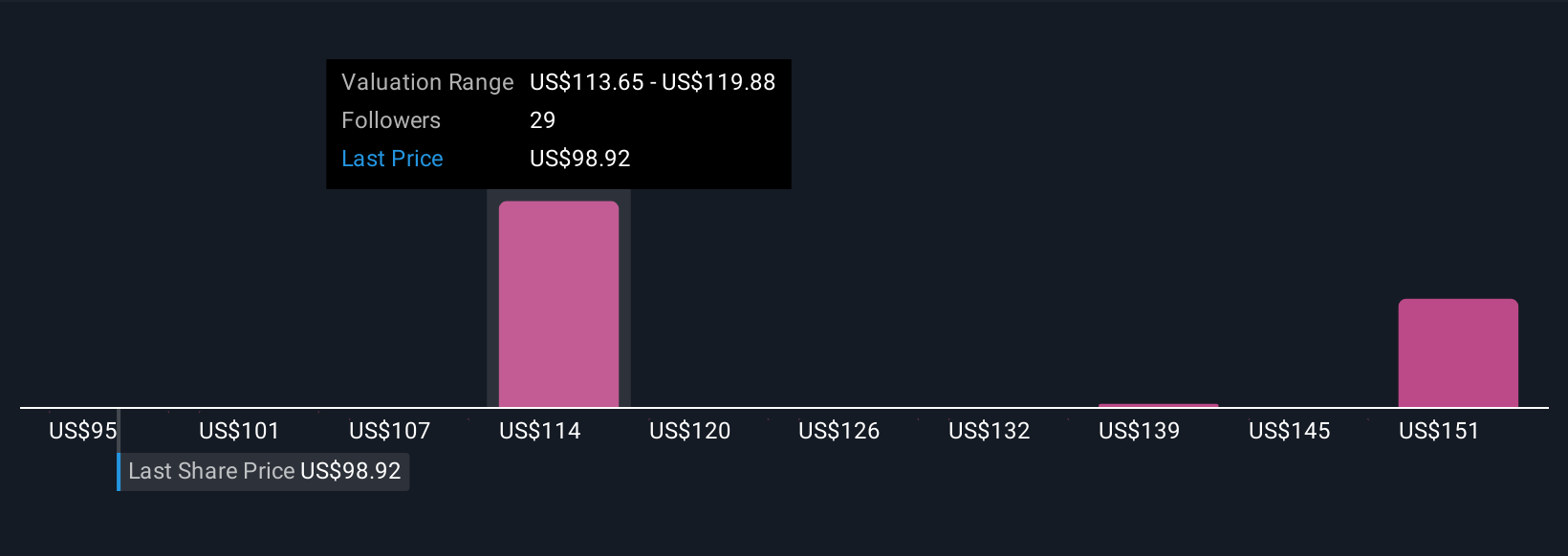

Six members of the Simply Wall St Community estimated Iron Mountain’s fair value between US$94.95 and US$218.20. With ongoing data center expansion driving growth but raising debt levels, these varied perspectives illustrate how your take on risk and upside potential could shape your view on the company’s performance.

Explore 6 other fair value estimates on Iron Mountain - why the stock might be worth just $94.95!

Build Your Own Iron Mountain Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iron Mountain research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Iron Mountain research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iron Mountain's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com