How Primerica’s $475 Million Share Repurchase Plan Has Changed Its Investment Story (PRI)

- On November 19, 2025, Primerica, Inc. announced a new share repurchase program authorizing the buyback of up to US$475 million of its shares, valid through December 31, 2026.

- This significant buyback authorization may signal management’s confidence in Primerica’s financial stability and future business outlook to investors.

- Now, we'll consider how this large-scale repurchase plan could strengthen Primerica’s investment narrative and future earnings assumptions.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Primerica Investment Narrative Recap

To be a shareholder in Primerica, you need to believe that long-term demand for financial solutions and insurance in the middle-income segment will outpace current macroeconomic pressures. While the new US$475 million buyback highlights management’s confidence and may lend short-term support to earnings per share, it does not directly address persistent risks like elevated lapse rates or pressure on new policy sales which are currently the most critical short-term factors.

The recent Q3 2025 earnings announcement is particularly relevant, showing both revenue and net income growth year-over-year. This underscores Primerica’s ability to generate profit in the present climate and sets a foundation for how share repurchases could interact with earnings metrics if core sales volume stabilizes or improves.

But as always, investors should be aware that despite positive announcements, persistent cost of living pressure continues to drive higher policy lapse rates and is...

Read the full narrative on Primerica (it's free!)

Primerica's outlook anticipates $3.7 billion in revenue and $775.3 million in earnings by 2028. This scenario is based on a 4.4% annual revenue growth rate and a $67.8 million increase in earnings from the current $707.5 million.

Uncover how Primerica's forecasts yield a $302.00 fair value, a 17% upside to its current price.

Exploring Other Perspectives

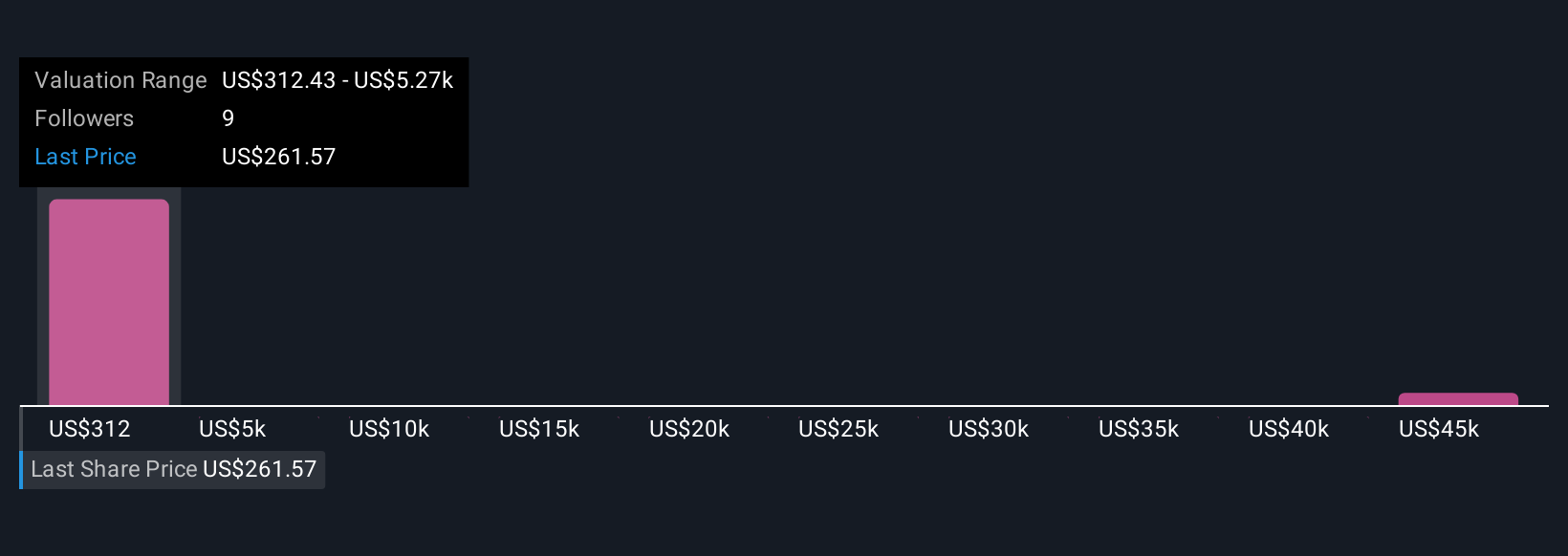

Simply Wall St Community members offered three distinct fair value estimates for Primerica, ranging from US$302 to a striking US$49,917. With ongoing uncertainty facing new policy sales and agent productivity, individual views on opportunity and risk can vary dramatically. Compare these perspectives to broaden your understanding.

Explore 3 other fair value estimates on Primerica - why the stock might be a potential multi-bagger!

Build Your Own Primerica Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Primerica research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Primerica research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Primerica's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com