United Parks & Resorts (PRKS) Faces DOJ Probe Over ADA Compliance What Does This Mean for Accessibility Strategy?

- In late November 2025, the U.S. Department of Justice launched a civil rights investigation into United Parks & Resorts Inc., examining whether accessibility policies at its theme parks, including SeaWorld Orlando and Busch Gardens Tampa Bay, violate the Americans with Disabilities Act by banning certain rollator walkers and imposing surcharges for alternative mobility devices.

- This high-profile inquiry could lead to changes in industry-wide accessibility standards and has put a spotlight on the company's approach to accommodating guests with disabilities.

- We will consider how the government probe into accessibility and compliance with federal law could impact United Parks & Resorts' investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

United Parks & Resorts Investment Narrative Recap

To be a shareholder in United Parks & Resorts, you have to believe in the long-term value of experiential entertainment and the company's ability to grow guest spending and attendance despite economic and operational headwinds. The recent Department of Justice investigation into accessibility policies has quickly become the most immediate risk, potentially overshadowing core catalysts like forward bookings, and could materially affect operational practices, reputation, and near-term investor sentiment if unresolved.

Among recent announcements, the appointment of Jim Forrester as interim CFO following the resignation of the previous finance chief stands out. Leadership stability in the financial function is particularly important when the company is under close regulatory and public scrutiny, as it can influence not only day-to-day operations but also investor confidence during periods of uncertainty and change.

Yet, risks to attendance and recurring revenue remain significant, especially if ...

Read the full narrative on United Parks & Resorts (it's free!)

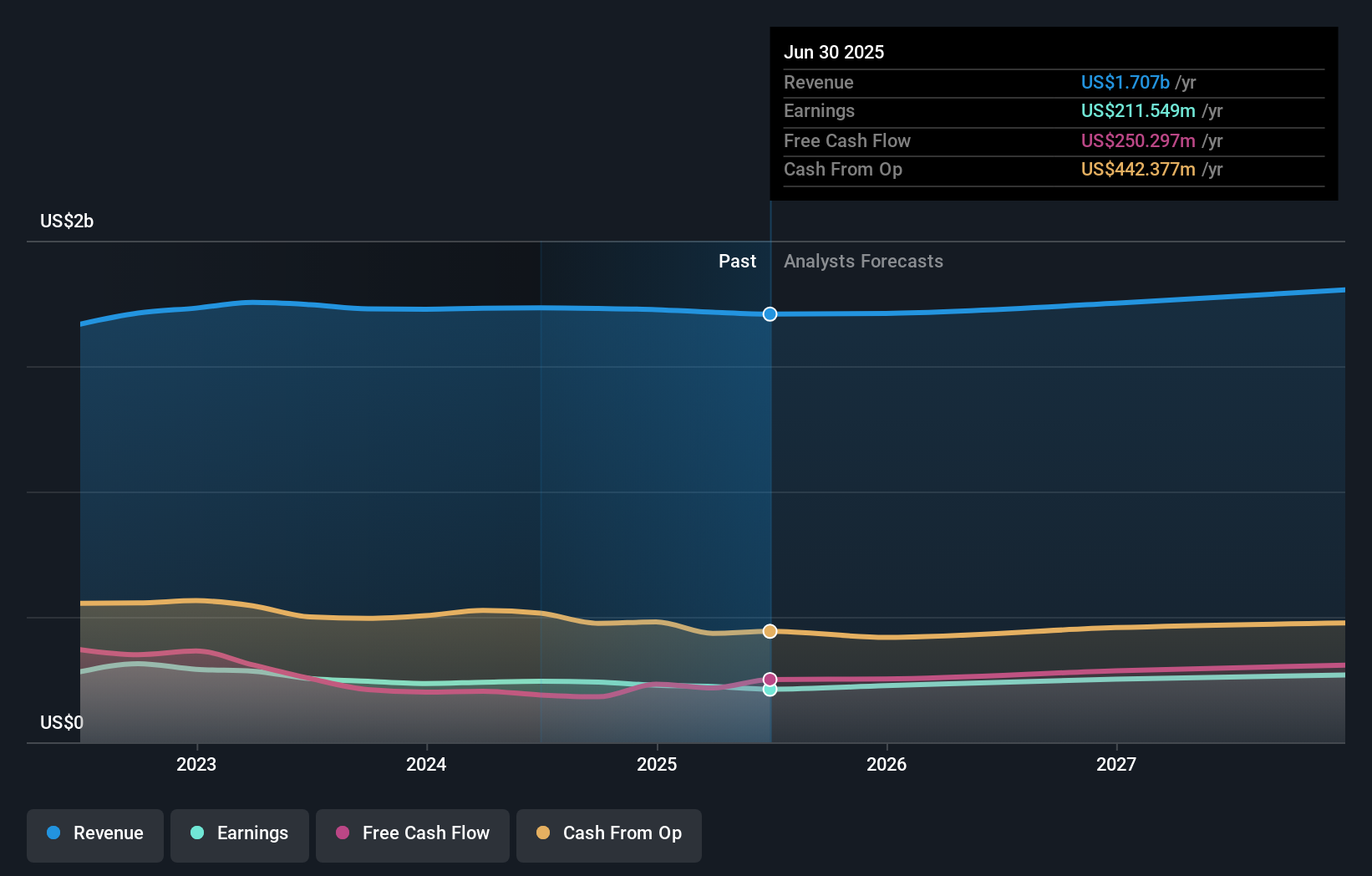

United Parks & Resorts is projected to reach $1.8 billion in revenue and $284.5 million in earnings by 2028. This outlook is based on expected annual revenue growth of 2.1% and a $73 million increase in earnings from the current $211.5 million.

Uncover how United Parks & Resorts' forecasts yield a $47.18 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community was recorded at US$47.18, showing no variation in community valuation. With federal scrutiny now directly challenging United Parks & Resorts’ accessibility practices, it is clear that investor opinions can widely differ and several alternative viewpoints are worth reviewing.

Explore another fair value estimate on United Parks & Resorts - why the stock might be worth as much as 31% more than the current price!

Build Your Own United Parks & Resorts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Parks & Resorts research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Parks & Resorts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Parks & Resorts' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com