The Bull Case For Charles Schwab (SCHW) Could Change Following Record November Asset Inflows and Account Growth

- In November 2025, Charles Schwab reported record core net new assets of US$44.4 billion for the month, an increase of 80% over October 2024, along with a 20% year-over-year rise in total client assets to US$11.83 trillion and 30% more new brokerage accounts opened.

- This uptick in assets and new accounts highlights strong investor engagement and increasing momentum in Schwab’s business operations.

- We'll review how record asset inflows at Schwab highlight persistent client demand and may impact the company's long-term growth outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Charles Schwab Investment Narrative Recap

To be a shareholder in Charles Schwab, you need to believe that the company can continue capturing new assets and accounts despite rapidly evolving competition from digital-first brokerages and shifting investor preferences. The record US$44.4 billion in net new assets and robust account growth for November 2025 reinforce demand for Schwab’s platform, but the near-term outlook still hinges on the sustainability of these inflows. Competitive pressure and exposure to changes in interest rates remain the clearest risks, and this news does not materially reduce those concerns. From the most recent announcements, the rumored acquisition of Forge Global, aimed at expanding Schwab’s access to private markets, directly aligns with the surge in client asset inflows. This move positions Schwab to appeal to investors seeking alternatives to traditional public markets, potentially supporting further asset growth and client engagement if such preferences persist. However, investors should also consider that fee pressure from rising competition and changing regulation…

Read the full narrative on Charles Schwab (it's free!)

Charles Schwab's outlook anticipates $30.2 billion in revenue and $11.0 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 11.8% and an increase in earnings of $4.2 billion from current earnings of $6.8 billion.

Uncover how Charles Schwab's forecasts yield a $111.61 fair value, a 20% upside to its current price.

Exploring Other Perspectives

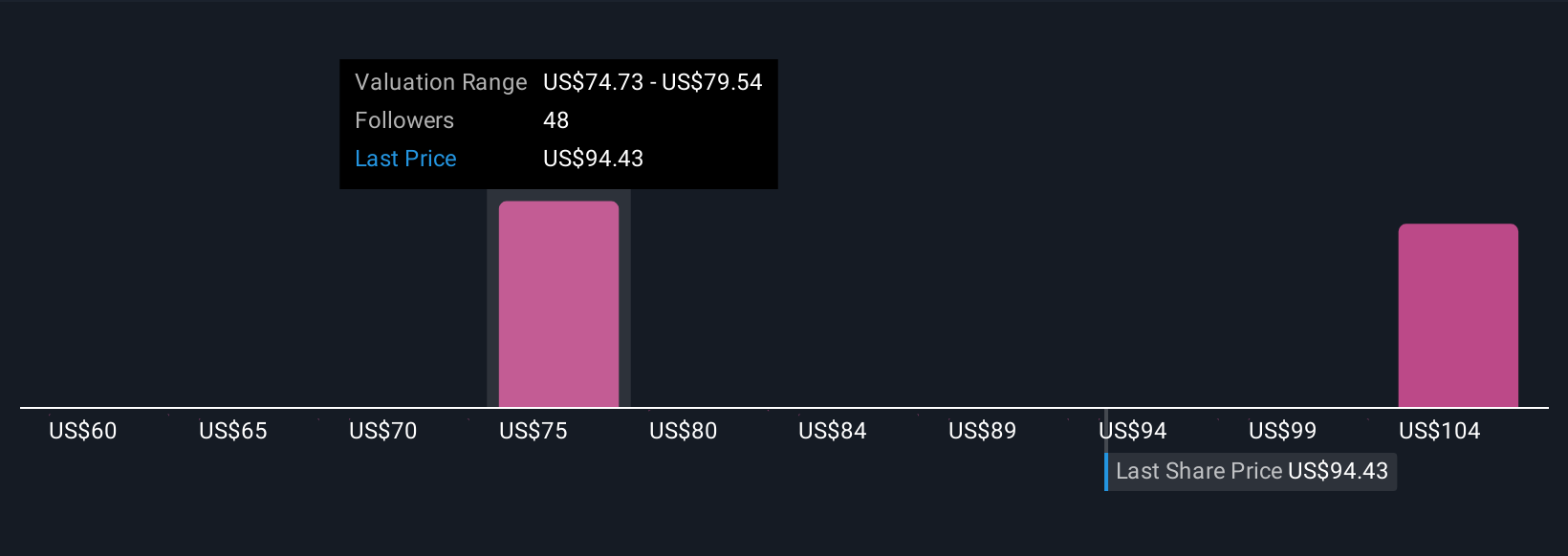

Recent fair value estimates from the Simply Wall St Community range from US$79.32 to US$111.61, reflecting seven unique and diverse investor viewpoints. While analysts see persistent client demand as a key catalyst, it’s clear that market participants hold widely different views, consider exploring these perspectives for a broader understanding.

Explore 7 other fair value estimates on Charles Schwab - why the stock might be worth as much as 20% more than the current price!

Build Your Own Charles Schwab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Charles Schwab research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Charles Schwab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Charles Schwab's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com