Patrick Industries (PATK) Dividend Increase Could Be a Game Changer for Shareholder Value

- On November 19, 2025, Patrick Industries' Board of Directors approved an increase in its quarterly cash dividend to US$0.47 per share, up from US$0.40, payable on December 15, 2025 to shareholders of record as of December 1, 2025.

- This dividend boost highlights the company’s ongoing commitment to returning capital to shareholders and suggests management’s confidence in its financial position.

- We’ll explore how the decision to raise the dividend may shape Patrick Industries’ investment case and long-term appeal to investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Patrick Industries Investment Narrative Recap

To be a shareholder in Patrick Industries, an investor needs to believe in the durability of the company's core end markets like RVs and marine, and that innovation and acquisitions can offset cyclical challenges. The recent dividend increase to US$0.47 per share reinforces management’s confidence, but does not materially change the fact that earnings remain sensitive to interest rates and macroeconomic risk, the main short-term catalyst continues to be shifts in consumer demand, while exposure to cyclical markets is still the most important risk.

Among recent announcements, the October 30, 2025, earnings release stands out, reporting sales of US$975.63 million yet lower net income year-on-year, underscoring persistent margin pressures despite steady revenues. This earnings trend offers important context to the dividend increase, reminding investors that while capital returns are prioritized, the business remains exposed to the volatility of its end markets and external economic forces.

In contrast, investors should also factor in the risk that a prolonged high-interest environment could still...

Read the full narrative on Patrick Industries (it's free!)

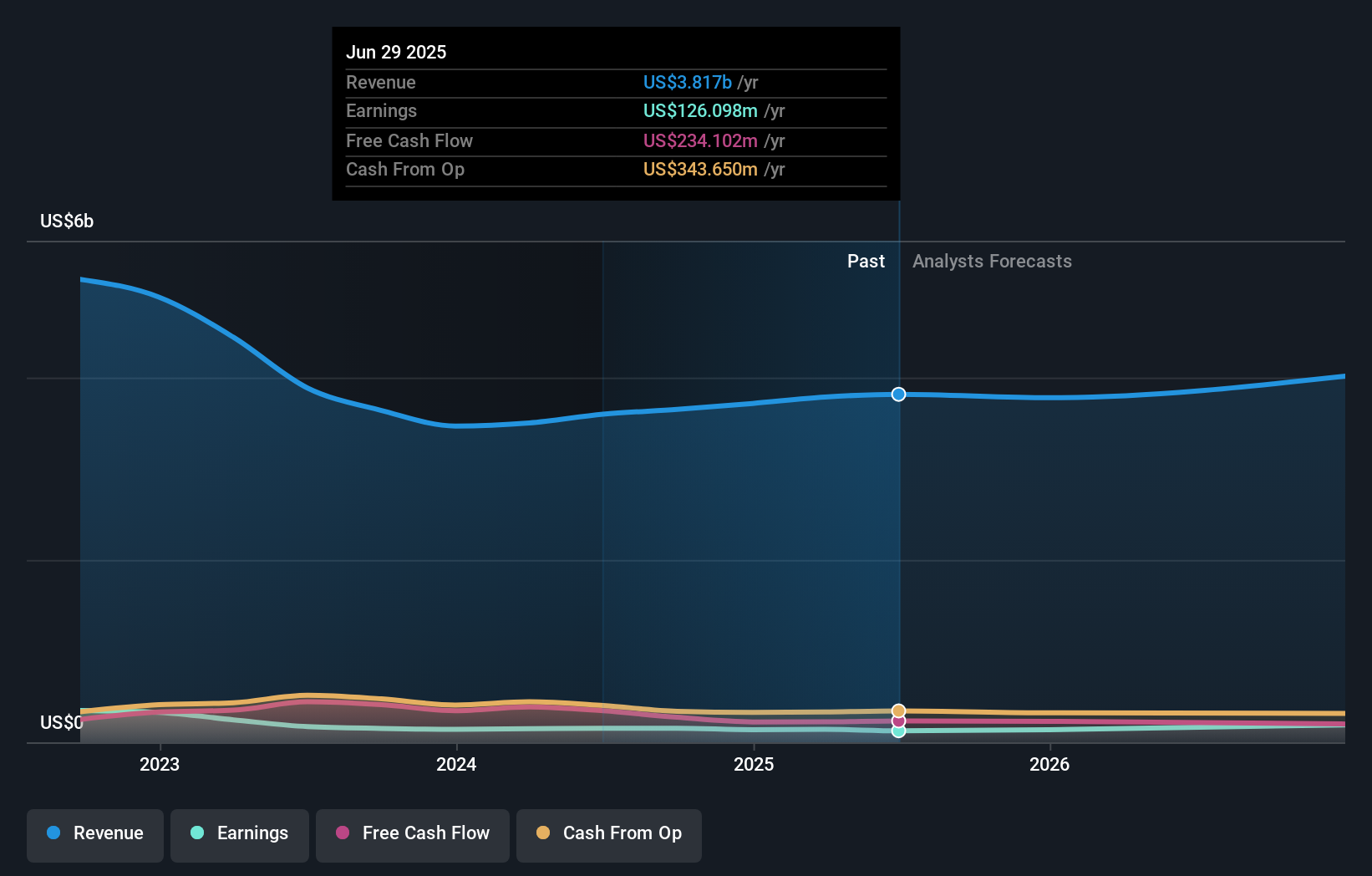

Patrick Industries' narrative projects $4.2 billion in revenue and $273.7 million in earnings by 2028. This requires 3.2% annual revenue growth and a $147.6 million earnings increase from current earnings of $126.1 million.

Uncover how Patrick Industries' forecasts yield a $110.20 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community provided two fair value estimates for Patrick Industries, stretching from US$110.20 up to US$153.98 per share. With ongoing sensitivity to economic cycles being a key concern, this variety of views signals just how differently market participants can interpret the company’s prospects, consider reviewing several viewpoints before drawing any firm conclusions.

Explore 2 other fair value estimates on Patrick Industries - why the stock might be worth as much as 42% more than the current price!

Build Your Own Patrick Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patrick Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Patrick Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patrick Industries' overall financial health at a glance.

No Opportunity In Patrick Industries?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com