Why Oscar Health (OSCR) Is Up 33.3% After Analysts Highlight Resilience Amid ACA Subsidy Uncertainty

- Oscar Health received a significant boost after analysts at Piper Sandler upgraded their rating, emphasizing the company's resilience in gaining market share and improving profitability even if Affordable Care Act subsidies expire, alongside its proactive education and enrollment initiatives for 2026.

- An important aspect highlighted by the news is the potential extension and expansion of Affordable Care Act subsidies, which could provide increased stability and consistency in membership for health insurers like Oscar Health amid an evolving regulatory landscape.

- To understand the potential impact of enhanced ACA subsidy stability, we'll assess how this development may alter Oscar Health's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Oscar Health Investment Narrative Recap

To be a shareholder in Oscar Health, you need confidence in its ability to capture and retain membership while moving toward profitability, even as market conditions shift. The recent news regarding potential Affordable Care Act (ACA) subsidy extensions directly strengthens the main short-term catalyst, increased enrollment stability, while reducing the immediate risk of subsidy expiration, which could have sharply reduced Oscar’s eligible customer base and pressured margins. If ACA support continues, Oscar’s growth outlook could be meaningfully more predictable.

The most relevant recent announcement is the Q3 earnings release, which showed revenue growth to US$2,986 million and increased membership, although net losses widened compared to the prior year. In the context of the current regulatory developments, this growth in top-line revenue and new members highlights Oscar’s progress against its catalysts but also the mounting challenge of achieving profitability as operating costs remain high. Yet, as membership steadies, the balance between growth and financial discipline will come into sharper focus.

However, despite headline stability, investors should still be aware of the risk that ...

Read the full narrative on Oscar Health (it's free!)

Oscar Health's narrative projects $12.4 billion revenue and $245.4 million earnings by 2028. This requires 4.9% yearly revenue growth and a $406.6 million increase in earnings from -$161.2 million currently.

Uncover how Oscar Health's forecasts yield a $12.88 fair value, a 28% downside to its current price.

Exploring Other Perspectives

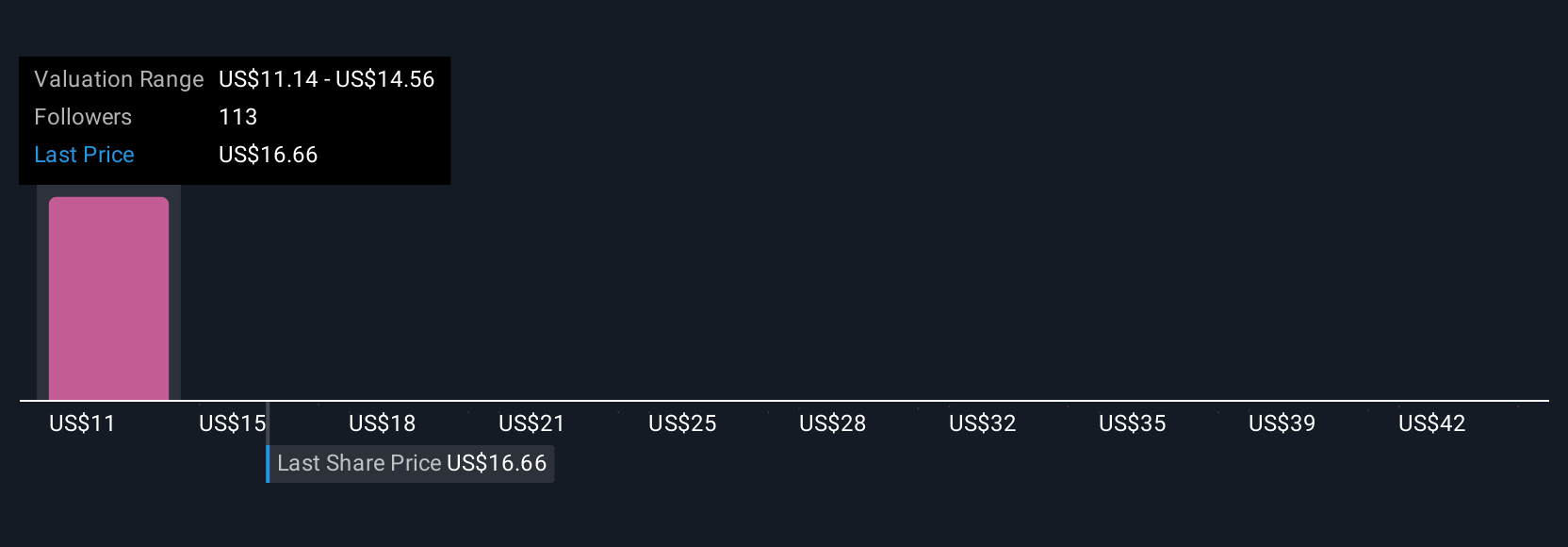

Private investors in the Simply Wall St Community provided 23 fair value estimates for Oscar Health, ranging widely from US$11.52 to US$66 per share. With subsidy stability now a central focus, these varying perspectives highlight how regulatory risk remains a key factor shaping outcomes for the company’s future performance.

Explore 23 other fair value estimates on Oscar Health - why the stock might be worth 36% less than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com