Will Cognizant's (CTSH) ONE Bridge Move Signal a New Edge in AI-Driven Data Transformation?

- Earlier in November, Ataccama and Cognizant Technology Solutions announced the launch of ONE Bridge, an automation accelerator designed to help enterprises migrate from legacy data platforms up to 40% faster and with lower risk by automating key migration processes and improving compliance controls.

- This collaboration highlights Cognizant’s expanding capabilities in AI-ready data solutions, enabling client organizations to modernize at scale while responding to increasing regulatory and data governance demands.

- We'll now examine how Cognizant's enhanced AI migration tools could support its positive investment narrative and business outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Cognizant Technology Solutions Investment Narrative Recap

To be a shareholder in Cognizant Technology Solutions, you need to believe in the company’s ability to deliver differentiated AI and automation solutions as enterprises accelerate digital transformation and modernization of legacy systems. The launch of ONE Bridge with Ataccama should reinforce Cognizant’s positioning in AI-driven data migration, potentially sharpening its appeal for large-scale enterprise deals, the biggest near-term catalyst, but the short-term impact appears limited given rising competitive intensity in the IT consulting space.

Among recent announcements, Cognizant’s collaboration with Anthropic to embed advanced large language models into its engineering platforms directly complements its push into AI-enabled enterprise solutions, which could further strengthen its competitive edge as demand for generative AI services expands. This alignment between proprietary platform development and partnerships supports Cognizant’s efforts to sustain growth amid digital adoption cycles, but also highlights the ongoing need to maintain relevance as client needs evolve.

By contrast, investors should be aware of emerging risks if hyperscalers and specialized AI vendors intensify competition for...

Read the full narrative on Cognizant Technology Solutions (it's free!)

Cognizant Technology Solutions is projected to reach $23.5 billion in revenue and $2.9 billion in earnings by 2028. This outlook depends on a 4.7% annual revenue growth rate and a $0.5 billion earnings increase from current earnings of $2.4 billion.

Uncover how Cognizant Technology Solutions' forecasts yield a $84.70 fair value, a 9% upside to its current price.

Exploring Other Perspectives

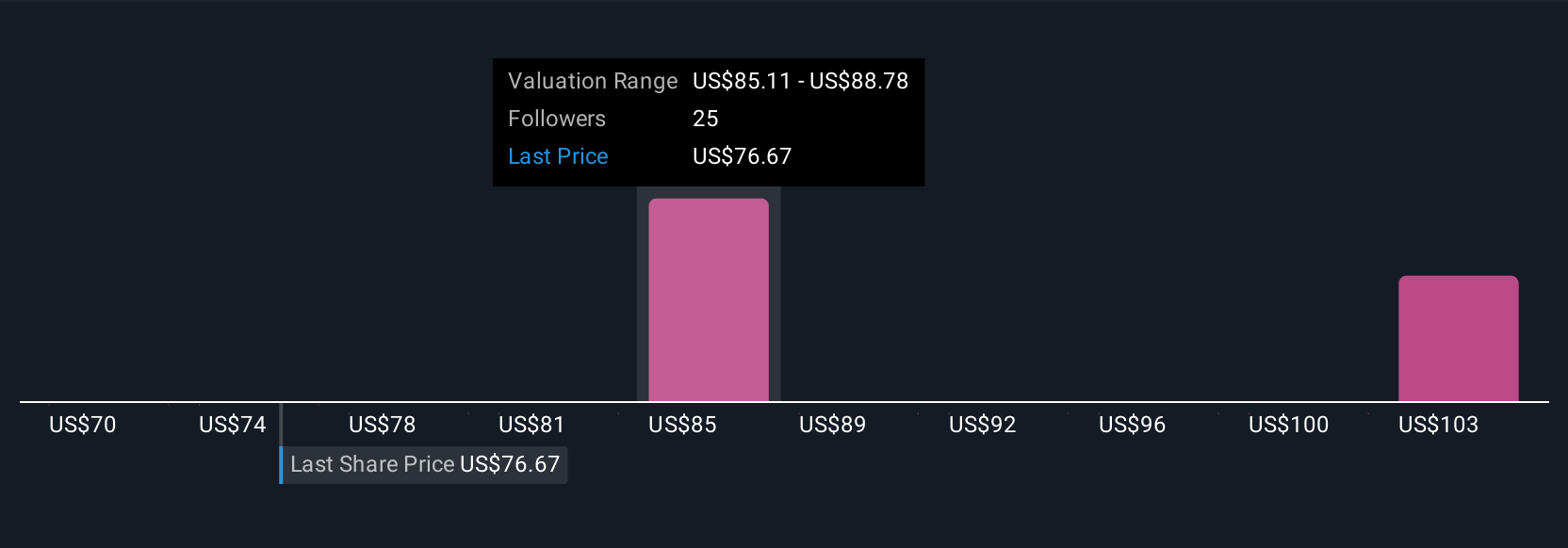

Eight separate Simply Wall St Community estimates peg Cognizant’s fair value between US$66.06 and US$124.82 per share. While some see deep value, the potential for margin pressure from intense competition could limit upside, so consider multiple viewpoints before forming your own outlook.

Explore 8 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth 15% less than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com