How Investors May Respond To Gartner (IT) as Global Governments Boost AI and IT Spending

- In recent Gartner research conducted prior to December 2025, more than half of government CIOs outside the US indicated plans to increase IT budgets in 2026, especially prioritizing cybersecurity, artificial intelligence, generative AI, and cloud platforms despite broader constraints on public finances.

- An interesting finding from the survey is that 74% of these CIOs have already deployed or plan to deploy AI within the next twelve months, signaling rapid adoption and integration of AI technologies across the public sector globally.

- We'll examine how accelerating public sector AI adoption and increased government IT spending could influence Gartner's investment narrative going forward.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Gartner Investment Narrative Recap

For an investor to be a Gartner shareholder, belief in the enduring importance of trusted research for digital transformation, AI, and IT strategy is essential, especially as enterprises and government agencies ramp up technology investment. The recent survey pointing to increased government IT budgets outside the US and rapid public sector AI adoption supports AI-driven demand for Gartner’s insights, but does not significantly alter the near-term catalyst, which remains enterprise demand for proprietary research, or the key risk: client shifts toward lower-cost, AI-based alternatives.

Among the recent company announcements, Gartner’s updated guidance affirming FX-neutral revenue growth in its core Insights business is closely linked to rising technology adoption and supports continued focus on enterprise renewals and subscription value. This is particularly relevant against the backdrop of accelerating AI investment from government clients, potentially enhancing Gartner’s retention rates and reinforcing confidence in recurring revenues.

However, investors should also consider the contrast between these growth catalysts and the increasing risk that generative AI tools may...

Read the full narrative on Gartner (it's free!)

Gartner's outlook anticipates $7.4 billion in revenue and $821.8 million in earnings by 2028. This scenario assumes a 4.7% annual revenue growth but a decrease in earnings of $478.2 million from the current $1.3 billion.

Uncover how Gartner's forecasts yield a $284.27 fair value, a 22% upside to its current price.

Exploring Other Perspectives

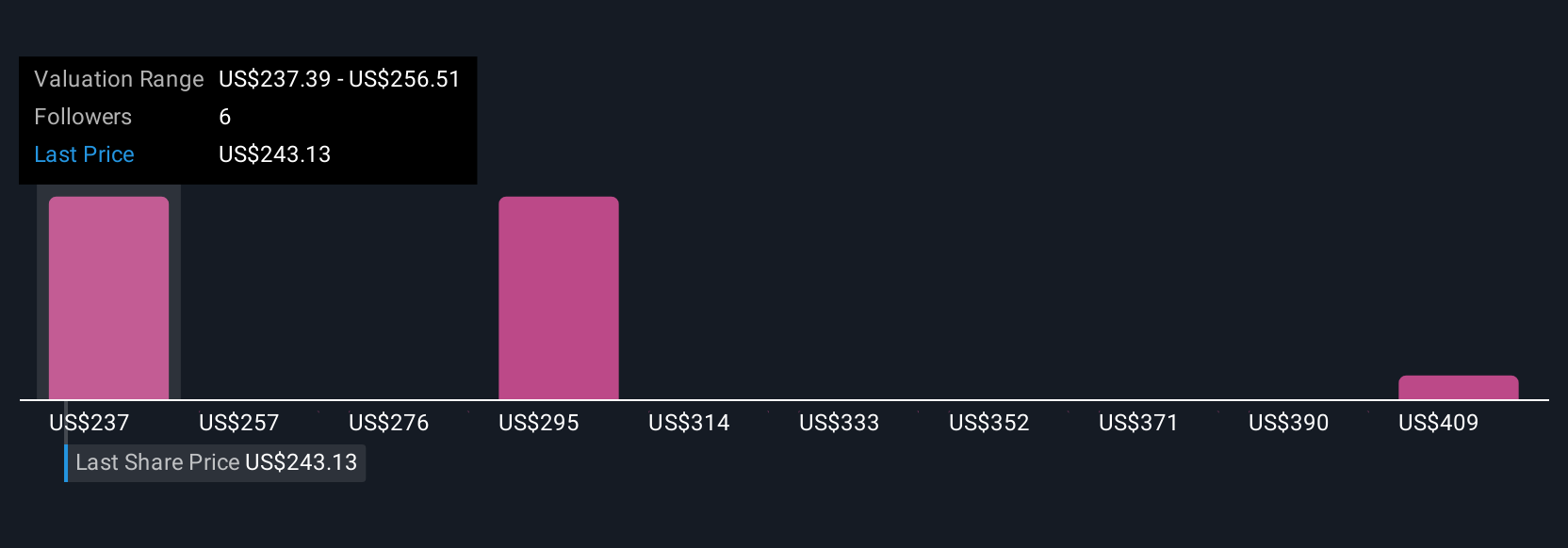

Simply Wall St Community members offered three unique fair value estimates for Gartner, spanning from US$284.27 up to US$420.71 per share. With so many differing outlooks, keep in mind that accelerating AI adoption in Gartner’s core markets raises important questions about the company’s competitive edge and long-term subscription resilience.

Explore 3 other fair value estimates on Gartner - why the stock might be worth just $284.27!

Build Your Own Gartner Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gartner research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gartner research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gartner's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com