How Early Project Delivery and Accelerated Buybacks at Cheniere Energy (LNG) Have Changed Its Investment Story

- In recent weeks, Cheniere Energy reported strong third-quarter results, beating revenue and EPS expectations, lifting full-year distributable cash flow guidance, and completing the third Train of Corpus Christi Stage 3 ahead of schedule.

- Despite some operational headwinds from feedgas quality issues, positive insider sentiment and sizeable share buybacks have further shaped the company's outlook.

- Now, we'll explore how early project delivery and ongoing buyback activity influence Cheniere Energy's updated investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cheniere Energy Investment Narrative Recap

To own Cheniere Energy, an investor needs to have confidence in the ongoing global demand for LNG and the company’s ability to capitalize on capacity expansions despite growing competition and decarbonization trends. The most important short-term catalyst remains the commissioning of new liquefaction trains and timely completion of expansion projects, while the biggest current risk is a looming global LNG oversupply; the latest operational and financial updates do not materially alter these central drivers.

One particularly relevant announcement is the early completion of the third Train at Corpus Christi Stage 3, which directly supports Cheniere’s capacity-led growth narrative. Bringing new capacity online ahead of schedule can enhance near-term export volumes, underpinning distributable cash flow guidance and helping offset concerns about potential market oversupply as new global projects come online.

However, what some investors may overlook is that capacity expansions alone cannot guard against the risk of prolonged LNG market oversupply, especially as new entrants ramp up output in...

Read the full narrative on Cheniere Energy (it's free!)

Cheniere Energy's outlook anticipates $24.1 billion in revenue and $3.1 billion in earnings by 2028. This forecast requires annual revenue growth of 9.8%, but reflects a decrease of $0.7 billion in earnings from the current $3.8 billion.

Uncover how Cheniere Energy's forecasts yield a $270.67 fair value, a 30% upside to its current price.

Exploring Other Perspectives

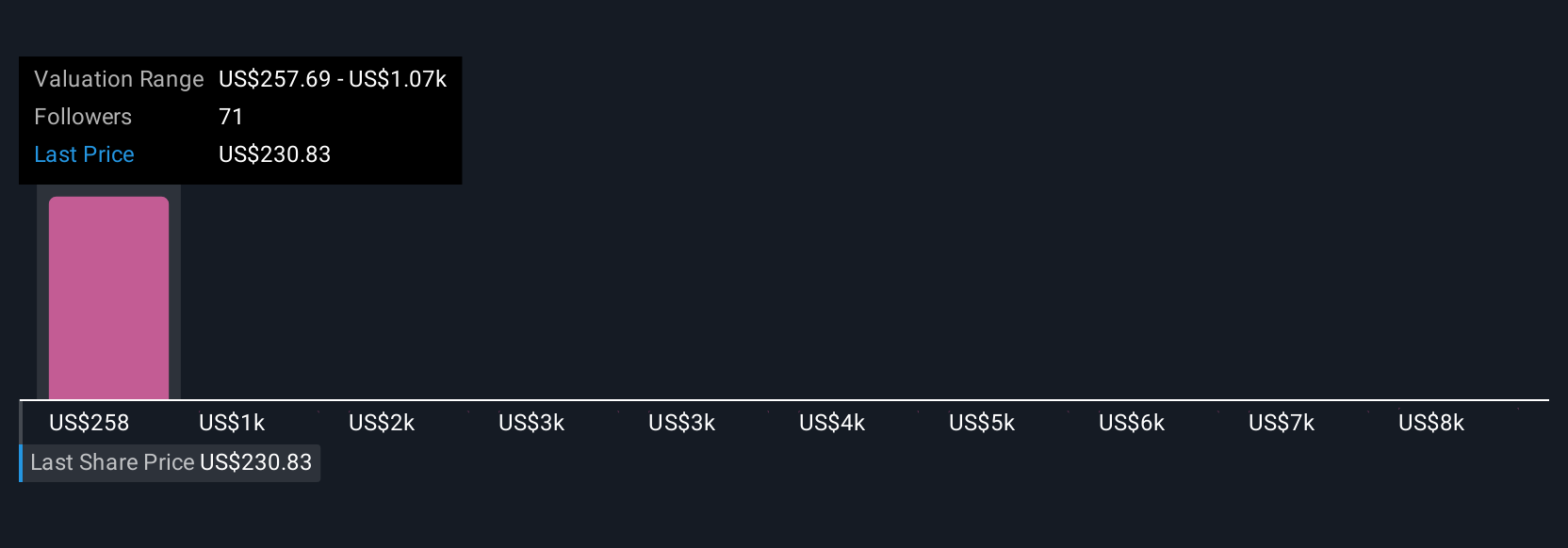

Five independent fair value estimates from the Simply Wall St Community range from US$270.67 to a striking US$6,591.19 per share. As opinions widely differ, keep in mind that the prospect of LNG market oversupply could shift the outlook for Cheniere’s growth and returns, consider looking into several viewpoints before making decisions.

Explore 5 other fair value estimates on Cheniere Energy - why the stock might be worth just $270.67!

Build Your Own Cheniere Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Cheniere Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com