Mattel’s (MAT) Formula 1 UNO Collaboration Could Be a Game Changer for Its Classic Games Portfolio

- Mattel announced the expansion of its UNO Elite line with the launch of UNO Elite Formula 1, featuring officially licensed content from all 10 F1 teams and a wide variety of collectible cards, with pre-orders available on Amazon ahead of a broader 2026 retail rollout.

- This collaboration merges the global appeal of Formula 1 with the enduring success of UNO, aiming to engage both motorsport fans and traditional game players through a fresh product experience.

- We’ll explore how this high-profile licensing partnership could reshape Mattel’s investment narrative by expanding the reach of its classic games portfolio.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Mattel's Investment Narrative?

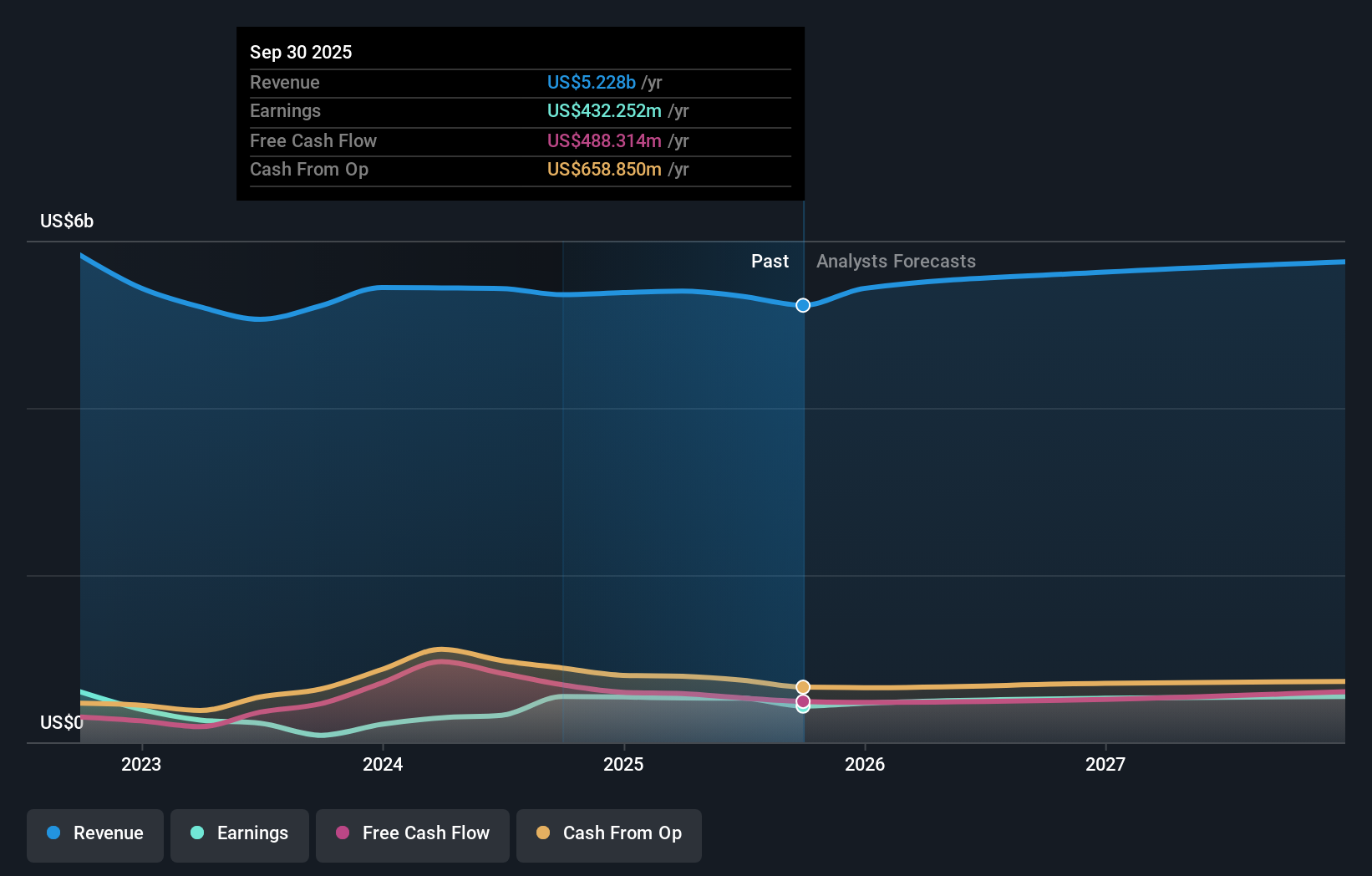

For anyone considering a position in Mattel, the key question is whether global branding partnerships like the new UNO Elite Formula 1 can meaningfully shift the company’s growth story and address the challenges it has faced in the past year. Mattel’s recent news, which brings the world’s top motorsport into its flagship game, could strengthen brand relevance and drive excitement across diverse consumer segments. While it offers a fresh short-term sales opportunity and aligns with similar F1-related launches like Hot Wheels, this initiative alone is unlikely to materially alter the major catalysts or risks already in focus. With revenue and profit growth expected to trail the broader US market and a high debt level still present, the F1 collaboration serves more as an incremental boost rather than a game changer. Management’s execution on innovation and cost control remains under the microscope, especially as earnings have declined and CEO compensation has risen.

But, rising executive pay amid flatlining or negative company performance is something investors should watch closely. Mattel's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Mattel - why the stock might be worth just $21.29!

Build Your Own Mattel Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mattel research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mattel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mattel's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com